Region:Middle East

Author(s):Dev

Product Code:KRAC4166

Pages:96

Published On:October 2025

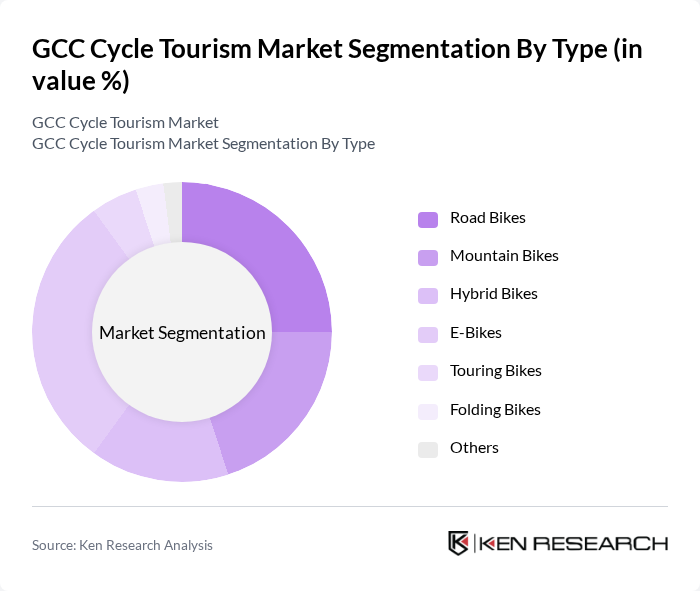

By Type:The market is segmented into various types of bicycles, each catering to different consumer preferences and cycling experiences.Road bikesare popular for their speed and efficiency, whilemountain bikescater to adventure seekers looking for rugged terrains.Hybrid bikescombine features of both, appealing to casual cyclists.E-bikesare gaining traction due to their convenience and accessibility, especially among urban commuters and older demographics.Touring bikesare favored for long-distance travel,folding bikesoffer portability for city dwellers, and other types include specialty bikes such as gravel and fat bikes .

TheE-Bikessegment is currently dominating the market due to their increasing popularity among both casual and serious cyclists. The convenience of electric assistance appeals to a broader audience, including those who may not have considered cycling otherwise. Additionally, the growing emphasis on eco-friendly transportation options, rising fuel prices, and the expansion of urban cycling infrastructure have further propelled demand for e-bikes. As urban areas become more congested, the practicality of e-bikes for commuting is a significant factor in their market leadership .

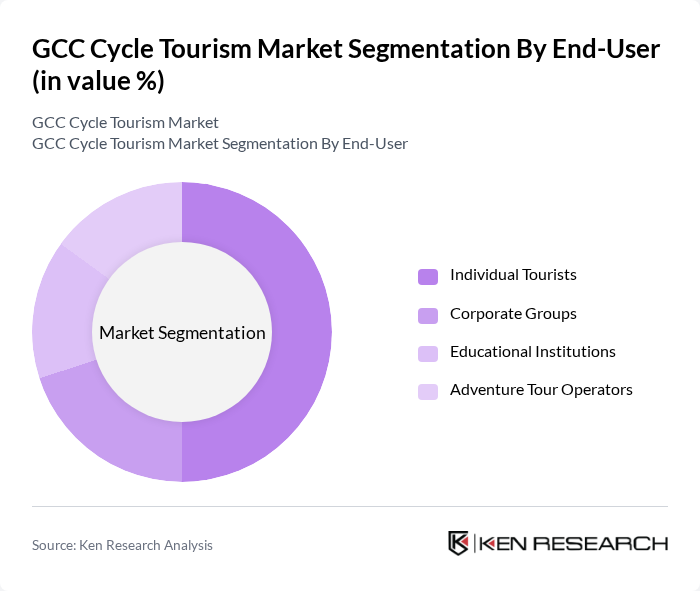

By End-User:The end-user segmentation includesindividual tourists,corporate groups,educational institutions, andadventure tour operators. Individual tourists represent a significant portion of the market, driven by the growing trend of cycling as a leisure activity and a means of exploring new destinations. Corporate groups often engage in team-building cycling events, while educational institutions promote cycling for health and environmental awareness. Adventure tour operators cater to thrill-seekers looking for unique cycling experiences. The increasing availability of customized cycling packages and wellness-focused tours further supports the growth in these segments .

Individual touristsdominate the end-user segment, accounting for half of the market share. This trend is largely attributed to the increasing popularity of cycling as a recreational activity, the desire for sustainable travel options, and the availability of diverse cycling tours and packages tailored for individual preferences. The rise in health consciousness and demand for authentic travel experiences further fuel this growth .

The GCC Cycle Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adventure Cycle Tours, Cycle Arabia, Gulf Cycle Tours, UAE Cycling Federation, Qatar Cycling Association, Oman Cycling Club, Bahrain Cycling Team, Saudi Cycling Federation, Cycle World, Eco-Cycle Tours, Bike & Hike Adventures, Green Trails, Cycle & Explore, Active Travel, and Pedal Power Tours contribute to innovation, geographic expansion, and service delivery in this space.

The future of cycle tourism in the GCC appears promising, driven by increasing health consciousness and government support for sustainable tourism. As infrastructure continues to improve, more tourists are likely to explore the region on two wheels. Additionally, the integration of technology in cycling experiences, such as mobile apps for route planning, will enhance the overall experience. With a focus on eco-friendly practices, the sector is poised for growth, attracting both local and international cyclists seeking adventure and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Bikes Mountain Bikes Hybrid Bikes E-Bikes Touring Bikes Folding Bikes Others |

| By End-User | Individual Tourists Corporate Groups Educational Institutions Adventure Tour Operators |

| By Tour Type | Guided Tours Self-Guided Tours Multi-Day Tours Day Trips |

| By Region | UAE Saudi Arabia Qatar Oman Bahrain Kuwait Others |

| By Service Type | Bike Rentals Guided Tours Support Services Accommodation Packages |

| By Customer Demographics | Age Groups Income Levels Experience Levels |

| By Duration of Tour | Short Tours (1-3 Days) Medium Tours (4-7 Days) Long Tours (8+ Days) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cycling Tour Operators | 45 | Business Owners, Tour Managers |

| Cycling Enthusiasts | 75 | Regular Cyclists, Event Participants |

| Local Government Officials | 28 | Tourism Development Officers, Urban Planners |

| Accommodation Providers | 42 | Hotel Managers, Guesthouse Owners |

| Equipment Retailers | 35 | Store Managers, Sales Representatives |

The GCC Cycle Tourism Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by health consciousness, government initiatives, and investments in cycling infrastructure across the region.