Region:Middle East

Author(s):Rebecca

Product Code:KRAC9810

Pages:99

Published On:November 2025

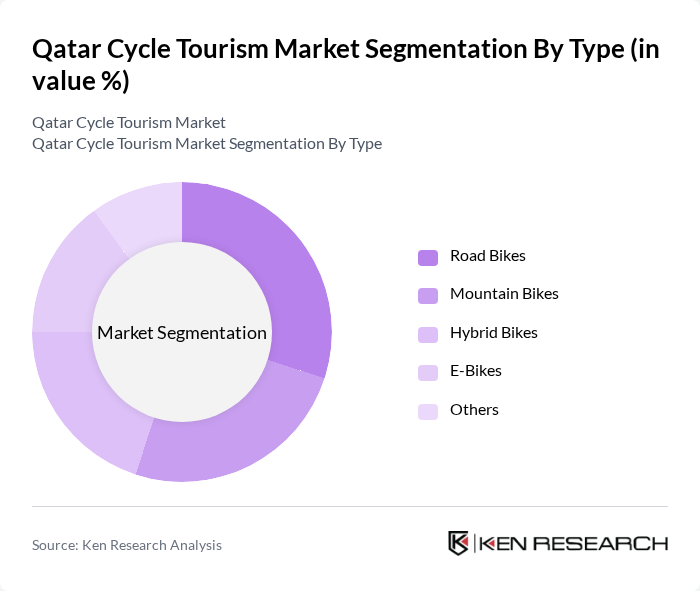

By Type:The market is segmented into road bikes, mountain bikes, hybrid bikes, e-bikes, and others. Each type addresses distinct consumer preferences and cycling experiences. Road bikes are favored for speed and efficiency, especially on Doha’s urban routes. Mountain bikes are popular among adventure seekers for off-road trails and desert landscapes. Hybrid bikes offer versatility for mixed terrains, while e-bikes are increasingly chosen for their accessibility and convenience, particularly among casual and older cyclists. The "others" category includes specialty and children’s bikes, catering to niche segments and family tourism .

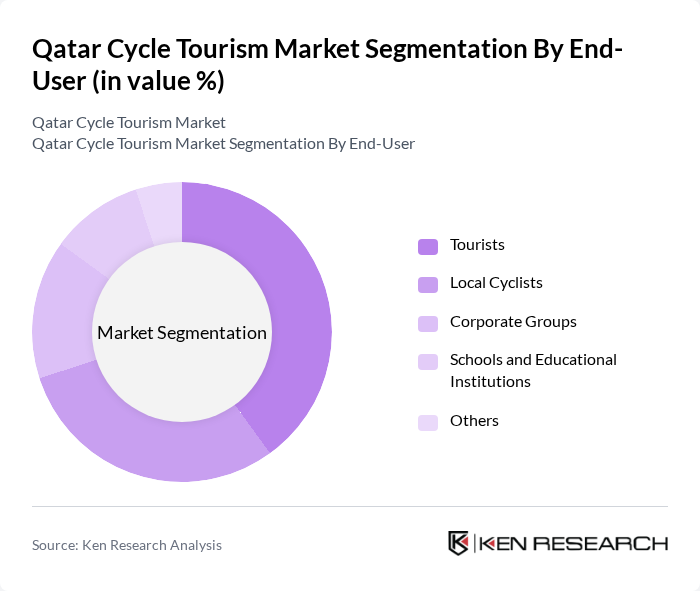

By End-User:The end-user segmentation includes tourists, local cyclists, corporate groups, schools and educational institutions, and others. Tourists constitute the largest segment, driven by the influx of international visitors seeking unique and immersive cycling experiences. Local cyclists contribute significantly as cycling gains popularity for leisure, commuting, and fitness. Corporate groups are increasingly adopting cycling for team-building and wellness initiatives, while educational institutions are integrating cycling into physical education and extracurricular programs. The "others" category encompasses community organizations and event-based users .

The Qatar Cycle Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Cyclists, Doha Cycling Tours, Discover Qatar (Qatar Airways Holidays), Cycle Qatar, Rasen Adventure, Qatar Eco Tours, Doha Bike Tours, Qatar Cycling Federation, Qatar Sports Club, Qatar Outdoor Adventures, Qatar Cycling Academy, Qatar Green Tours, Doha Cycling Experience, Qatar Bike Adventures, and Rasen Sports contribute to innovation, geographic expansion, and service delivery in this space.

The future of cycle tourism in Qatar appears promising, driven by increasing health consciousness and government support for sustainable initiatives. As infrastructure improves, more residents and tourists are likely to engage in cycling activities. The integration of technology, such as mobile apps for route planning and safety, will enhance the cycling experience. Additionally, the rise of e-bikes is expected to attract a broader demographic, making cycling more accessible and enjoyable for all age groups.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Bikes Mountain Bikes Hybrid Bikes E-Bikes Others |

| By End-User | Tourists Local Cyclists Corporate Groups Schools and Educational Institutions Others |

| By Tour Type | Guided Tours Self-Guided Tours Adventure Tours Family Tours Others |

| By Duration | Half-Day Tours Full-Day Tours Multi-Day Tours Weekend Getaways Others |

| By Geographic Area | Urban Areas Rural Areas Coastal Areas Desert Areas Others |

| By Customer Segment | Families Solo Travelers Corporate Clients Adventure Seekers Groups/Friends Couples Others |

| By Service Type | Rental Services Tour Packages Maintenance Services Accessories and Gear Sales Others |

| By Age Group | Under 18 Years to 30 Years to 50 Years Above 50 Years Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Local Cycling Tour Operators | 60 | Business Owners, Tour Managers |

| International Tourists Engaged in Cycling | 90 | Leisure Travelers, Adventure Tourists |

| Government Officials in Tourism Development | 40 | Policy Makers, Tourism Planners |

| Cycling Enthusiasts and Local Riders | 100 | Club Members, Event Participants |

| Retailers of Cycling Equipment and Accessories | 50 | Store Managers, Sales Representatives |

The Qatar Cycle Tourism Market is valued at approximately USD 120 million, reflecting a growing interest in sustainable travel and wellness tourism, alongside government investments in cycling infrastructure and an increase in both local and international cycling enthusiasts.