Region:Middle East

Author(s):Shubham

Product Code:KRAC8944

Pages:98

Published On:November 2025

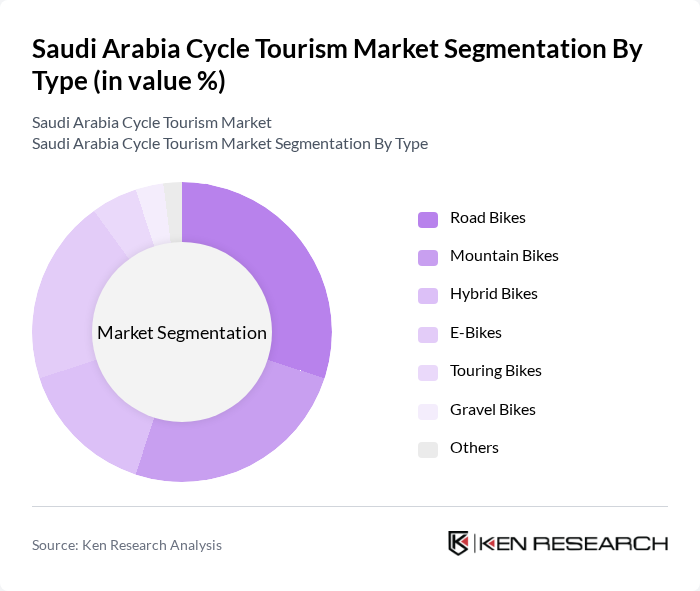

By Type:The cycle tourism market can be segmented into various types of bicycles, including Road Bikes, Mountain Bikes, Hybrid Bikes, E-Bikes, Touring Bikes, Gravel Bikes, and Others. Each type caters to different preferences and terrains, influencing consumer choices based on their cycling experiences and the nature of the tours they wish to undertake. Road bikes are popular for their speed and efficiency on paved roads, while mountain bikes are favored for off-road adventures. E-bikes are gaining traction due to their convenience, growing urban infrastructure, and accessibility for a broader audience, especially in city-based tourism and last-mile mobility .

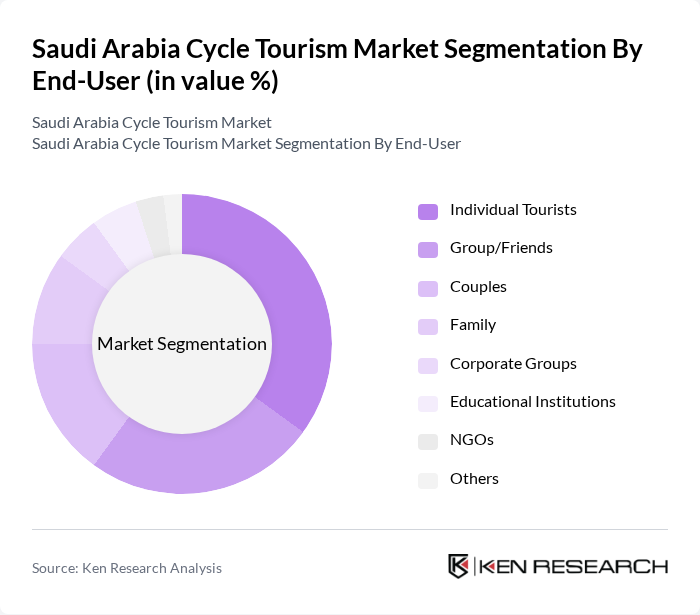

By End-User:The end-user segmentation includes Individual Tourists, Group/Friends, Couples, Family, Corporate Groups, Educational Institutions, NGOs, and Others. Each segment reflects different motivations for cycling, from leisure and adventure to team-building and educational experiences. Individual tourists often seek personalized experiences, while corporate groups may focus on team-building activities. Families and couples typically look for enjoyable and safe cycling routes that cater to all ages. The growing trend of organized cycling events and educational cycling programs is also increasing participation from schools and NGOs , .

The Saudi Arabia Cycle Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Cycling Federation, Adventure HQ Saudi, Cycle Arabia, Saudi Bike Tours, Al-Masmak Cycling Club, Riyadh Cycling Community, Jeddah Cyclists Club, Saudi Arabia Cycling Association, Bike Nation Saudi, Green Wheels KSA, Cycle Zone Riyadh, Saudi Cycling Adventures, EcoCycle Tours Saudi, Desert Cycling Tours KSA, Urban Cyclist Saudi contribute to innovation, geographic expansion, and service delivery in this space.

The future of cycle tourism in Saudi Arabia appears promising, driven by increasing domestic tourism and government support for cycling infrastructure. As health consciousness rises, more citizens are likely to engage in cycling activities, enhancing the market's appeal. Additionally, the integration of technology in cycling experiences, such as mobile apps for route planning, is expected to attract tech-savvy tourists. Overall, the sector is poised for significant growth, with a focus on sustainability and community engagement.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Bikes Mountain Bikes Hybrid Bikes E-Bikes Touring Bikes Gravel Bikes Others |

| By End-User | Individual Tourists Group/Friends Couples Family Corporate Groups Educational Institutions NGOs Others |

| By Region | Riyadh Jeddah Dammam Mecca Medina Al Khobar Others |

| By Tour Type | Guided Tours Self-Guided Tours Adventure Tours Family Tours Event-Based Tours Others |

| By Duration | Short-term (1-3 days) Medium-term (4-7 days) Long-term (8+ days) Others |

| By Service Type | Rental Services Tour Packages Maintenance Services Bike-Sharing Services Others |

| By Customer Segment | Local Residents International Tourists Cycling Enthusiasts Casual Riders Adventure Seekers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cycling Tour Operators | 60 | Business Owners, Tour Managers |

| Cycling Enthusiasts | 100 | Amateur Cyclists, Club Members |

| Local Government Officials | 40 | Tourism Development Officers, Urban Planners |

| Event Organizers | 50 | Event Coordinators, Marketing Managers |

| Infrastructure Developers | 40 | Project Managers, Civil Engineers |

The Saudi Arabia Cycle Tourism Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increased interest in outdoor activities, government investments in cycling infrastructure, and a rise in health-conscious lifestyles among the population.