Region:Global

Author(s):Geetanshi

Product Code:KRAA9166

Pages:82

Published On:November 2025

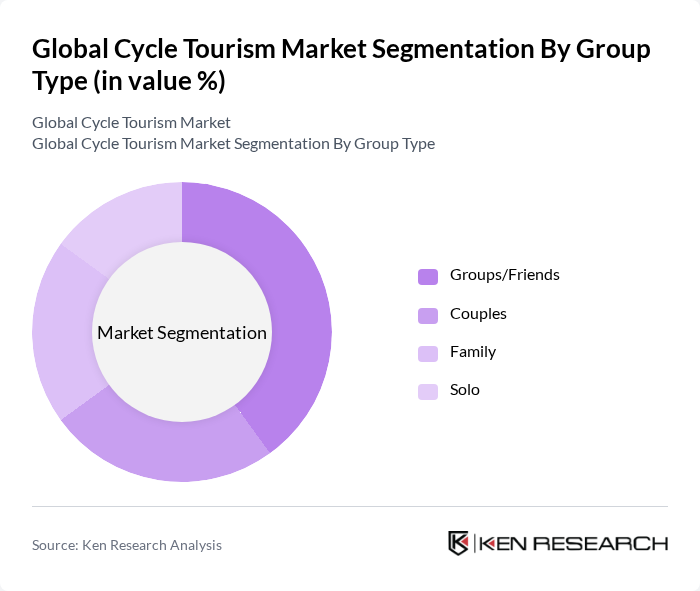

By Group Type:The market is segmented into four main group types: Groups/Friends, Couples, Family, and Solo. TheGroups/Friendssegment is particularly dominant, reflecting the growing trend of group adventure travel and shared experiences. Friends traveling together are drawn to cycling tours for the combination of adventure, social interaction, and wellness. Couples and families also represent significant segments, favoring cycling for bonding and leisure, while solo travelers increasingly seek cycling as a means of personal exploration and self-discovery.

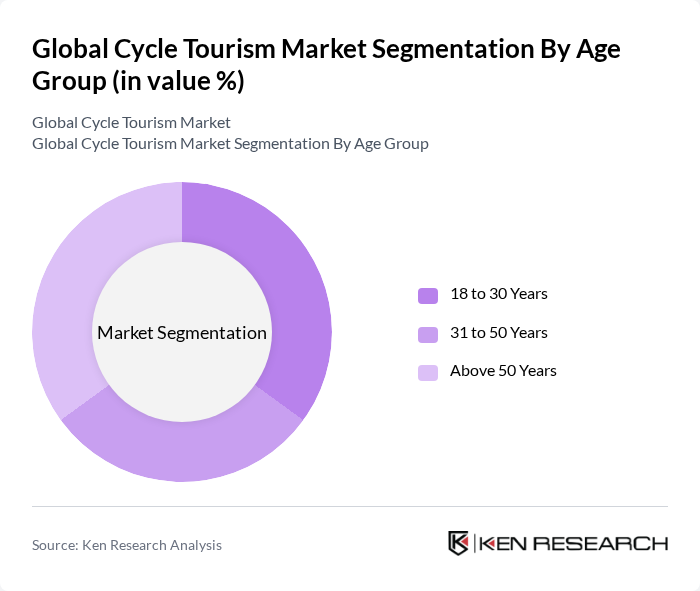

By Age Group:The age group segmentation includes 18 to 30 Years, 31 to 50 Years, and Above 50 Years. The18 to 30 Yearssegment leads the market, driven by younger consumers’ enthusiasm for adventure travel, fitness, and unique experiences. The 31 to 50 Years group follows, often traveling with families or friends and seeking both recreation and wellness. The Above 50 Years segment is steadily expanding, with a focus on leisure, health, and active aging.

The Global Cycle Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as TUI Group (Eurobike), Intrepid Travel, Backroads, Exodus Travels, Discover France, SpiceRoads Cycling, BikeTours.com, Butterfield & Robinson, Cycle Europe, Pedal Nation, Pure Adventures, Trek Travel, Adventure Cycling Association, Radweg-Reisen, and UTracks contribute to innovation, geographic expansion, and service delivery in this space.

The future of cycle tourism appears promising, driven by increasing health awareness and a shift towards sustainable travel. As more travelers seek active and eco-friendly vacation options, the demand for cycling experiences is expected to rise. Additionally, advancements in cycling technology and infrastructure improvements will likely enhance safety and accessibility. The integration of digital platforms for booking and planning cycling tours will further streamline the experience, making it more appealing to a diverse range of tourists seeking unique adventures.

| Segment | Sub-Segments |

|---|---|

| By Group Type | Groups/Friends Couples Family Solo |

| By Age Group | to 30 Years to 50 Years Above 50 Years |

| By Booking Channel | Direct Travel Agent Marketplace Booking |

| By Region | Europe North America Asia-Pacific Latin America Middle East and Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cycle Tour Operators | 100 | Business Owners, Operations Managers |

| Cycling Event Participants | 120 | Cyclists, Event Organizers |

| Local Businesses in Cycling Destinations | 80 | Business Owners, Marketing Managers |

| Tourism Boards and Associations | 60 | Policy Makers, Tourism Development Officers |

| Environmental and Cycling Advocacy Groups | 50 | Advocacy Leaders, Community Organizers |

The Global Cycle Tourism Market is valued at approximately USD 146 billion, reflecting a significant growth trend driven by increasing consumer interest in sustainable travel and health benefits associated with cycling.