Region:Middle East

Author(s):Rebecca

Product Code:KRAC9672

Pages:84

Published On:November 2025

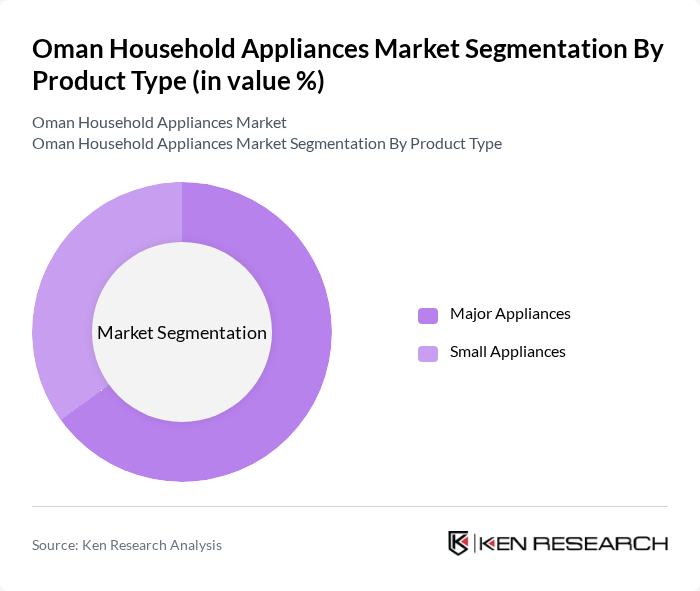

By Product Type:The market is segmented into major appliances and small appliances. Major appliances include refrigerators, freezers, dishwashing machines, washing machines, ovens, air conditioners, and other major appliances. Small appliances encompass coffee makers, food processors, grills and roasters, vacuum cleaners, and other small appliances. The major appliances segment is currently dominating the market due to the essential nature of these products in households and the increasing adoption of smart and energy-efficient models.

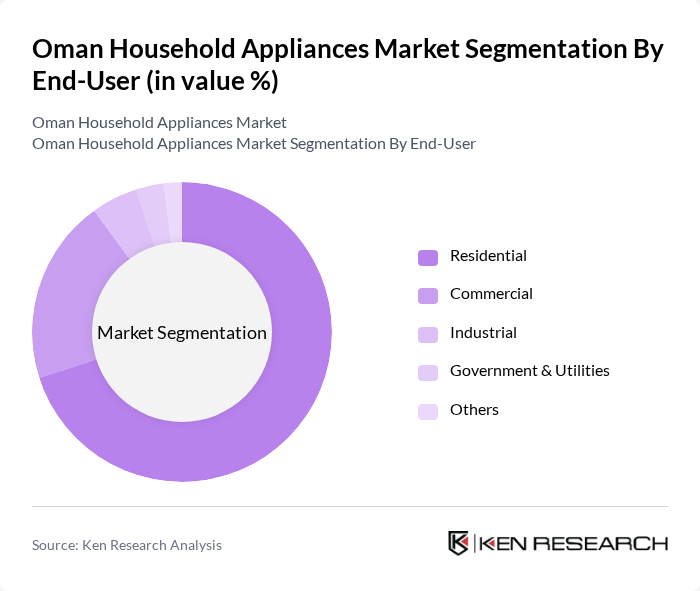

By End-User:The end-user segmentation includes residential, commercial, industrial, government & utilities, and others. The residential segment is the largest, driven by the increasing number of households, the growing trend of home automation, and the expansion of smart home technologies. The commercial segment is also significant, fueled by the growth of the hospitality and service sectors, including hotels and restaurants.

The Oman Household Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics, LG Electronics, Whirlpool Corporation, Bosch Home Appliances, Panasonic Corporation, Haier Group, Electrolux, Midea Group, Sharp Corporation, Gree Electric Appliances, Arçelik A.?., Hisense Group, TCL Technology, Super General Company, and Clikon contribute to innovation, geographic expansion, and service delivery in this space.

The Oman household appliances market is poised for significant transformation as consumer preferences shift towards energy-efficient and smart technologies. With increasing disposable incomes and urbanization, the demand for modern appliances is expected to rise. Additionally, government initiatives promoting sustainability and energy efficiency will likely encourage manufacturers to innovate. As e-commerce continues to expand, it will provide consumers with greater access to a variety of products, further driving market growth and enhancing competition among retailers.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Major Appliances Refrigerators Freezers Dishwashing Machines Washing Machines Ovens Air Conditioners Other Major Appliances Small Appliances Coffee Makers Food Processors Grills and Roasters Vacuum Cleaners Other Small Appliances |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Distribution Channel | Multi-Branded Stores Specialty Stores Online Stores Other Distribution Channels |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Brand | Local Brands International Brands Private Labels Others |

| By Energy Efficiency Rating | A++ A+ B C Others |

| By Technology | Smart Appliances Conventional Appliances Hybrid Appliances Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Household Appliances | 100 | Store Managers, Sales Executives |

| Consumer Preferences and Buying Behavior | 120 | Homeowners, Renters |

| Market Trends in Energy-Efficient Appliances | 80 | Product Managers, Sustainability Officers |

| Impact of E-commerce on Appliance Sales | 90 | eCommerce Managers, Digital Marketing Specialists |

| After-Sales Service and Customer Satisfaction | 60 | Customer Service Representatives, Warranty Managers |

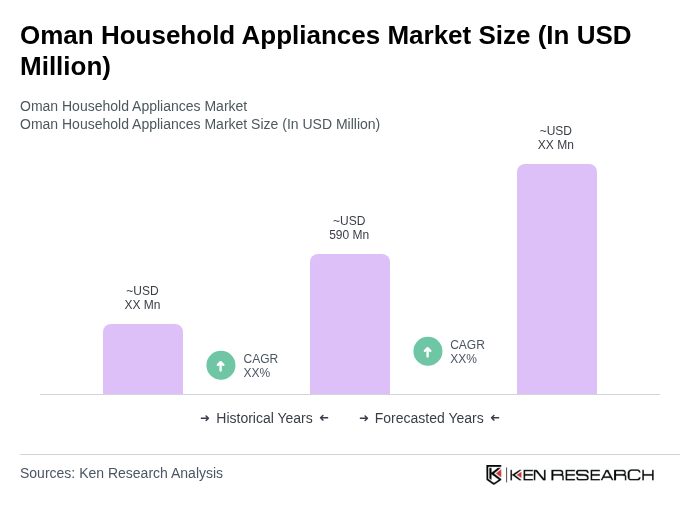

The Oman Household Appliances Market is valued at approximately USD 590 million, reflecting growth driven by increasing disposable incomes, urbanization, and a preference for energy-efficient and smart appliances among consumers.