Region:Middle East

Author(s):Rebecca

Product Code:KRAB2199

Pages:85

Published On:January 2026

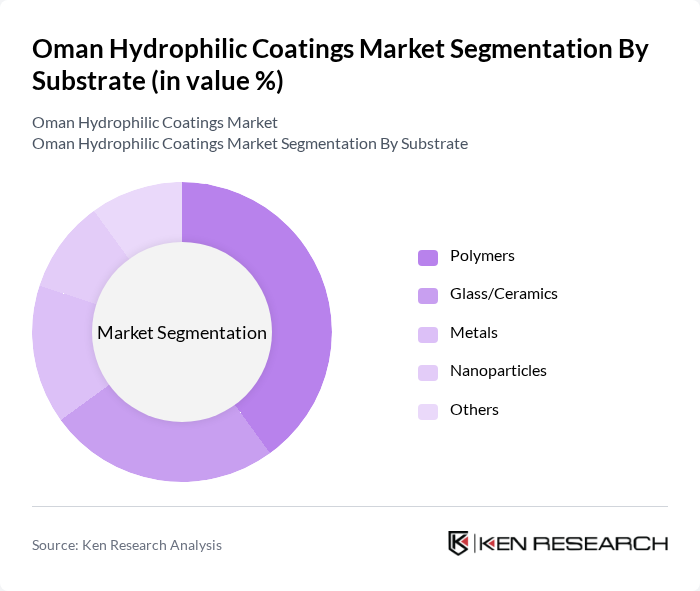

By Substrate:The substrate segment includes various materials that hydrophilic coatings can be applied to, such as polymers, glass/ceramics, metals, nanoparticles, and others, which is consistent with global market practice. Among these, polymers are the leading subsegment due to their versatility, ease of processing, and widespread use in catheters, guidewires, and other disposable medical devices, as well as in automotive and consumer products. The demand for lightweight and durable materials in medical and transport applications reinforces the preference for polymer substrates, making them a dominant choice for hydrophilic coatings.

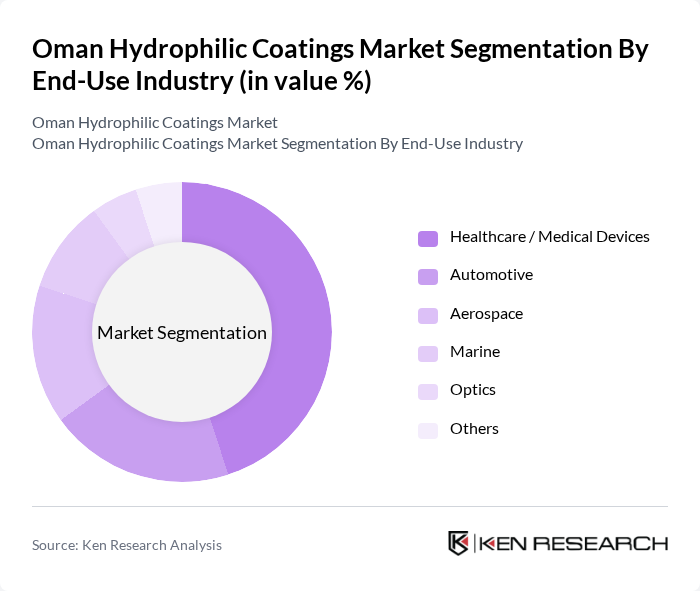

By End-Use Industry:The end-use industry segment encompasses various sectors utilizing hydrophilic coatings, including healthcare/medical devices, automotive, aerospace, marine, optics, and others, in line with global segmentation of this market. The healthcare/medical devices sector is the most significant contributor, driven by rising demand for minimally invasive devices, catheters, and diagnostic equipment that require hydrophilic properties for improved lubricity, reduced friction, and better patient safety, supported by continuous innovation in medical device coatings. Additional growth comes from automotive, aerospace, marine, and optics applications, where hydrophilic coatings are increasingly used to enhance visibility, reduce icing and fouling, and improve durability and maintenance performance.

The Oman Hydrophilic Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as PPG Industries, Inc., Akzo Nobel N.V., BASF SE, The Sherwin-Williams Company, Dow Inc., Nippon Paint Holdings Co., Ltd., Jotun A/S, RPM International Inc., Hempel A/S, Axalta Coating Systems Ltd., 3M Company, Henkel AG & Co. KGaA, Eastman Chemical Company, Clariant AG, Huntsman Corporation contribute to innovation, geographic expansion, and service delivery in this space, leveraging their global hydrophilic and functional coatings portfolios for applications in medical, marine, industrial, and transportation sectors.

The future of the hydrophilic coatings market in Oman appears promising, driven by increasing investments in sustainable technologies and a growing focus on multifunctional coatings. As industries continue to prioritize eco-friendly solutions, the demand for hydrophilic coatings is expected to rise. Additionally, the expansion of the healthcare and electronics sectors will likely create new avenues for growth, with innovative applications emerging. The market is poised for significant transformation as awareness and acceptance of these advanced coatings increase among end-users.

| Segment | Sub-Segments |

|---|---|

| By Substrate | Polymers Glass/Ceramics Metals Nanoparticles Others |

| By End-Use Industry | Healthcare / Medical Devices Automotive Aerospace Marine Optics Others |

| By Application Function | Lubricious / Low-Friction Coatings Anti-fogging Coatings Anti-fouling & Anti-soiling Coatings Self-cleaning Coatings Others |

| By Technology | Water-based Solvent-based UV-cured Others |

| By Distribution Channel | Direct Sales (Key Accounts & OEMs) Distributors & Local Agents Online / E-commerce Others |

| By Region | Muscat Salalah Sohar Duqm & Other Regions |

| By Customer Type | OEMs Contract Manufacturers / Coaters Hospitals & Healthcare Providers Government & Public Sector Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Coatings | 120 | Product Managers, Quality Assurance Leads |

| Aerospace Applications | 90 | Engineering Managers, Procurement Specialists |

| Medical Device Coatings | 70 | Regulatory Affairs Managers, R&D Directors |

| Consumer Goods Coatings | 80 | Marketing Managers, Product Development Teams |

| Industrial Applications | 60 | Operations Managers, Supply Chain Coordinators |

The Oman Hydrophilic Coatings Market is valued at approximately USD 12 million, based on a five-year historical analysis. This valuation reflects the growing demand for advanced coatings across various sectors, particularly healthcare and automotive.