Region:Asia

Author(s):Rebecca

Product Code:KRAB2201

Pages:84

Published On:January 2026

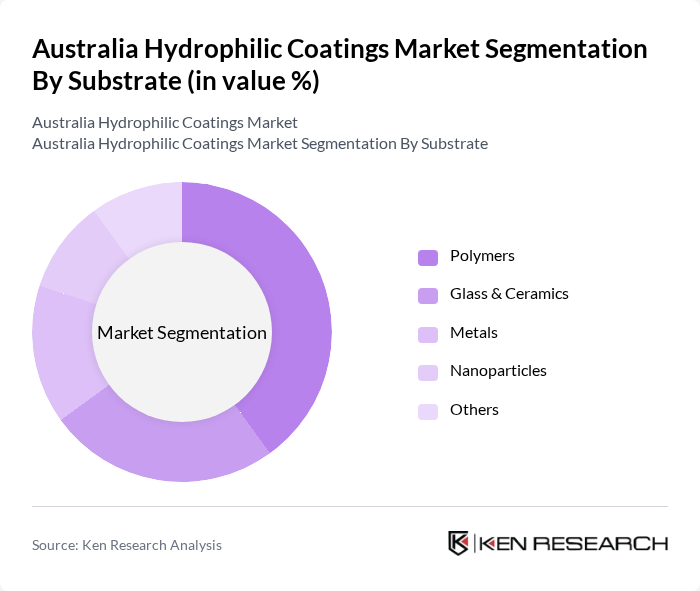

By Substrate:The hydrophilic coatings market can be segmented based on substrate types, which include Polymers, Glass & Ceramics, Metals, Nanoparticles, and Others. Each substrate type offers unique properties that cater to specific applications, influencing the overall market dynamics.

The polymer substrate segment is the leading category in the hydrophilic coatings market, primarily due to its versatility and wide range of applications. Polymers are extensively used in medical devices, automotive components, and consumer products, where their hydrophilic properties enhance performance and user experience through improved lubricity, anti-fog behavior, and controlled moisture interaction. The increasing demand for lightweight and durable materials in various industries, coupled with ongoing development of PFAS-free and eco-friendly polymer chemistries, further drives the growth of this segment, making it a key focus for manufacturers.

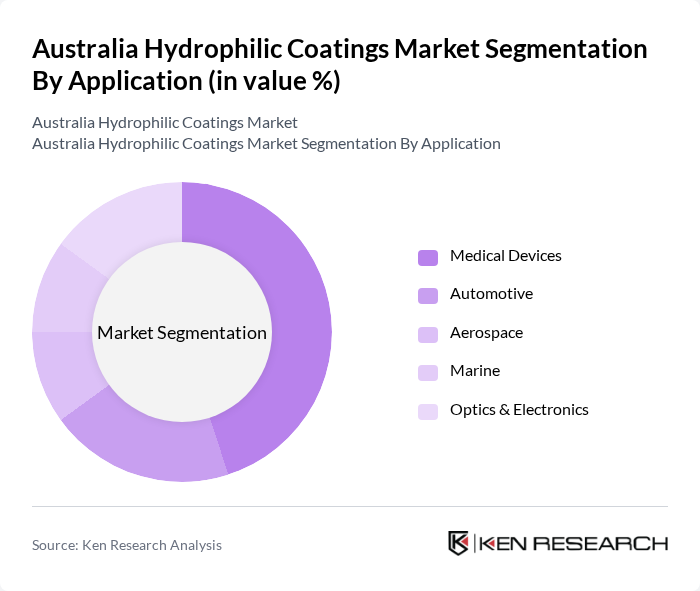

By Application:The market can also be segmented based on applications, which include Medical Devices, Automotive, Aerospace, Marine, Optics & Electronics, and Others. Each application area has distinct requirements that hydrophilic coatings can fulfill, contributing to the market's expansion.

The medical devices application segment holds the largest market share, driven by the increasing demand for advanced coatings that enhance the performance and safety of medical instruments and minimally invasive devices. Hydrophilic coatings are essential in applications such as catheters, guidewires, and surgical instruments, where they improve biocompatibility, reduce friction, and support smoother navigation through tissues and vessels. The growing focus on healthcare innovation, an expanding medical device manufacturing base in the Asia Pacific region (including Australia), and stricter performance expectations from clinicians and regulators continue to propel this segment's growth, making it a critical area for investment and development.

The Australia Hydrophilic Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as DSM, Biocoat Incorporated, Hydromer Inc., Harland Medical Systems Inc., AST Products Inc., Abbott, Aculon Inc., Wacker Chemie AG, DIC Corporation, Eternal Materials Co. Ltd, Dow, 3M, Covestro AG, Eastman Chemical Company, Axalta Coating Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hydrophilic coatings market in Australia appears promising, driven by technological advancements and increasing environmental awareness. The shift towards sustainable and eco-friendly coatings is expected to gain momentum, with manufacturers investing in innovative solutions that meet regulatory standards. Additionally, the integration of smart technologies in coatings will enhance functionality, catering to diverse applications. As awareness grows, the market is likely to witness increased adoption across various sectors, fostering a competitive landscape that encourages further innovation and collaboration.

| Segment | Sub-Segments |

|---|---|

| By Substrate | Polymers Glass & Ceramics Metals Nanoparticles Others |

| By Application | Medical Devices Automotive Aerospace Marine Optics & Electronics Others |

| By Function | Lubricity Enhancement Anti-Fogging Anti-Microbial / Anti-Fouling Corrosion & Wear Protection Others |

| By Technology | Solvent-Based Coatings Water-Based Coatings UV-Curable Coatings Others |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Others |

| By End-User Type | OEMs (Original Equipment Manufacturers) Contract Coaters / Coating Service Providers Distributors & Traders Others |

| By Customer Segment | B2B B2G (Business-to-Government) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Coatings | 120 | Product Managers, Quality Assurance Engineers |

| Medical Device Coatings | 90 | Regulatory Affairs Specialists, R&D Managers |

| Construction Coatings | 80 | Architects, Project Managers |

| Aerospace Coatings | 70 | Manufacturing Engineers, Supply Chain Managers |

| Consumer Goods Coatings | 60 | Marketing Managers, Product Development Specialists |

The Australia Hydrophilic Coatings Market is valued at approximately USD 180 million, reflecting its significance within the Asia Pacific and global hydrophilic coatings industry, driven by demand in sectors like medical devices and automotive.