Philippines Hydrophilic Coatings Market Overview

- The Philippines Hydrophilic Coatings Market is valued at USD 12 million, based on a five-year historical analysis, as part of the broader Asia–Pacific hydrophilic coatings industry that holds the largest share of a global market estimated at over USD 11 billion. This growth is primarily driven by the increasing demand for advanced coatings in medical devices, automotive components, and electronics, in line with rapid manufacturing expansion and foreign direct investment in the Philippines and Southeast Asia. The rising awareness of the benefits of hydrophilic coatings, such as improved wettability, lubricity for catheters and guidewires, and anti-fogging and anti-contamination properties for optical and electronic surfaces, has further supported market expansion.

- Metro Manila, Cebu, and Davao are the dominant regions in the Philippines Hydrophilic Coatings Market. Metro Manila, being the capital, has a high concentration of industrial parks, automotive assembly, healthcare facilities, and research institutions, which drives innovation and demand for specialty coatings. Cebu and Davao are also emerging as industrial and logistics hubs, with growing investments in manufacturing, electronics assembly, ship repair, and medical services, which in turn supports demand for functional and performance coatings, including hydrophilic systems.

- The Philippine government has implemented regulations to promote the use of environmentally friendly coatings. The Department of Environment and Natural Resources (DENR), through the Revised Chemical Control Order (CCO) for Ozone Depleting Substances issued under DENR Administrative Order 2013-25 and related implementing rules, restricts hazardous substances and encourages the shift to low-emission, compliant coatings systems in manufacturing. In parallel, the Philippine Clean Air Act framework and DENR guidelines on air quality management drive adoption of low-VOC (volatile organic compounds) coatings, including waterborne and high?solids hydrophilic coatings, to reduce solvent emissions while maintaining or enhancing product performance.

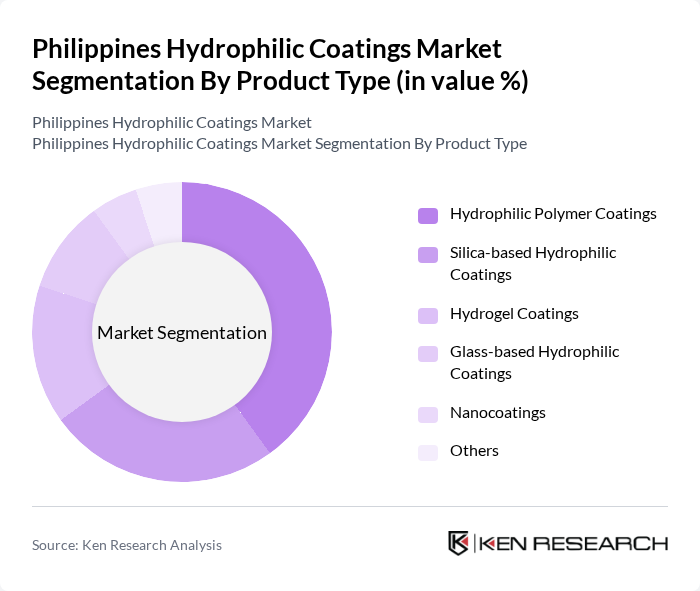

Philippines Hydrophilic Coatings Market Segmentation

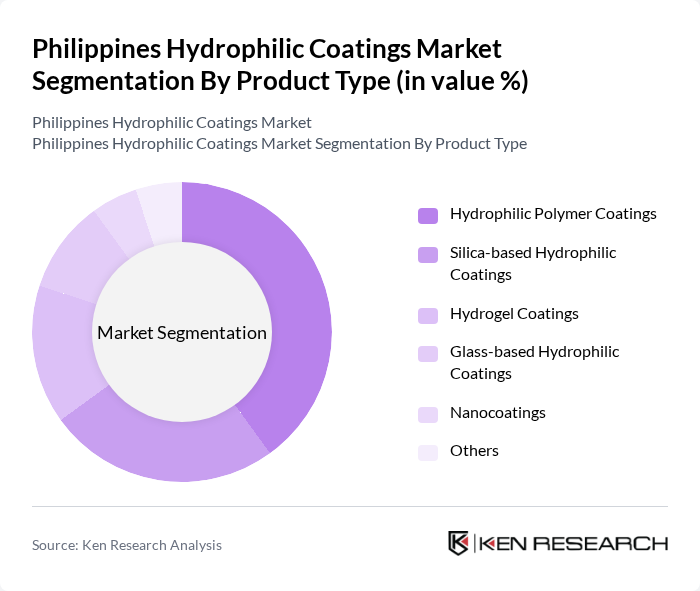

By Product Type:The product type segmentation includes various categories of hydrophilic coatings, each serving distinct applications and industries. The subsegments are Hydrophilic Polymer Coatings, Silica-based Hydrophilic Coatings, Hydrogel Coatings, Glass-based Hydrophilic Coatings, Nanocoatings, and Others. Hydrophilic Polymer Coatings are leading the market due to their versatility and widespread use in medical devices, catheters, guidewires, and consumer goods, reflecting the global trend where polymer-based systems account for the largest share of hydrophilic coatings demand. The increasing demand for high-performance, lubricious, and biocompatible coatings in minimally invasive medical procedures, as well as anti-fog and easy-clean surfaces in optics and electronics, is driving the growth of this subsegment.

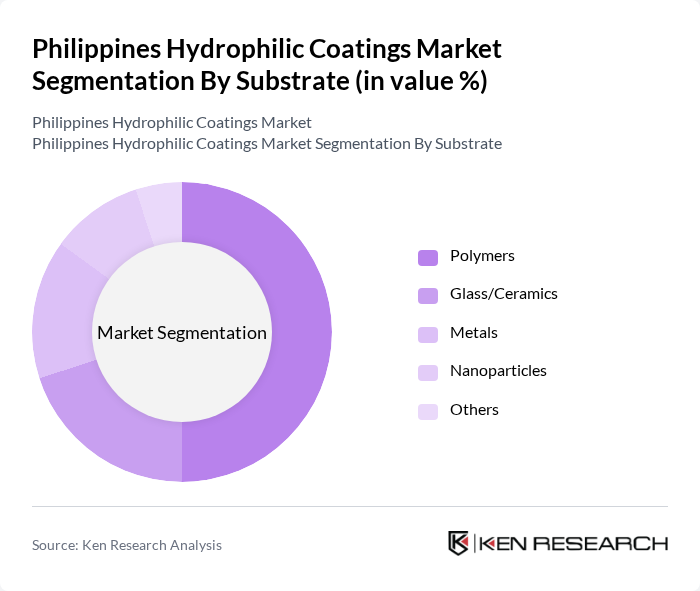

By Substrate:The substrate segmentation encompasses various materials that hydrophilic coatings can be applied to, including Polymers, Glass/Ceramics, Metals, Nanoparticles, and Others. Polymers are the dominant substrate in this market due to their extensive use in disposable and reusable medical devices, flexible tubing, and consumer products, mirroring the global pattern where polymer substrates represent the largest share of hydrophilic coating applications. The adaptability of hydrophilic coatings on polymer substrates enhances their lubricity, wetting, and biocompatibility, making them a preferred choice for manufacturers in medical, automotive, and electronics sectors.

Philippines Hydrophilic Coatings Market Competitive Landscape

The Philippines Hydrophilic Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as PPG Industries, Inc., AkzoNobel N.V., BASF SE, The Sherwin-Williams Company, Dow Inc., 3M Company, Huntsman Corporation, Eastman Chemical Company, Covestro AG, Nippon Paint Holdings Co., Ltd., Jotun A/S, RPM International Inc., Hempel A/S, Axalta Coating Systems Ltd., The Valspar Corporation (now part of The Sherwin-Williams Company) contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Hydrophilic Coatings Market Industry Analysis

Growth Drivers

- Increasing Demand for Anti-Fogging and Anti-Reflective Coatings:The Philippines has seen a surge in demand for hydrophilic coatings, particularly in the automotive and eyewear sectors, driven by a 15% increase in consumer preference for anti-fogging solutions. The automotive industry alone is projected to contribute approximately PHP 2.5 billion in revenue in future, as manufacturers seek to enhance visibility and safety features in vehicles. This trend is further supported by rising consumer awareness regarding product performance and safety.

- Growth in the Healthcare and Medical Device Sectors:The healthcare sector in the Philippines is expected to grow at a rate of 10% annually, with the medical device market projected to reach PHP 50 billion in future. This growth is driving the demand for hydrophilic coatings, which are essential for medical devices to enhance biocompatibility and reduce infection risks. The increasing number of surgical procedures and the rise in chronic diseases are further propelling this demand, creating a robust market for specialized coatings.

- Rising Awareness of Environmental Sustainability:With the Philippines committing to reduce greenhouse gas emissions by 70% in future, there is a growing emphasis on eco-friendly products. The hydrophilic coatings market is benefiting from this trend, as manufacturers are increasingly adopting sustainable practices. In future, it is estimated that 30% of new coatings will be developed with environmentally friendly materials, reflecting a significant shift towards sustainability in the industry, driven by both consumer demand and regulatory pressures.

Market Challenges

- High Production Costs of Hydrophilic Coatings:The production of hydrophilic coatings involves advanced technologies and raw materials, leading to high manufacturing costs. In future, the average cost of production is expected to be around PHP 1,200 per liter, which poses a challenge for manufacturers aiming to maintain competitive pricing. This high cost can limit market penetration, particularly among small and medium enterprises that struggle to invest in expensive production technologies.

- Limited Awareness Among End-Users:Despite the benefits of hydrophilic coatings, there remains a significant knowledge gap among potential end-users, particularly in non-industrial sectors. A survey indicated that only 40% of consumers are aware of the advantages of these coatings. This lack of awareness can hinder market growth, as potential customers may opt for traditional coatings without understanding the long-term benefits of hydrophilic alternatives, impacting overall adoption rates.

Philippines Hydrophilic Coatings Market Future Outlook

The future of the hydrophilic coatings market in the Philippines appears promising, driven by technological advancements and increasing environmental consciousness. As manufacturers invest in research and development, innovative applications are likely to emerge, enhancing product performance and sustainability. Additionally, the growing trend towards smart coatings, which integrate functionalities like self-cleaning and anti-bacterial properties, is expected to attract new customers and expand market reach, fostering a competitive landscape that prioritizes innovation and eco-friendliness.

Market Opportunities

- Expansion in Emerging Markets:The rising middle class in Southeast Asia presents a significant opportunity for hydrophilic coatings. With an estimated 50 million people entering the middle class in future, demand for high-quality consumer products, including automotive and healthcare applications, is expected to rise, creating new market avenues for manufacturers.

- Development of Innovative Product Applications:There is a growing potential for hydrophilic coatings in niche markets such as electronics and textiles. As industries seek to enhance product functionality, the integration of hydrophilic coatings can lead to innovative solutions, such as moisture management in textiles, which could capture a market share worth PHP 1 billion in future, driving further growth.