Region:Middle East

Author(s):Rebecca

Product Code:KRAB2198

Pages:97

Published On:January 2026

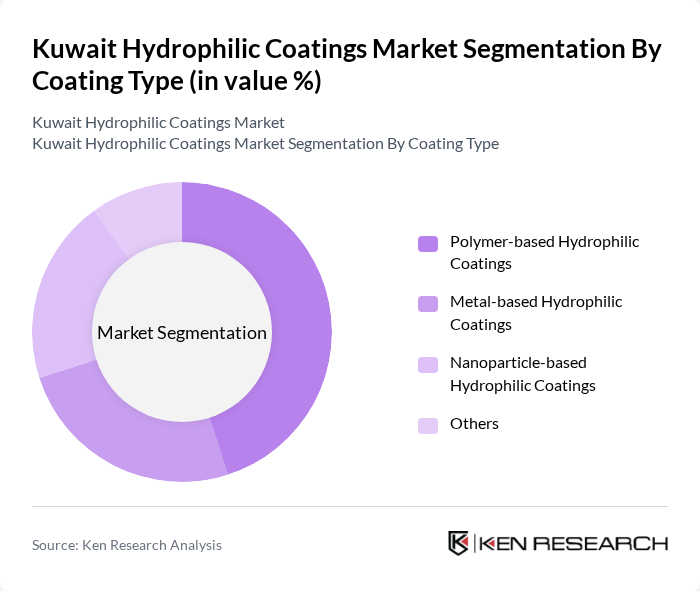

By Coating Type:

The hydrophilic coatings market can be segmented into several types, including Polymer-based Hydrophilic Coatings, Metal-based Hydrophilic Coatings, Nanoparticle-based Hydrophilic Coatings, and Others. Polymer-based hydrophilic coatings typically dominate global usage due to their versatility, tunable chemistry, strong adhesion to substrates, and wide range of applications, particularly in catheters, guidewires, stents, and consumer products where low friction and high wettability are required. The increasing demand for lightweight and durable materials in various industries, combined with the shift toward PFAS?free and eco-friendly polymer systems, further supports the growth of this subsegment.

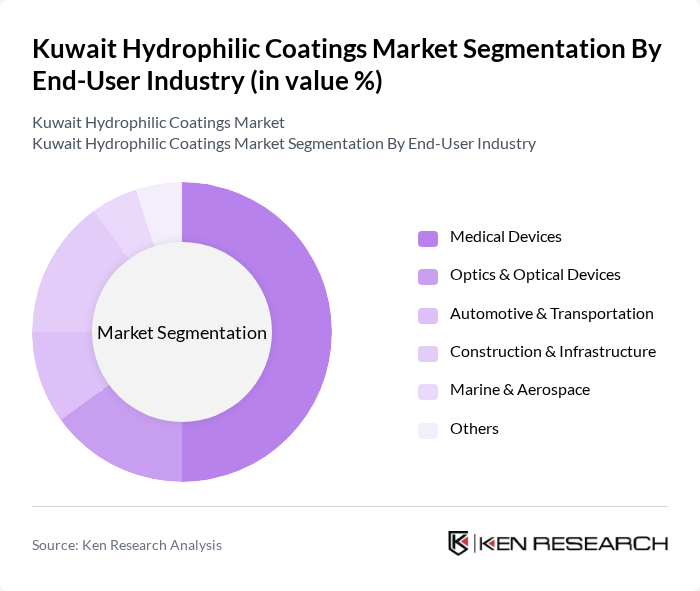

By End-User Industry:

The end-user industries for hydrophilic coatings include Medical Devices, Optics & Optical Devices, Automotive & Transportation, Construction & Infrastructure, Marine & Aerospace, and Others. The Medical Devices segment is the leading end-user globally, driven by the increasing demand for minimally invasive and implantable medical technologies and devices that require specialized lubricious, biocompatible coatings for improved performance and patient safety. The growing healthcare sector in Kuwait, supported by hospital expansion, higher procedure volumes, and greater adoption of advanced interventional devices, significantly contributes to the expansion of this segment and supports higher penetration of hydrophilic coating technologies in the country.

The Kuwait Hydrophilic Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as PPG Industries, Inc., Akzo Nobel N.V., BASF SE, The Sherwin-Williams Company, Dow Inc., 3M Company, Huntsman Corporation, Nippon Paint Holdings Co., Ltd., Jotun A/S, Eastman Chemical Company, Covestro AG, RPM International Inc., Axalta Coating Systems Ltd., Clariant AG, Momentive Performance Materials Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the Kuwait hydrophilic coatings market appears promising, driven by increasing investments in sustainable technologies and the growing demand for multifunctional coatings. As industries prioritize eco-friendly solutions, the market is likely to witness a shift towards innovative formulations that meet environmental standards. Additionally, the integration of digital technologies in manufacturing processes is expected to enhance efficiency and reduce costs, further supporting market expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Coating Type | Polymer-based Hydrophilic Coatings Metal-based Hydrophilic Coatings Nanoparticle-based Hydrophilic Coatings Others |

| By End-User Industry | Medical Devices Optics & Optical Devices Automotive & Transportation Construction & Infrastructure Marine & Aerospace Others |

| By Application | Catheters, Guidewires & Other Interventional Devices Anti-fogging & Anti-condensation Surfaces Self-cleaning & Easy-to-clean Surfaces Optical Lenses, Displays & Screens Others |

| By Substrate | Polymers Glass & Ceramics Metals Others |

| By Distribution Channel | Direct Sales to OEMs Distributors/Dealers Online/Indirect Channels Others |

| By Region (Within Kuwait) | Capital Governorate (Kuwait City) Hawalli Governorate Farwaniya Governorate Ahmadi Governorate Jahra Governorate Mubarak Al-Kabeer Governorate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Coatings | 110 | Product Managers, Quality Assurance Engineers |

| Medical Device Coatings | 85 | Regulatory Affairs Specialists, R&D Managers |

| Construction Coatings | 95 | Project Managers, Procurement Officers |

| Consumer Goods Coatings | 75 | Marketing Managers, Product Development Leads |

| Industrial Applications | 65 | Operations Managers, Supply Chain Coordinators |

The Kuwait Hydrophilic Coatings Market is valued at approximately USD 120 million, reflecting a robust growth trajectory driven by increasing demand in sectors such as medical devices and automotive applications.