Region:Middle East

Author(s):Rebecca

Product Code:KRAD6140

Pages:81

Published On:December 2025

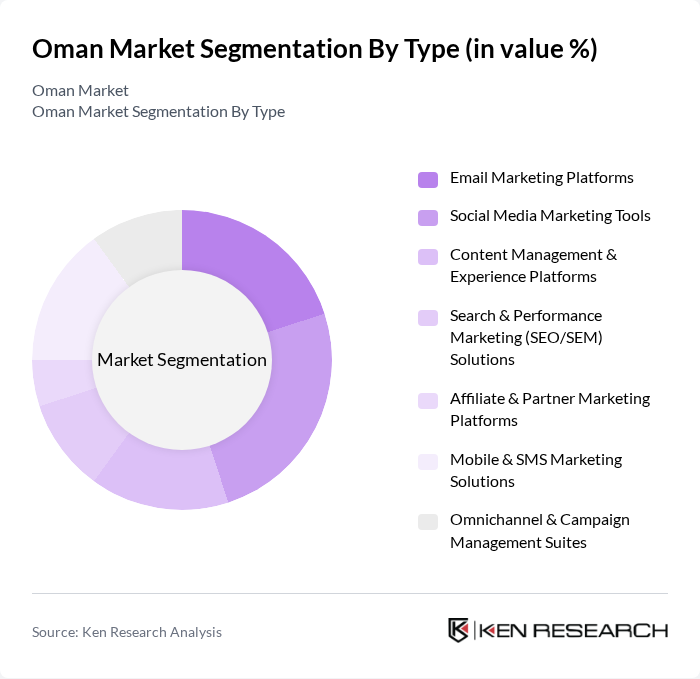

By Type:The marketing technology market can be segmented into various types, including Email Marketing Platforms, Social Media Marketing Tools, Content Management & Experience Platforms, Search & Performance Marketing (SEO/SEM) Solutions, Affiliate & Partner Marketing Platforms, Mobile & SMS Marketing Solutions, and Omnichannel & Campaign Management Suites. Each of these sub-segments plays a crucial role in helping businesses reach their target audiences effectively.

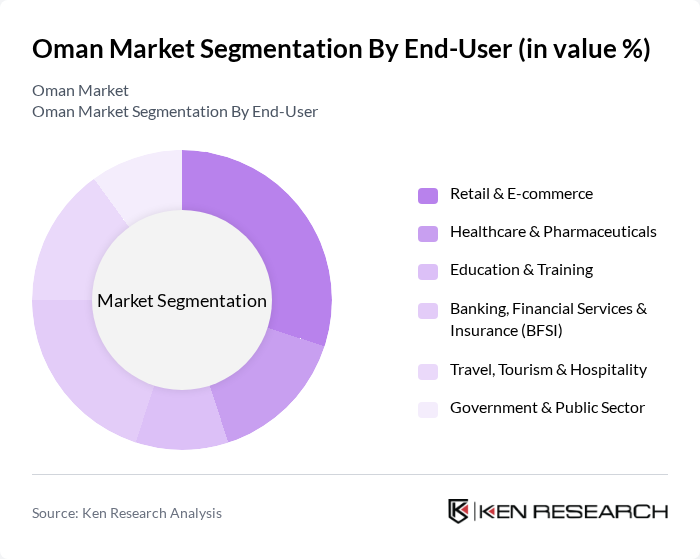

By End-User:The end-user segmentation includes Retail & E-commerce, Healthcare & Pharmaceuticals, Education & Training, Banking, Financial Services & Insurance (BFSI), Travel, Tourism & Hospitality, and Government & Public Sector. Each sector utilizes marketing technology differently, reflecting their unique needs and customer engagement strategies.

The Oman Marketing Technology market is characterized by a dynamic mix of regional and international players. Leading participants such as Omantel, Ooredoo Oman, Vodafone Oman, Awasr, Oman Data Park, Bahwan CyberTek, Gulf CyberTech, Muscat Media Group, Impact Integrated, Zeenah Group, UMS (United Media Services), eSpace (Oman), OmanTel ICT & Digital Solutions, ODP Marketing & Cloud Services, Key Regional MarTech Vendors Active in Oman (e.g., HubSpot, Salesforce, Adobe Experience Cloud) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman marketing technology landscape is poised for significant evolution, driven by increasing digital adoption and government initiatives. As businesses recognize the importance of data analytics and customer experience, investments in marketing technologies are expected to rise. The integration of AI and automation tools will further enhance marketing strategies, enabling companies to deliver personalized experiences. Additionally, the growth of e-commerce and mobile marketing will create new avenues for engagement, positioning Oman as a competitive player in the regional market.

| Segment | Sub-Segments |

|---|---|

| By Type | Email Marketing Platforms Social Media Marketing Tools Content Management & Experience Platforms Search & Performance Marketing (SEO/SEM) Solutions Affiliate & Partner Marketing Platforms Mobile & SMS Marketing Solutions Omnichannel & Campaign Management Suites |

| By End-User | Retail & E-commerce Healthcare & Pharmaceuticals Education & Training Banking, Financial Services & Insurance (BFSI) Travel, Tourism & Hospitality Government & Public Sector |

| By Industry | Telecommunications & ICT Automotive & Transport Real Estate & Construction Consumer Goods & FMCG Media, Entertainment & Publishing |

| By Marketing Channel | Web & Search Social & Influencer Mobile App & In-App SMS & Messaging Events, Experiential & OOH-Linked Digital |

| By Technology | Customer Relationship Management (CRM) Software Marketing Automation & Journey Orchestration Platforms Analytics, CDP & Attribution Platforms Social Media Management & Listening Tools Tag Management, Adtech & Programmatic Platforms |

| By Budget Size | Less than OMR 50,000 annually OMR 50,000–250,000 annually Above OMR 250,000 annually Project-Based / Campaign-Based Spend |

| By Policy Support | Vision 2040 & National Digital Strategies Tax & Investment Incentives for ICT Government Innovation & Training Programs Free Zones, Tech Parks & Incubation Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Market | 100 | Retail Managers, Electronics Buyers |

| Food and Beverage Sector | 120 | Product Managers, Supply Chain Coordinators |

| Fashion and Apparel Industry | 80 | Brand Managers, Retail Store Owners |

| Home Appliances Segment | 70 | Sales Executives, Category Managers |

| Health and Beauty Products | 90 | Marketing Directors, Product Development Leads |

The Oman Marketing Technology market is valued at approximately USD 125 million, driven by the increasing adoption of digital marketing strategies, e-commerce growth, and the importance of data analytics in marketing decision-making.