Region:Middle East

Author(s):Rebecca

Product Code:KRAC2766

Pages:94

Published On:January 2026

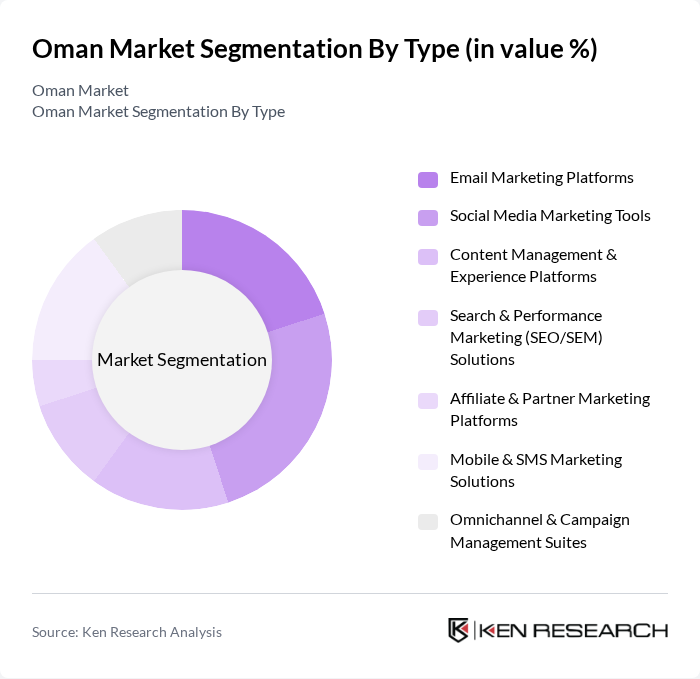

By Type:The Oman Marketing Technology market can be segmented into various types, including Email Marketing Platforms, Social Media Marketing Tools, Content Management & Experience Platforms, Customer Relationship Management (CRM) Software, Marketing Automation Platforms, Analytics and Reporting Tools, and Others. Among these, Email Marketing Platforms and CRM Software are particularly dominant due to their effectiveness in customer engagement and relationship management.

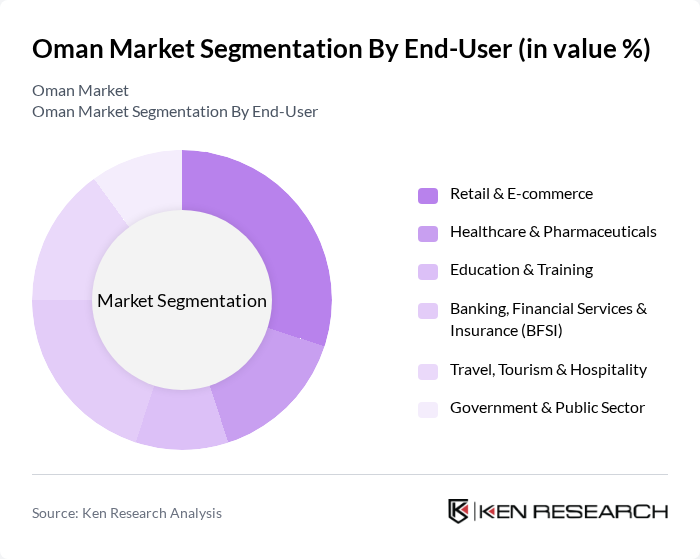

By End-User:The market can also be segmented by end-user categories, which include Retail & E-commerce, Healthcare & Pharmaceuticals, Education & Training, Banking, Financial Services & Insurance (BFSI), Travel, Tourism & Hospitality, Government & Public Sector, and Others. Retail & E-commerce and BFSI are leading segments, as they increasingly recognize the importance of digital marketing to compete effectively in the market.

The Oman Marketing Technology market is characterized by a dynamic mix of regional and international players. Leading participants such as Omantel, Ooredoo Oman, Zain Oman, Awasr, Majan Telecom, Al Nahda, Oman Data Park, Muscat Media Group, Oman Web Solutions, Digital Marketing Oman, Oman Advertising Company, Al Harthy Group, Al Jazeera Media Network, Al Maseer Group, Oman Marketing Agency contribute to innovation, geographic expansion, and service delivery in this space.

The Oman marketing technology landscape is poised for significant evolution, driven by advancements in artificial intelligence and machine learning. As businesses increasingly prioritize customer experience, the integration of personalized marketing strategies will become essential. Furthermore, the rise of omnichannel marketing approaches will necessitate seamless coordination across various platforms, enhancing customer engagement. With government support for digital initiatives, the market is expected to witness robust growth, fostering innovation and attracting investments in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Email Marketing Solutions Social Media Management Tools Content Management Systems Customer Relationship Management (CRM) Software Marketing Automation Platforms Analytics and Reporting Tools Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Corporations Government Agencies Non-Profit Organizations Others |

| By Industry Vertical | Retail Healthcare Education Financial Services Travel and Hospitality Others |

| By Marketing Channel | Digital Advertising Social Media Email Marketing Search Engine Marketing Others |

| By Geographic Distribution | Muscat Salalah Sohar Nizwa Others |

| By Customer Segment | B2B B2C C2C Others |

| By Policy Support | Government Grants for Digital Marketing Tax Incentives for Tech Adoption Training and Development Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Goods Retail | 120 | Store Managers, Category Buyers |

| Food and Beverage Sector | 100 | Product Managers, Supply Chain Coordinators |

| Electronics and Appliances | 80 | Sales Executives, Marketing Managers |

| Textiles and Apparel | 70 | Merchandising Managers, Retail Analysts |

| Health and Beauty Products | 90 | Brand Managers, Retail Operations Heads |

The Oman Marketing Technology market is valued at approximately USD 125 million, driven by the increasing adoption of digital marketing strategies, e-commerce growth, and the integration of AI and automation tools for personalized customer experiences.