Region:Middle East

Author(s):Rebecca

Product Code:KRAC9673

Pages:96

Published On:November 2025

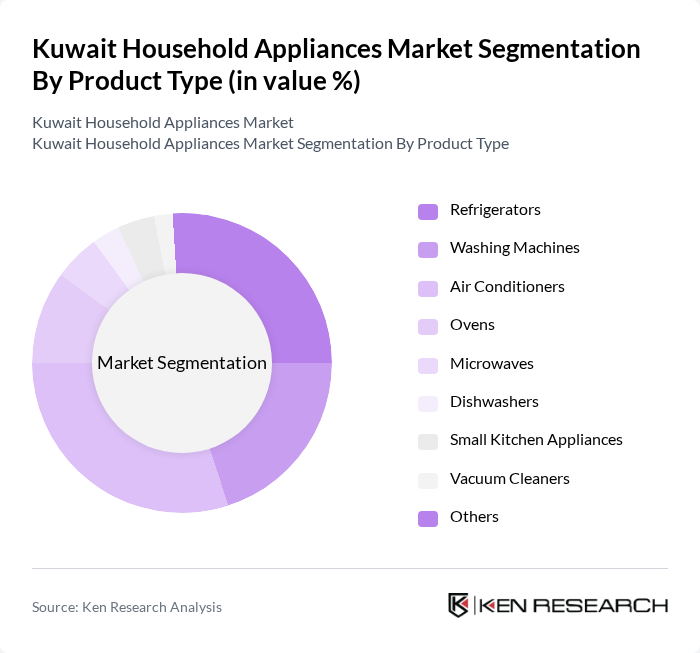

By Product Type:The household appliances market can be segmented into various product types, including refrigerators, washing machines, air conditioners, ovens, microwaves, dishwashers, small kitchen appliances, vacuum cleaners, and others. Each of these segments caters to different consumer needs and preferences, with specific trends influencing their market performance.

The air conditioners segment dominates the market due to the extreme climate conditions in Kuwait, leading to a high demand for cooling solutions. Consumers are increasingly opting for energy-efficient models, which not only provide comfort but also help in reducing electricity bills. The trend towards smart home technology has also contributed to the growth of this segment, as consumers seek appliances that offer convenience and connectivity.

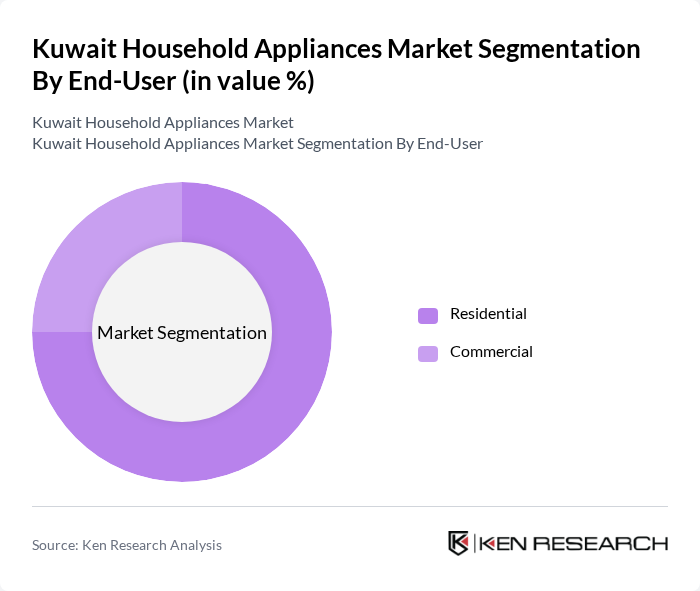

By End-User:The market can be segmented into residential and commercial end-users. The residential segment is the largest, driven by the increasing number of households and the growing trend of home renovations. The commercial segment, while smaller, is also significant, particularly in the hospitality and food service industries, where the demand for high-quality appliances is rising.

The residential segment leads the market due to the increasing number of households and the trend towards modernizing home appliances. Consumers are investing in high-quality, energy-efficient products that enhance their living standards. The commercial segment, while smaller, is growing as businesses seek reliable and efficient appliances to meet their operational needs.

The Kuwait Household Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alghanim Industries (X-cite), Orca Appliances, Panasonic Marketing Middle East & Africa FZE, LG Electronics Gulf FZE, Samsung Electronics Co., Ltd., Whirlpool Corporation, BSH Home Appliances Group (Bosch, Siemens), Midea Group, Electrolux AB, Haier Group Corporation, Sharp Corporation, Arçelik A.?., Hisense Group, Gorenje Group, Smeg S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait household appliances market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As smart home technologies gain traction, manufacturers are likely to focus on integrating IoT features into their products. Additionally, the increasing emphasis on energy efficiency and sustainability will shape product development, encouraging brands to innovate. With a growing urban population and rising disposable incomes, the market is expected to adapt to evolving consumer demands, fostering a competitive landscape that prioritizes quality and innovation.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Refrigerators Washing Machines Air Conditioners Ovens Microwaves Dishwashers Small Kitchen Appliances (e.g., blenders, coffee makers, food processors) Vacuum Cleaners Others |

| By End-User | Residential Commercial |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Salmiya Others |

| By Technology | Smart Home Appliances Energy-Efficient Models Conventional Appliances |

| By Price Range | Budget Mid-Range Premium |

| By Distribution Channel | Multi-Branded Stores Specialty Stores Online Platforms Direct Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Refrigerators | 100 | Homeowners, Renters |

| Market Insights on Washing Machines | 90 | Household Decision Makers, Appliance Buyers |

| Trends in Kitchen Appliances | 60 | Home Cooks, Kitchen Designers |

| Consumer Attitudes towards Energy-Efficient Appliances | 50 | Environmentally Conscious Consumers, Tech Enthusiasts |

| Feedback on After-Sales Services | 40 | Recent Appliance Buyers, Customer Service Users |

The Kuwait Household Appliances Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by rising disposable incomes, urbanization, and a preference for energy-efficient and smart appliances among consumers.