Region:Middle East

Author(s):Rebecca

Product Code:KRAD8263

Pages:100

Published On:December 2025

By Service Type:The service type segmentation includes various categories such as Primary Care Services, Specialty Care Services, Rehabilitation Services, Palliative Care Services, and Others. Among these, Primary Care Services are currently leading the market due to their essential role in preventive care and chronic disease management. The increasing emphasis on early diagnosis and continuous patient engagement drives the demand for these services. Specialty Care Services are also gaining traction as more patients seek specialized treatments.

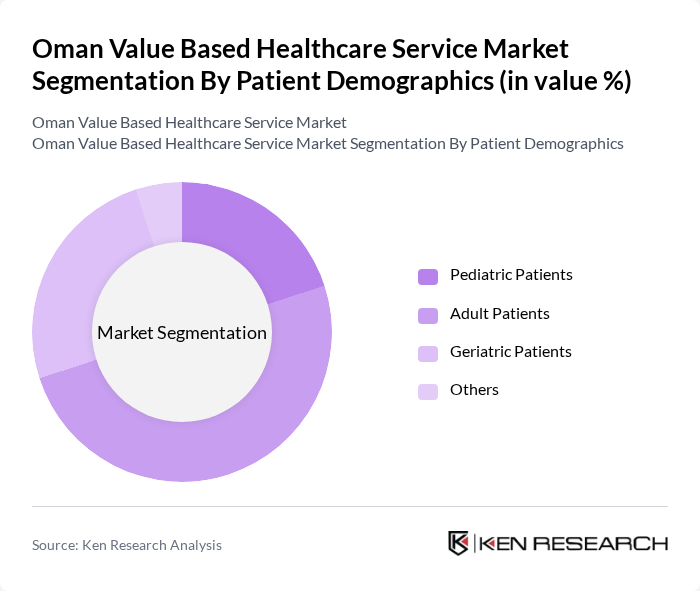

By Patient Demographics:The patient demographics segmentation includes Pediatric Patients, Adult Patients, Geriatric Patients, and Others. Adult Patients dominate this segment, driven by the increasing prevalence of chronic diseases and lifestyle-related health issues. The growing awareness of preventive healthcare among adults is also contributing to the demand for value-based services tailored to this demographic. Geriatric Patients are another significant segment, as the aging population requires specialized care and management.

The Oman Value Based Healthcare Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Medical Specialty Centre, Muscat Private Hospital, Sultan Qaboos University Hospital, Al Nahda Hospital, Aster DM Healthcare, Dr. Sulaiman Al Habib Medical Group, NMC Healthcare, Oman International Hospital, Badr Al Samaa Group, Al Hayat Hospital, Muscat Private Hospital, Al Noor Hospital, Royal Hospital, Oman Medical Association, Al Shifa Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman value-based healthcare service market appears promising, driven by ongoing government support and technological advancements. As the population ages and chronic diseases rise, the demand for efficient healthcare solutions will increase. The integration of artificial intelligence and data analytics will further enhance patient care and operational efficiency. Stakeholders are likely to focus on preventive care and personalized medicine, ensuring that healthcare delivery aligns with patient needs and preferences, ultimately improving health outcomes across the nation.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Primary Care Services Specialty Care Services Rehabilitation Services Palliative Care Services Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| By Healthcare Provider Type | Hospitals Clinics Home Healthcare Providers Others |

| By Payment Model | Fee-for-Service Capitation Pay-for-Performance Others |

| By Technology Utilization | Electronic Health Records (EHR) Telemedicine Platforms Health Information Exchange (HIE) Others |

| By Geographic Coverage | Urban Areas Rural Areas Others |

| By Insurance Coverage | Public Insurance Private Insurance Self-Pay Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Healthcare Providers | 45 | Hospital Administrators, Department Heads |

| Private Healthcare Facilities | 38 | Clinic Managers, Healthcare Executives |

| Insurance Companies | 28 | Underwriters, Claims Managers |

| Patient Advocacy Groups | 22 | Patient Representatives, Community Leaders |

| Healthcare Policy Makers | 17 | Government Officials, Health Policy Analysts |

The Oman Value Based Healthcare Service Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increasing demand for quality healthcare services and government initiatives aimed at enhancing healthcare infrastructure.