Region:Central and South America

Author(s):Rebecca

Product Code:KRAA4823

Pages:90

Published On:September 2025

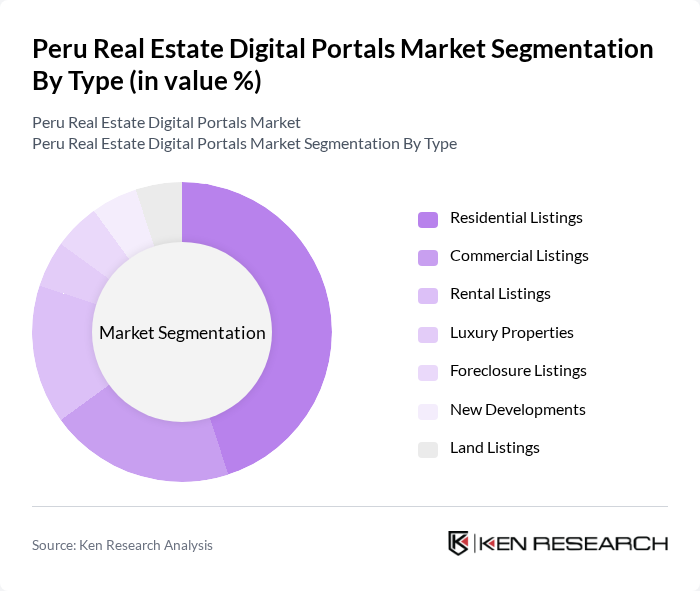

By Type:The market is segmented into Residential Listings, Commercial Listings, Rental Listings, Luxury Properties, Foreclosure Listings, New Developments, and Land Listings. Among these, Residential Listings dominate the market due to high demand for housing solutions, driven by urbanization, population growth, and the convenience of online search tools. Consumers increasingly prefer digital platforms for their comprehensive options, virtual tours, and data-driven insights, making this sub-segment a key player in the overall market.

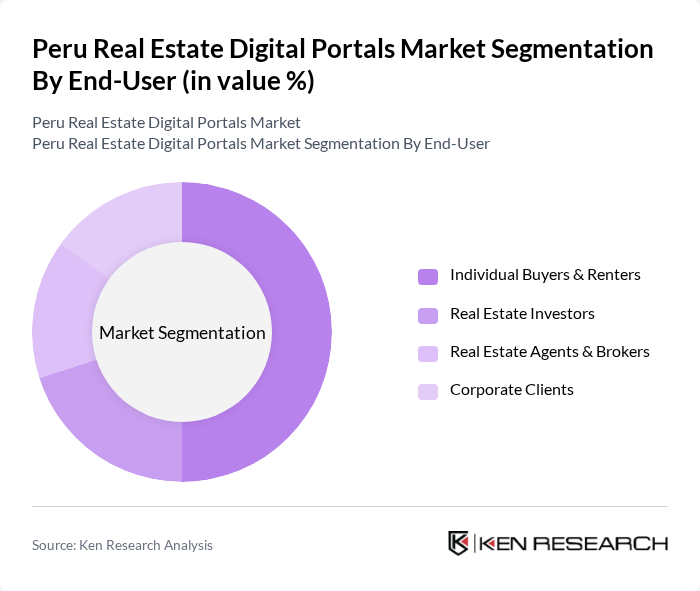

By End-User:The end-user segmentation includes Individual Buyers & Renters, Real Estate Investors, Real Estate Agents & Brokers, and Corporate Clients. Individual Buyers & Renters represent the largest segment, driven by the increasing number of first-time homebuyers and renters seeking affordable housing options. The shift to digital platforms has made it easier for these users to access listings, utilize virtual tours, and leverage data analytics for informed decision-making, solidifying their dominance in the market.

The Peru Real Estate Digital Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Properati, Urbania, Adondevivir, Inmuebles24, LaEncontré, OLX Perú, Mercado Libre, RE/MAX Perú, Century 21 Perú, Tinsa Perú, Inmobiliaria Edifica, Grupo Centenario, Viva Real Perú, QuintoAndar Perú, Inmobiliaria La Molina contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Peru real estate digital portals market appears promising, driven by technological advancements and changing consumer behaviors. As internet penetration continues to rise, more users are expected to engage with digital platforms for property transactions. Additionally, the integration of innovative technologies such as virtual reality and AI will enhance user experiences, making online property searches more efficient. The market is likely to see increased collaboration between digital platforms and traditional real estate agents, creating a hybrid model that leverages the strengths of both sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Listings Commercial Listings Rental Listings Luxury Properties Foreclosure Listings New Developments Land Listings |

| By End-User | Individual Buyers & Renters Real Estate Investors Real Estate Agents & Brokers Corporate Clients |

| By Sales Channel | Online Portals (Websites) Mobile Applications Social Media Platforms Aggregator Platforms |

| By Geographic Focus | Lima Arequipa Trujillo Cusco Other Regions |

| By Property Type | Single-Family Homes Multi-Family Homes Commercial Buildings Land Parcels |

| By User Demographics | First-Time Buyers Investors Retirees Young Professionals |

| By Price Range | Low-End Properties Mid-Range Properties High-End Properties Luxury Properties |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 100 | First-time homebuyers, Investors |

| Commercial Real Estate Investors | 60 | Real estate fund managers, Corporate investors |

| Real Estate Agents and Brokers | 50 | Licensed real estate professionals, Market analysts |

| Property Developers | 40 | Construction managers, Development project leads |

| Digital Real Estate Platform Users | 70 | Active users of online property portals, Tech-savvy buyers |

The Peru Real Estate Digital Portals Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the increasing adoption of digital platforms for property transactions and enhanced internet penetration.