Region:Europe

Author(s):Shubham

Product Code:KRAB1241

Pages:88

Published On:October 2025

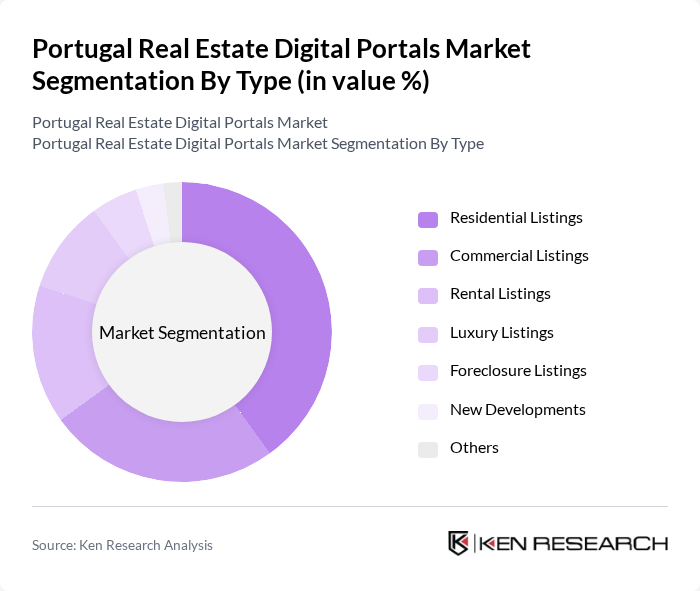

By Type:The market can be segmented into various types, including Residential Listings, Commercial Listings, Rental Listings, Luxury Listings, Foreclosure Listings, New Developments, and Others. Each of these segments addresses specific consumer needs, such as home purchases, investment properties, short- and long-term rentals, premium and luxury estates, distressed assets, and newly constructed developments. The segmentation reflects the diverse and evolving landscape of the Portuguese real estate market, with digital portals increasingly offering specialized search filters and tailored content for each segment .

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents, Investors, and Corporates. Each group demonstrates distinct motivations and requirements: Individual Buyers seek transparency and convenience, Real Estate Agents leverage portals for lead generation and marketing, Investors focus on data analytics and market trends, and Corporates utilize platforms for portfolio management and commercial transactions. These dynamics shape the service offerings and user experience strategies of leading digital portals .

The Portugal Real Estate Digital Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Idealista, Imovirtual, OLX Portugal, BPI Expresso Imobiliário, Casa Sapo, Remax Portugal, Century 21 Portugal, ERA Portugal, Sotheby's International Realty Portugal, Engel & Völkers Portugal, Trovit Portugal, Nestpick Portugal, Property Finder Portugal, Homify Portugal, Flatfy Portugal contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Portugal real estate digital portals market appears promising, driven by technological advancements and changing consumer preferences. As mobile usage continues to rise, platforms that optimize for mobile access will likely capture a larger audience. Additionally, the integration of AI and big data analytics will enhance user experiences, providing personalized property recommendations and improving transaction efficiency. These trends indicate a dynamic market landscape poised for innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Listings Commercial Listings Rental Listings Luxury Listings Foreclosure Listings New Developments Others |

| By End-User | Individual Buyers Real Estate Agents Investors Corporates |

| By Sales Channel | Online Portals Mobile Applications Social Media Platforms Direct Listings |

| By Geographic Coverage | Lisbon Porto Algarve Coimbra Braga Others |

| By Listing Type | Standard Listings Featured Listings Premium Listings Auction Listings |

| By User Demographics | First-Time Buyers Retirees Young Professionals Families |

| By Price Range | Below €100,000 €100,000 - €300,000 €300,000 - €500,000 Above €500,000 |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 100 | First-time Buyers, Investors, Relocators |

| Commercial Real Estate Agents | 80 | Commercial Brokers, Property Managers |

| Digital Portal Users | 90 | Active Users, Casual Browsers, Property Seekers |

| Real Estate Developers | 60 | Project Managers, Sales Directors |

| Property Rental Market Participants | 70 | Landlords, Tenants, Property Managers |

The Portugal Real Estate Digital Portals Market is valued at approximately EUR 1.5 billion, reflecting significant growth driven by increased digitization, online property searches, and the adoption of advanced technologies like AI and virtual tours.