Region:Asia

Author(s):Rebecca

Product Code:KRAA6361

Pages:95

Published On:September 2025

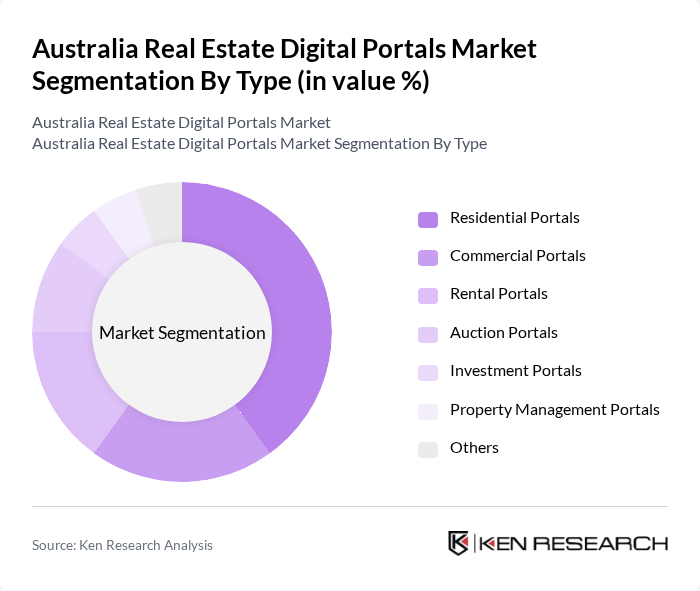

By Type:The market is segmented into various types, including Residential Portals, Commercial Portals, Rental Portals, Auction Portals, Investment Portals, Property Management Portals, and Others. Among these, Residential Portals dominate the market due to the high demand for housing and the increasing trend of home buyers utilizing online platforms for property searches. The convenience and accessibility of these portals have made them the preferred choice for consumers looking to buy or rent homes.

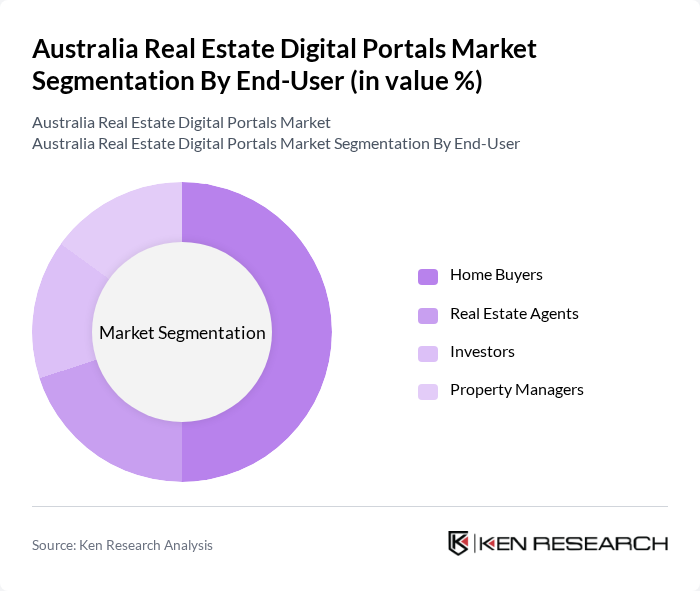

By End-User:The end-user segmentation includes Home Buyers, Real Estate Agents, Investors, and Property Managers. Home Buyers represent the largest segment, driven by the increasing number of first-time buyers entering the market and the growing reliance on digital platforms for property searches. The ease of access to information and the ability to compare properties online have made this segment a key driver of market growth.

The Australia Real Estate Digital Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as REA Group Limited, Domain Group, Allhomes, PropertyGuru, Homely, Rent.com.au, Realestate.com.au, LJ Hooker, McGrath Estate Agents, First National Real Estate, Ray White, Harcourts, Belle Property, Stockdale & Leggo, Ouwens Casserly Real Estate contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia real estate digital portals market appears promising, driven by technological advancements and evolving consumer preferences. As more users demand seamless online experiences, portals will likely enhance their platforms with features like virtual reality tours and AI-driven recommendations. Additionally, the integration of blockchain technology for secure transactions may revolutionize the industry, fostering greater trust and efficiency. Overall, the market is poised for continued growth as it adapts to these emerging trends and consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Portals Commercial Portals Rental Portals Auction Portals Investment Portals Property Management Portals Others |

| By End-User | Home Buyers Real Estate Agents Investors Property Managers |

| By Sales Channel | Direct Sales Online Listings Mobile Applications Affiliate Marketing |

| By Subscription Model | Free Listings Premium Listings Subscription-Based Services |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas |

| By User Demographics | First-Time Buyers Luxury Buyers Investors |

| By Technology Integration | AI-Driven Portals Blockchain-Based Listings Virtual Reality Tours Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 150 | First-time home buyers, Investors |

| Commercial Property Investors | 100 | Real estate investors, Business owners |

| Real Estate Agents | 80 | Real estate agents, Brokers |

| Digital Portal Users | 120 | Active users of real estate digital platforms |

| Property Developers | 70 | Developers, Project managers |

The Australia Real Estate Digital Portals Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by the increasing adoption of digital platforms for property listings and online transactions among consumers.