Region:Middle East

Author(s):Dev

Product Code:KRAA6134

Pages:82

Published On:September 2025

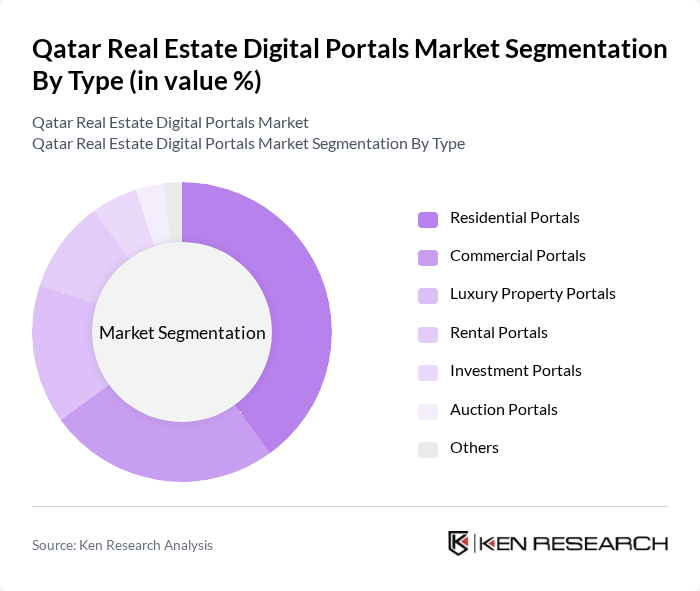

By Type:The market is segmented into various types of digital portals catering to different real estate needs. The subsegments include Residential Portals, Commercial Portals, Luxury Property Portals, Rental Portals, Investment Portals, Auction Portals, and Others. Among these, Residential Portals dominate the market due to the high demand for housing solutions among both locals and expatriates. The increasing trend of online property searches and the convenience of virtual tours have further propelled the growth of this segment.

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents, Property Developers, and Investors. Individual Buyers represent the largest segment, driven by the growing population and the increasing trend of home ownership among expatriates. The ease of access to digital platforms has made it convenient for individuals to search for properties, compare prices, and make informed decisions, thus solidifying their dominance in the market.

The Qatar Real Estate Digital Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Property Finder Qatar, Qatar Living, JustProperty.com, Bayut.com, Dubizzle, Aqarmap, Real Estate Qatar, Qatari Investors Group, Al Asmakh Real Estate Development, Ezdan Real Estate, United Development Company, Al Jazeera Real Estate, Al Meera Real Estate, Qatari Diar, Barwa Real Estate contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar real estate digital portals market appears promising, driven by technological advancements and evolving consumer preferences. As mobile applications become increasingly sophisticated, they will enhance user experiences and streamline property searches. Additionally, the integration of virtual reality tours is expected to revolutionize how properties are showcased, providing immersive experiences for potential buyers. These trends indicate a shift towards more interactive and user-centric platforms, positioning the market for sustained growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Portals Commercial Portals Luxury Property Portals Rental Portals Investment Portals Auction Portals Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Investors |

| By Sales Channel | Direct Sales Online Marketing Affiliate Marketing Others |

| By User Demographics | Young Professionals Families Retirees Expatriates |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas Others |

| By Service Type | Listing Services Marketing Services Transaction Services Consulting Services |

| By Payment Model | Subscription-Based Pay-Per-Listing Freemium Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Buyers | 150 | First-time homebuyers, Investors |

| Commercial Property Investors | 100 | Real estate investment managers, Corporate buyers |

| Rental Market Participants | 80 | Tenants, Landlords |

| Real Estate Developers | 70 | Project managers, Business development heads |

| Real Estate Agents and Brokers | 90 | Sales agents, Brokerage firm owners |

The Qatar Real Estate Digital Portals Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital platforms for property transactions and a growing expatriate population seeking housing solutions.