Region:Asia

Author(s):Shubham

Product Code:KRAA6192

Pages:83

Published On:September 2025

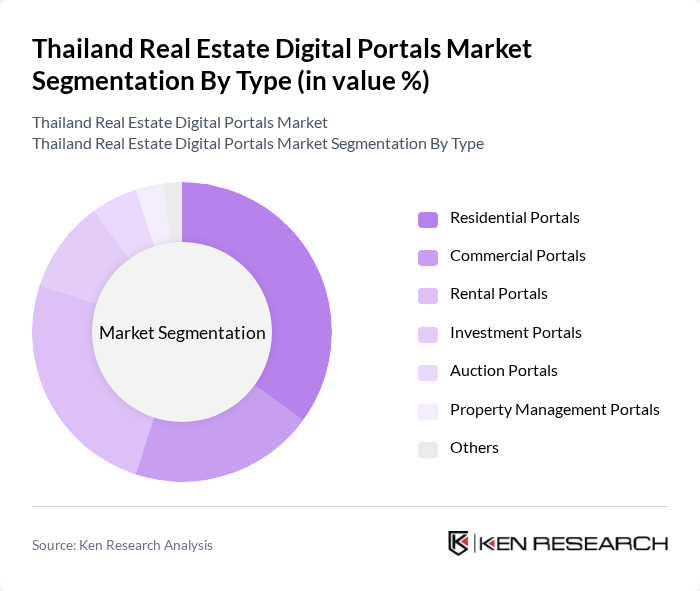

By Type:The market is segmented into various types of digital portals, including Residential Portals, Commercial Portals, Rental Portals, Investment Portals, Auction Portals, Property Management Portals, and Others. Each of these segments caters to different consumer needs and preferences, with specific functionalities and services tailored to enhance user experience.

The Residential Portals segment is currently dominating the market, driven by the increasing demand for housing and the convenience of online property searches. Consumers are increasingly looking for user-friendly platforms that provide comprehensive listings, virtual tours, and detailed property information. The trend of urban migration and the rise of first-time homebuyers have further fueled the growth of this segment, making it a key player in the digital real estate landscape.

By End-User:The market is segmented by end-users into Individual Buyers, Real Estate Agents, Property Developers, and Investors. Each group has distinct requirements and preferences, influencing the types of digital portals they utilize for their real estate transactions.

The Individual Buyers segment is the largest in the market, as a significant portion of the population seeks to purchase homes or investment properties. The ease of access to information and the ability to compare various listings online have made digital portals a preferred choice for this demographic. Additionally, the growing trend of millennials entering the housing market has further solidified the dominance of this segment.

The Thailand Real Estate Digital Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as PropertyGuru Group, Hipflat, Thai Apartment, Baania, DDproperty, RentHub, Kaidee, Ananda Development, Sansiri, AP Thailand, LPN Development, Pruksa Real Estate, Supalai, Land and Houses, SET-listed Property Companies contribute to innovation, geographic expansion, and service delivery in this space.

The future of Thailand's real estate digital portals market appears promising, driven by technological advancements and evolving consumer preferences. As mobile usage continues to rise, portals are likely to enhance their mobile platforms, providing seamless access to property listings. Additionally, the integration of artificial intelligence and big data analytics will enable personalized user experiences, improving property recommendations and search efficiency. These trends will likely foster a more competitive landscape, encouraging innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Portals Commercial Portals Rental Portals Investment Portals Auction Portals Property Management Portals Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Investors |

| By Sales Channel | Direct Sales Online Marketing Affiliate Marketing Social Media Advertising |

| By Geographic Coverage | Bangkok Chiang Mai Phuket Pattaya Others |

| By User Demographics | Millennials Gen X Baby Boomers |

| By Property Type | Single-Family Homes Condominiums Commercial Properties Land Sales |

| By Price Range | Budget Properties Mid-Range Properties Luxury Properties Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 150 | First-time homebuyers, Investors, Real estate agents |

| Commercial Property Investors | 100 | Property developers, Investment managers, Real estate consultants |

| Digital Portal Users | 120 | Active users of real estate platforms, Property seekers, Sellers |

| Real Estate Agents | 80 | Agents from leading digital portals, Independent brokers, Franchise owners |

| Market Analysts | 50 | Real estate analysts, Economic researchers, Digital marketing experts |

The Thailand Real Estate Digital Portals Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased digital platform adoption for property transactions and enhanced internet penetration among consumers.