Region:Europe

Author(s):Rebecca

Product Code:KRAA6324

Pages:81

Published On:September 2025

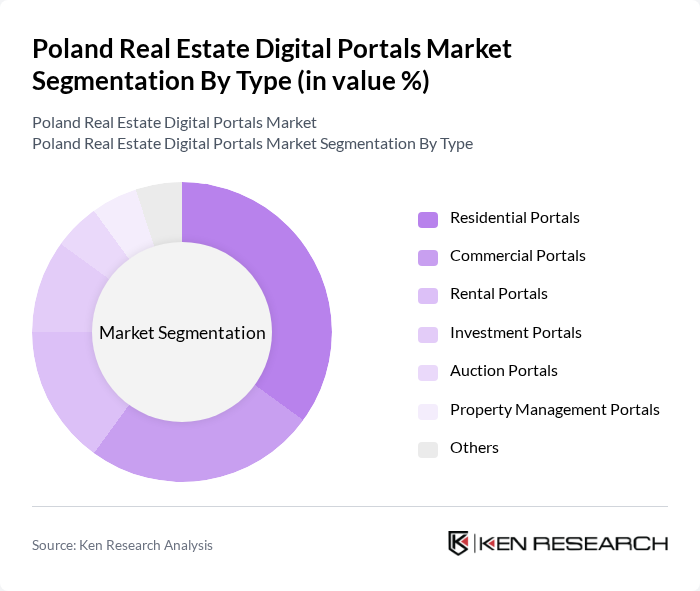

By Type:The market is segmented into various types of digital portals that cater to different needs in the real estate sector. The primary types include Residential Portals, Commercial Portals, Rental Portals, Investment Portals, Auction Portals, Property Management Portals, and Others. Each type serves a unique purpose, addressing the specific requirements of buyers, sellers, and investors.

The Residential Portals segment is the leading sub-segment in the market, driven by the high demand for housing and the increasing trend of home buying among millennials. These portals provide comprehensive listings, user-friendly interfaces, and advanced search features, making them the preferred choice for individual buyers. The convenience of browsing properties online and accessing detailed information has significantly influenced consumer behavior, leading to a surge in the use of residential portals.

By End-User:The market is segmented based on the end-users, which include Individual Buyers, Real Estate Agents, Property Developers, and Investors. Each group has distinct needs and preferences when utilizing digital portals for real estate transactions.

Individual Buyers represent the largest segment of end-users, as they increasingly turn to digital portals for their property searches. The ease of access to listings, virtual tours, and detailed property information caters to their needs, making it a preferred choice for homebuyers. This trend is further supported by the growing digital literacy among consumers, which enhances their confidence in using online platforms for significant transactions.

The Poland Real Estate Digital Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Otodom.pl, Gratka.pl, Morizon.pl, Nieruchomosci-online.pl, Domiporta.pl, Property Finder, Home Broker, RE/MAX Poland, Knight Frank Poland, CBRE Poland, JLL Poland, Savills Poland, Metrohouse, 4investors.pl, HRE Investments contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Poland real estate digital portals market appears promising, driven by technological advancements and evolving consumer preferences. As mobile platforms continue to expand, user engagement is expected to increase, enhancing the overall market landscape. Furthermore, the integration of AI and big data analytics will enable portals to offer personalized experiences, improving customer satisfaction and retention. These trends indicate a dynamic shift towards more innovative and user-centric solutions in the real estate sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Portals Commercial Portals Rental Portals Investment Portals Auction Portals Property Management Portals Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Investors |

| By Sales Channel | Direct Sales Online Marketplaces Affiliate Marketing Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Pricing Model | Subscription-Based Pay-Per-Listing Freemium Model |

| By User Experience Features | Mobile Compatibility Virtual Reality Tours User Reviews and Ratings |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 150 | First-time Home Buyers, Investors |

| Commercial Real Estate Investors | 100 | Property Managers, Investment Analysts |

| Real Estate Agents | 80 | Real Estate Brokers, Sales Agents |

| Digital Portal Users | 120 | Home Seekers, Renters |

| Property Developers | 70 | Project Managers, Development Directors |

The Poland Real Estate Digital Portals Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased digitization, internet penetration, and consumer preference for online property searches.