Region:Asia

Author(s):Geetanshi

Product Code:KRAB4019

Pages:86

Published On:October 2025

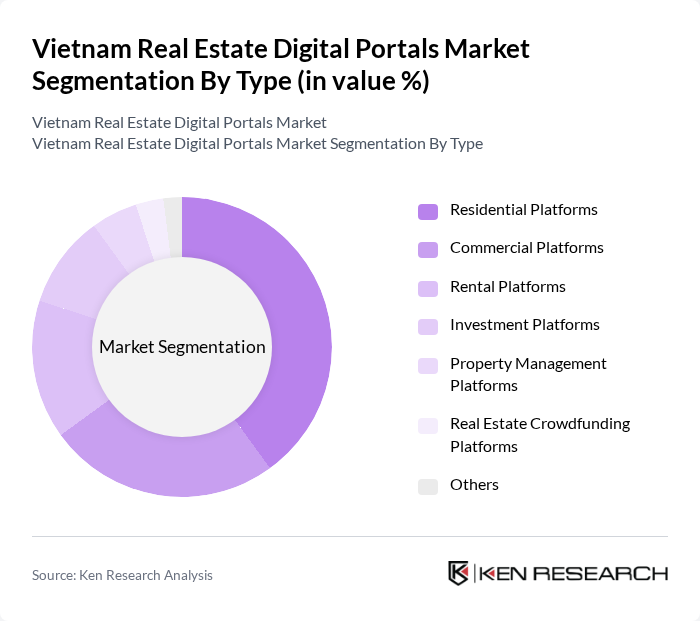

By Type:The market is segmented into various types, including Residential Platforms, Commercial Platforms, Rental Platforms, Investment Platforms, Property Management Platforms, Real Estate Crowdfunding Platforms, and Others. Among these, Residential Platforms are currently leading the market due to the high demand for housing and the increasing number of first-time homebuyers. The convenience of online searches and the ability to compare properties have made these platforms particularly popular among consumers.

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents, Property Developers, and Investors. Individual Buyers dominate the market as they represent a significant portion of the transactions, driven by the increasing number of young professionals and families looking to purchase homes. The ease of access to information and the ability to conduct transactions online have made it more appealing for individual buyers to engage with digital portals.

The Vietnam Real Estate Digital Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Batdongsan.com.vn, Muabannhadat.vn, Homedy.com, Propzy.vn, Rever.vn, CenLand.vn, Nhadat24h.net, Nhadat.net, NhaDatSo.com, NhaTrangRealEstate.com, DatXanhGroup.vn, Vietstarland.com, NhaDatOnline.com, NhaDatViet.com, NhaDatMienNam.com, Vinhomes.vn, Novaland.com.vn, FPT Corporation, Viettel Group, TNR Holdings Vietnam, An Gia Investment, Kinh Do Realty, Phu My Hung Development Corporation, indid.lab, REalyse contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam real estate digital portals market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As mobile applications become more sophisticated, users will demand enhanced features such as virtual reality tours and AI-driven property recommendations. Additionally, the integration of blockchain technology for secure transactions is likely to gain traction. These trends will not only improve user experience but also foster greater trust in digital platforms, paving the way for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Platforms Commercial Platforms Rental Platforms Investment Platforms Property Management Platforms Real Estate Crowdfunding Platforms Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Investors |

| By Sales Channel | Online Sales Offline Sales Direct Sales Third-Party Platforms |

| By Application | Buying Selling Renting Property Management |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) |

| By User Demographics | Age Group Income Level Geographic Location |

| By Policy Support | Government Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 100 | First-time Home Buyers, Investors |

| Commercial Real Estate Investors | 80 | Real Estate Fund Managers, Corporate Buyers |

| Real Estate Developers | 70 | Project Managers, Business Development Heads |

| Property Management Firms | 60 | Property Managers, Operations Directors |

| Real Estate Agents | 90 | Sales Agents, Brokers |

The Vietnam Real Estate Digital Portals Market is valued at approximately USD 1.2 billion, driven by urbanization, digital technology adoption, and a growing middle class seeking efficient property solutions.