Region:Middle East

Author(s):Dev

Product Code:KRAC4072

Pages:96

Published On:October 2025

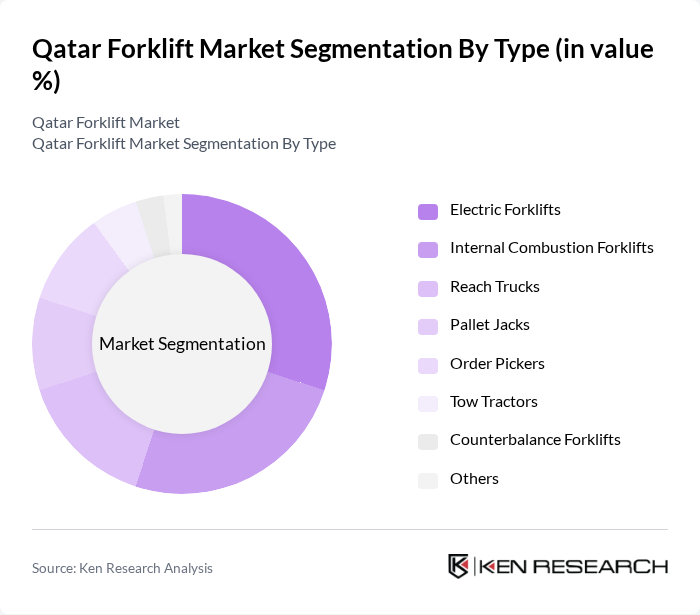

By Type:The market is segmented into various types of forklifts, including Electric Forklifts, Internal Combustion Forklifts, Reach Trucks, Pallet Jacks, Order Pickers, Tow Tractors, Counterbalance Forklifts, and Others. Electric Forklifts are gaining traction due to their eco-friendliness and lower operational costs, while Internal Combustion Forklifts remain popular for heavy-duty applications. Reach Trucks and Order Pickers are increasingly used in warehousing and distribution, reflecting the growing e-commerce sector .

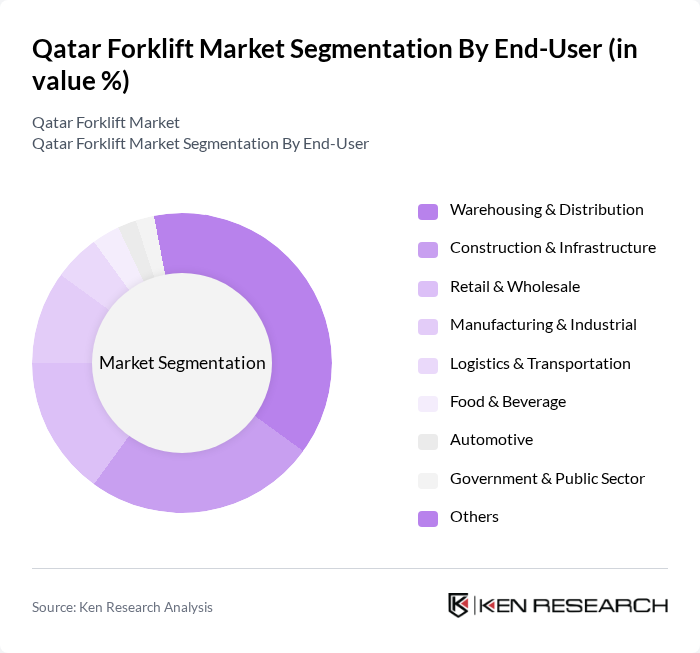

By End-User:The end-user segmentation includes Warehousing & Distribution, Construction & Infrastructure, Retail & Wholesale, Manufacturing & Industrial, Logistics & Transportation, Food & Beverage, Automotive, Government & Public Sector, and Others. The Warehousing & Distribution sector is the largest consumer of forklifts, driven by the growth of e-commerce and the need for efficient inventory management. The Construction sector also significantly contributes to the market due to ongoing infrastructure projects .

The Qatar Forklift Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Material Handling, KION Group AG (Linde, STILL, Baoli), Jungheinrich AG, Hyster-Yale Materials Handling, Inc., Crown Equipment Corporation, Mitsubishi Logisnext Co., Ltd. (UniCarriers, Nichiyu), Doosan Industrial Vehicle, Clark Material Handling Company, Komatsu Ltd., Manitou Group, Hangcha Group Co., Ltd., Anhui Heli Co., Ltd., Hyundai Construction Equipment, Lonking Holdings Limited, Al-Futtaim Motors (Toyota Forklift Qatar Distributor), Jaidah Heavy Equipment (Qatar Local Dealer), Arabian Agencies Company (AAC) (Qatar Dealer for Hyster-Yale, Manitou, etc.) contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar forklift market is poised for significant transformation, driven by technological advancements and a shift towards automation. As companies increasingly adopt smart forklifts equipped with IoT capabilities, operational efficiency is expected to improve. Additionally, the focus on sustainability will likely lead to a rise in electric forklift adoption, aligning with global trends towards greener solutions. These developments will create a more competitive landscape, encouraging innovation and investment in the sector, ultimately enhancing productivity across various industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Forklifts Internal Combustion Forklifts Reach Trucks Pallet Jacks Order Pickers Tow Tractors Counterbalance Forklifts Others |

| By End-User | Warehousing & Distribution Construction & Infrastructure Retail & Wholesale Manufacturing & Industrial Logistics & Transportation Food & Beverage Automotive Government & Public Sector Others |

| By Application | Material Handling Loading and Unloading Inventory Management Container Handling Transportation Others |

| By Payload Capacity | Less than 2,000 kg ,000 kg to 5,000 kg ,000 kg to 10,000 kg More than 10,000 kg |

| By Sales Channel | Direct Sales Distributors/Dealers Online Sales Rental & Leasing Services Others |

| By Distribution Mode | Retail Distribution Wholesale Distribution Direct Distribution Others |

| By Price Range | Low Price Mid Price High Price Premium Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Forklift Usage | 100 | Site Managers, Equipment Supervisors |

| Logistics and Warehousing Operations | 80 | Warehouse Managers, Logistics Coordinators |

| Manufacturing Industry Forklift Fleet | 60 | Production Managers, Safety Officers |

| Rental Services for Forklifts | 50 | Rental Managers, Business Development Executives |

| Forklift Maintenance and Repair Services | 40 | Maintenance Managers, Service Technicians |

The Qatar Forklift Market is valued at approximately USD 40 million, driven by the growth of the construction and logistics sectors, as well as the increasing demand for efficient material handling solutions in warehouses and distribution centers.