Region:Asia

Author(s):Dev

Product Code:KRAB4331

Pages:86

Published On:October 2025

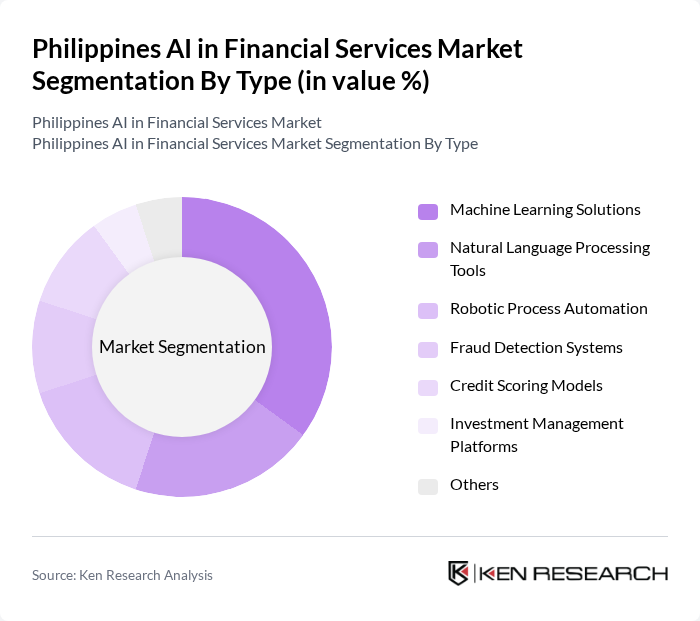

By Type:The market is segmented into various types of AI solutions, including Machine Learning Solutions, Natural Language Processing Tools, Robotic Process Automation, Fraud Detection Systems, Credit Scoring Models, Investment Management Platforms, and Others. Among these, Machine Learning Solutions are leading the market due to their ability to analyze vast amounts of data and provide predictive insights, which are crucial for risk assessment and customer service automation.

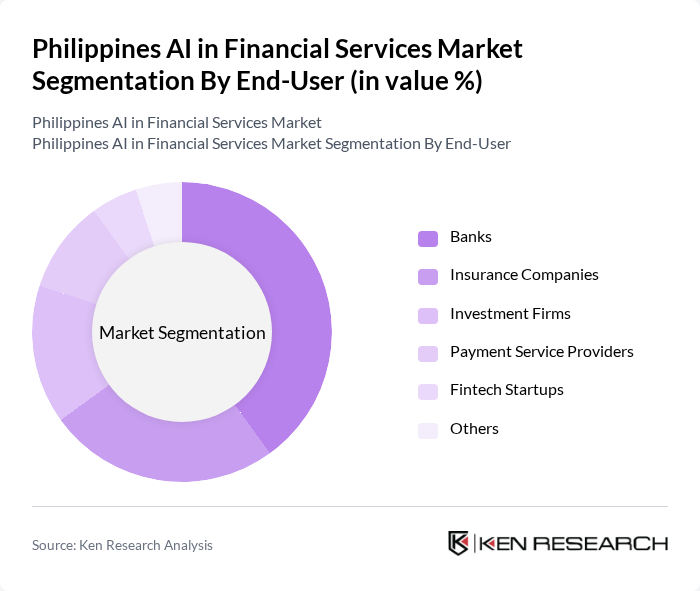

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Payment Service Providers, Fintech Startups, and Others. Banks are the dominant end-users of AI solutions, leveraging these technologies for enhanced customer service, risk management, and operational efficiency. The increasing competition in the banking sector drives the adoption of AI to improve service delivery and customer engagement.

The Philippines AI in Financial Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as UnionBank of the Philippines, BDO Unibank, Inc., Metrobank, Security Bank Corporation, GCash, PayMaya, CIMB Bank Philippines, Philippine National Bank, EastWest Banking Corporation, RCBC, Grab Financial Group, Aboitiz InfraCapital, Finastra, FIS Global, IBM Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in the Philippines' financial services market appears promising, driven by technological advancements and increasing digital adoption. As institutions continue to embrace AI for risk management and customer service, the integration of ethical AI practices will become paramount. Furthermore, the collaboration between fintech startups and traditional banks is expected to foster innovation, enhancing service offerings and operational efficiency. This synergy will likely lead to a more robust financial ecosystem, positioning the Philippines as a regional leader in AI-driven financial services.

| Segment | Sub-Segments |

|---|---|

| By Type | Machine Learning Solutions Natural Language Processing Tools Robotic Process Automation Fraud Detection Systems Credit Scoring Models Investment Management Platforms Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Service Providers Fintech Startups Others |

| By Application | Customer Service Automation Risk Assessment Compliance Monitoring Market Analysis Personalized Financial Advice Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Institutions Third-Party Resellers Others |

| By Investment Source | Venture Capital Private Equity Government Grants Corporate Investments Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Frameworks Public-Private Partnerships Others |

| By Technology | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector AI Integration | 100 | Chief Technology Officers, IT Managers |

| Insurance Industry AI Applications | 80 | Product Development Heads, Risk Managers |

| Fintech Startups AI Utilization | 70 | Founders, Business Development Managers |

| Investment Firms AI Strategies | 60 | Portfolio Managers, Data Analysts |

| Regulatory Compliance AI Tools | 50 | Compliance Officers, Legal Advisors |

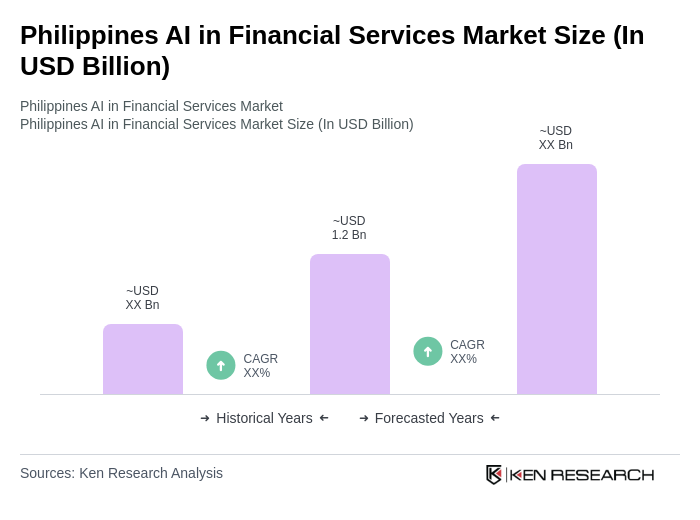

The Philippines AI in Financial Services market is valued at approximately USD 1.2 billion, driven by the increasing adoption of digital banking, fintech innovations, and the demand for enhanced customer experiences through AI solutions.