Region:Central and South America

Author(s):Rebecca

Product Code:KRAB5354

Pages:95

Published On:October 2025

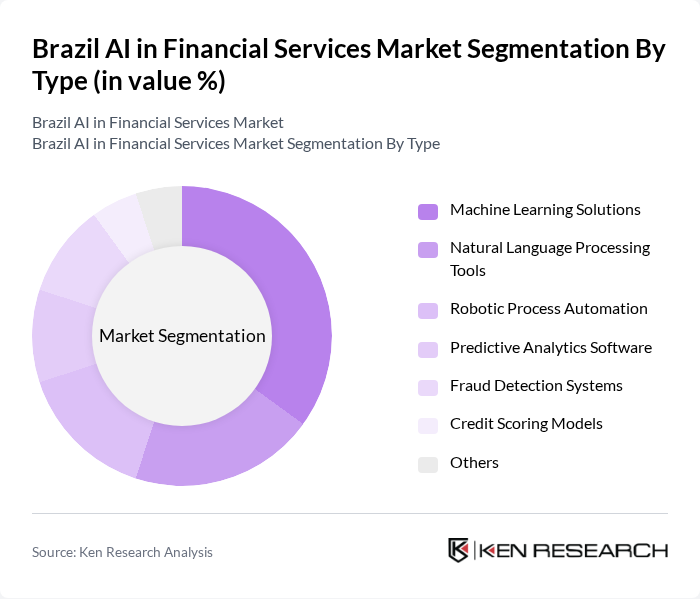

By Type:The market is segmented into various types of AI solutions, including Machine Learning Solutions, Natural Language Processing Tools, Robotic Process Automation, Predictive Analytics Software, Fraud Detection Systems, Credit Scoring Models, and Others. Among these, Machine Learning Solutions are leading the market due to their ability to analyze vast amounts of data and improve decision-making processes in real-time. The increasing need for personalized financial services and risk management is driving the adoption of these technologies.

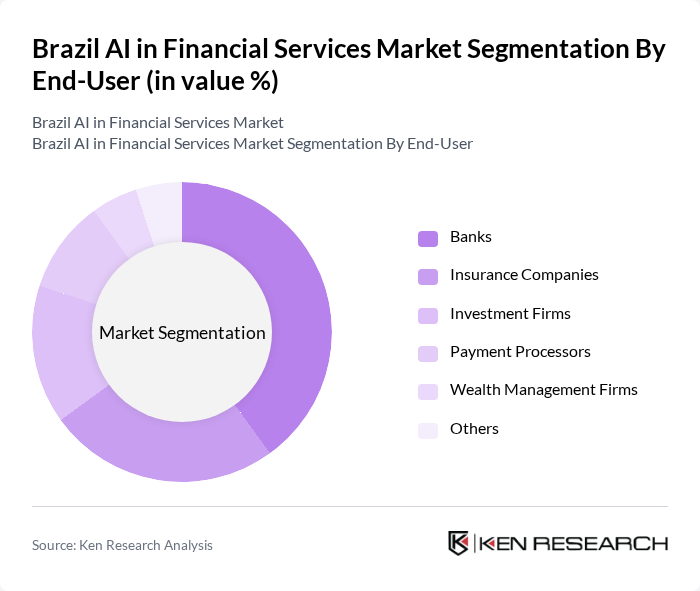

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Payment Processors, Wealth Management Firms, and Others. Banks are the dominant segment, leveraging AI for various applications such as customer service, risk assessment, and fraud detection. The increasing competition in the banking sector is pushing institutions to adopt AI technologies to enhance customer engagement and streamline operations.

The Brazil AI in Financial Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banco do Brasil S.A., Itaú Unibanco Holding S.A., Bradesco S.A., BTG Pactual S.A., XP Inc., Nubank S.A., PagSeguro Digital Ltd., C6 Bank S.A., Banco Inter S.A., Banco Safra S.A., StoneCo Ltd., Creditas S.A., PicPay S.A., Banco Original S.A., B3 S.A. - Brasil, Bolsa, Balcão contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in Brazil's financial services market appears promising, driven by technological advancements and evolving consumer expectations. By future, the integration of AI technologies is expected to enhance operational efficiencies and customer engagement significantly. As institutions increasingly adopt AI-driven solutions, the focus will shift towards developing robust cybersecurity measures and ensuring compliance with evolving regulations. This dynamic landscape will foster innovation, enabling financial institutions to offer more personalized and secure services to their customers.

| Segment | Sub-Segments |

|---|---|

| By Type | Machine Learning Solutions Natural Language Processing Tools Robotic Process Automation Predictive Analytics Software Fraud Detection Systems Credit Scoring Models Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Processors Wealth Management Firms Others |

| By Application | Customer Service Automation Risk Management Compliance Monitoring Investment Analysis Fraud Prevention Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Implementation Services Maintenance and Support Services |

| By Customer Segment | Retail Customers Corporate Clients High Net-Worth Individuals |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking AI Solutions | 150 | Banking Executives, IT Managers |

| Insurance Sector AI Applications | 100 | Insurance Analysts, Product Managers |

| Investment Management AI Tools | 80 | Portfolio Managers, Financial Advisors |

| Regulatory Compliance AI Systems | 70 | Compliance Officers, Risk Management Heads |

| Fintech Innovations in AI | 90 | Startup Founders, Technology Strategists |

The Brazil AI in Financial Services Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the adoption of AI technologies by financial institutions to enhance operational efficiency and customer experience.