Region:Europe

Author(s):Dev

Product Code:KRAA4907

Pages:98

Published On:September 2025

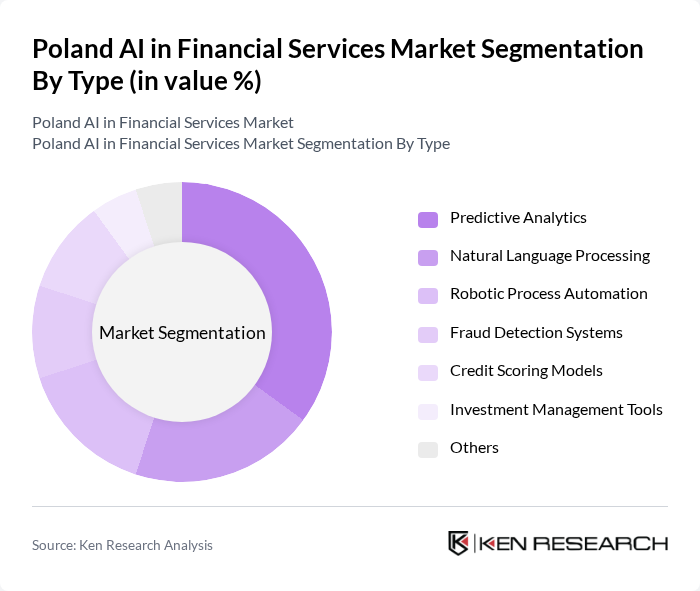

By Type:The market is segmented into various types, including Predictive Analytics, Natural Language Processing, Robotic Process Automation, Fraud Detection Systems, Credit Scoring Models, Investment Management Tools, and Others. Among these, Predictive Analytics is currently the leading sub-segment, driven by its ability to analyze vast amounts of data to forecast trends and behaviors, which is crucial for risk management and customer insights in financial services.

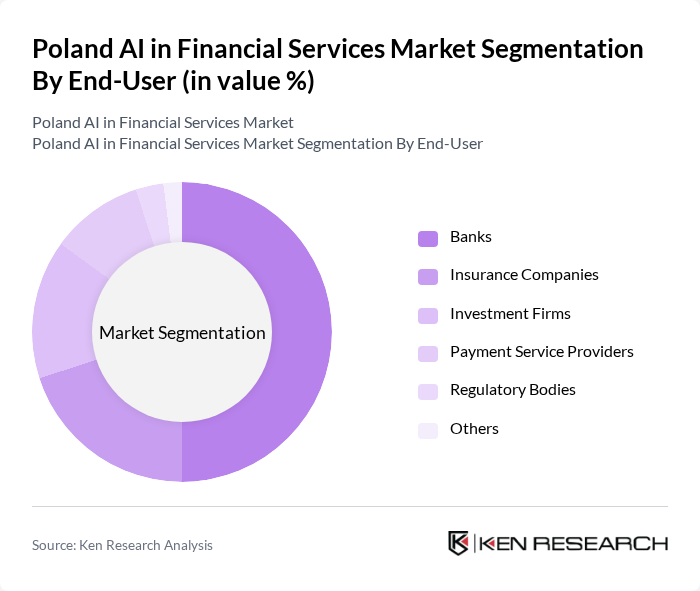

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Payment Service Providers, Regulatory Bodies, and Others. Banks are the dominant end-user segment, leveraging AI technologies for enhanced customer service, risk assessment, and operational efficiency. The increasing competition in the banking sector has prompted these institutions to adopt AI solutions to stay ahead.

The Poland AI in Financial Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as PKO Bank Polski, mBank S.A., ING Bank ?l?ski, Santander Bank Polska, Alior Bank, Getin Noble Bank, Credit Agricole Bank Polska, Bank Millennium, BNP Paribas Bank Polska, T-Mobile Banking Services, Revolut, Zencap, FinTech Group, Asseco Poland, Comarch contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in Poland's financial services market appears promising, driven by ongoing technological advancements and increasing digitalization. As institutions continue to embrace AI, we can expect enhanced customer experiences through personalized services and improved operational efficiencies. Additionally, the collaboration between banks and technology firms is likely to foster innovation, leading to the development of new AI applications. This synergy will not only address existing challenges but also pave the way for a more resilient financial ecosystem in Poland.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Natural Language Processing Robotic Process Automation Fraud Detection Systems Credit Scoring Models Investment Management Tools Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Service Providers Regulatory Bodies Others |

| By Application | Customer Service Automation Risk Assessment Compliance Monitoring Market Analysis Portfolio Management Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Online Sales Partnerships Distributors |

| By Customer Segment | Retail Customers Corporate Clients SMEs Large Enterprises |

| By Geographic Region | Central Poland Northern Poland Southern Poland Eastern Poland Western Poland Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector AI Integration | 100 | Chief Technology Officers, Innovation Managers |

| Fintech Startups AI Utilization | 80 | Founders, Product Managers |

| Insurance Companies AI Applications | 70 | Data Analysts, Risk Management Officers |

| Investment Firms AI Strategies | 60 | Portfolio Managers, Quantitative Analysts |

| Regulatory Bodies AI Oversight | 50 | Policy Makers, Compliance Officers |

The Poland AI in Financial Services Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the adoption of AI technologies by financial institutions to enhance operational efficiency and customer experience.