Region:Middle East

Author(s):Dev

Product Code:KRAB5431

Pages:87

Published On:October 2025

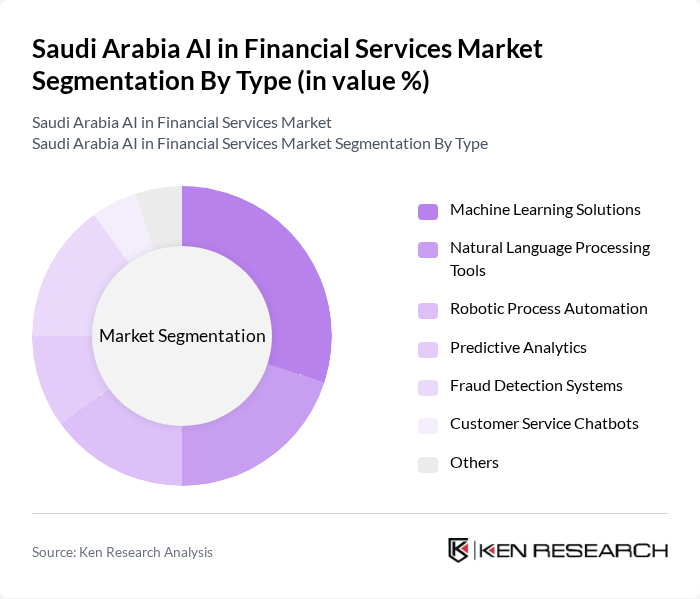

By Type:The market is segmented into various types of AI solutions, including Machine Learning Solutions, Natural Language Processing Tools, Robotic Process Automation, Predictive Analytics, Fraud Detection Systems, Customer Service Chatbots, and Others. Each of these sub-segments plays a crucial role in enhancing the efficiency and effectiveness of financial services.

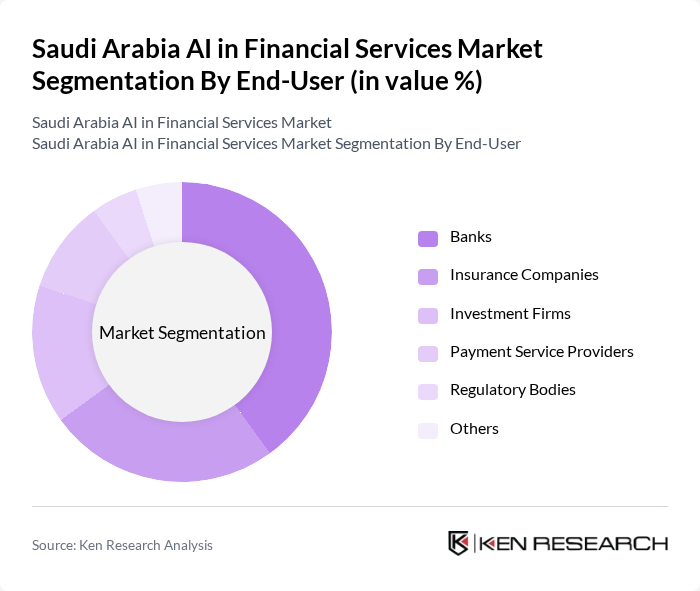

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Payment Service Providers, Regulatory Bodies, and Others. Each segment utilizes AI technologies to address specific challenges and improve service delivery.

The Saudi Arabia AI in Financial Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi National Bank, Al Rajhi Bank, Riyad Bank, Samba Financial Group, Arab National Bank, Banque Saudi Fransi, Alinma Bank, National Commercial Bank, Gulf International Bank, Saudi Investment Bank, Bank Albilad, Alawwal Bank, Emirates NBD, HSBC Saudi Arabia, Standard Chartered Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in Saudi Arabia's financial services market appears promising, driven by ongoing technological advancements and a supportive regulatory environment. As institutions increasingly adopt AI-driven solutions, the focus will shift towards enhancing cybersecurity measures and ensuring compliance with evolving data protection laws. Additionally, the collaboration between local banks and global tech firms is expected to foster innovation, leading to the development of more sophisticated financial products tailored to consumer needs, ultimately transforming the financial landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Machine Learning Solutions Natural Language Processing Tools Robotic Process Automation Predictive Analytics Fraud Detection Systems Customer Service Chatbots Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Service Providers Regulatory Bodies Others |

| By Application | Risk Management Customer Insights and Analytics Compliance and Regulatory Reporting Fraud Prevention Personalized Banking Services Others |

| By Deployment Mode | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions |

| By Sales Channel | Direct Sales Online Sales Partnerships with Financial Institutions |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Banks AI Integration | 100 | Chief Technology Officers, AI Project Managers |

| Fintech Startups AI Solutions | 80 | Founders, Product Development Leads |

| Insurance Sector AI Applications | 70 | Risk Managers, Data Analysts |

| Investment Firms AI Utilization | 60 | Portfolio Managers, Quantitative Analysts |

| Regulatory Bodies AI Oversight | 50 | Compliance Officers, Regulatory Analysts |

The Saudi Arabia AI in Financial Services Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of AI technologies by financial institutions to enhance operational efficiency and customer experience.