Region:Global

Author(s):Geetanshi

Product Code:KRAB5109

Pages:99

Published On:October 2025

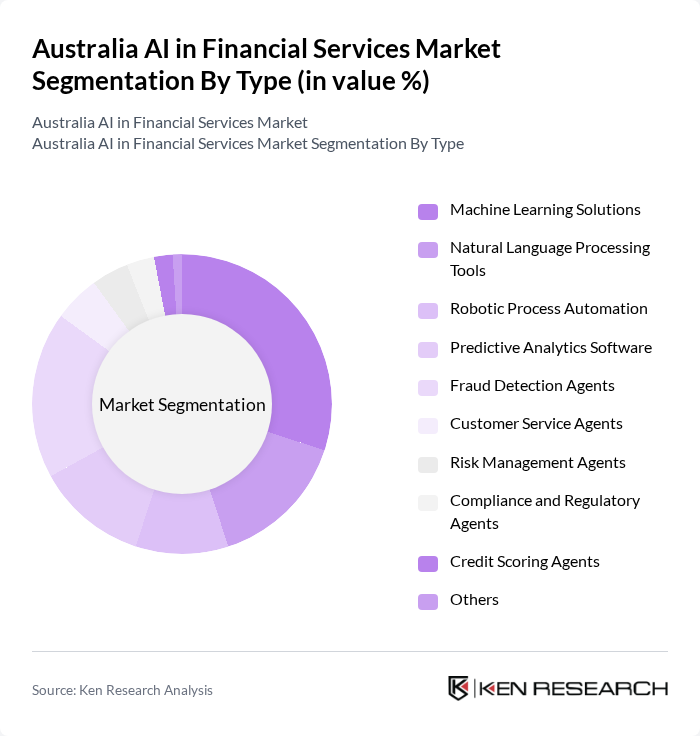

By Type:The market is segmented into various types of AI solutions, including Machine Learning Solutions, Natural Language Processing Tools, Robotic Process Automation, Predictive Analytics Software, Fraud Detection Agents, Customer Service Agents, Risk Management Agents, Compliance and Regulatory Agents, Credit Scoring Agents, and Others. Among these, Fraud Detection Agents and Machine Learning Solutions are particularly prominent due to their critical roles in enhancing decision-making processes and safeguarding financial transactions. Fraud detection is the largest revenue-generating segment, while customer service agents are registering the fastest growth .

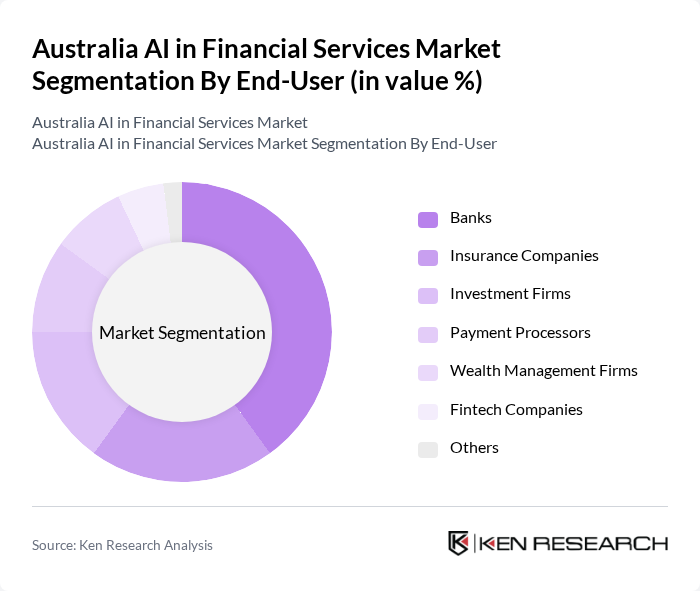

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Payment Processors, Wealth Management Firms, Fintech Companies, and Others. Banks are the leading end-users, leveraging AI technologies to streamline operations, enhance customer service, and improve risk assessment processes, thereby driving significant market growth. Insurance companies and investment firms are also major adopters, using AI for claims processing and portfolio management .

The Australia AI in Financial Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Commonwealth Bank of Australia, Westpac Banking Corporation, National Australia Bank, ANZ Banking Group, Macquarie Group Limited, Suncorp Group Limited, QBE Insurance Group Limited, IAG (Insurance Australia Group), Afterpay Limited, Zip Co Limited, Xero Limited, Prospa Group Limited, Tyro Payments Limited, Frollo Australia Pty Ltd, DataRobot Australia Pty Ltd contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in Australia's financial services market appears promising, driven by technological advancements and increasing consumer expectations. In future, the integration of AI with emerging technologies like blockchain is expected to enhance transaction security and efficiency. Additionally, the rise of personalized financial services, powered by AI, will cater to individual customer needs, fostering loyalty and engagement. As regulatory frameworks evolve, they will likely support innovation while ensuring consumer protection, creating a balanced environment for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Machine Learning Solutions Natural Language Processing Tools Robotic Process Automation Predictive Analytics Software Fraud Detection Agents Customer Service Agents Risk Management Agents Compliance and Regulatory Agents Credit Scoring Agents Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Processors Wealth Management Firms Fintech Companies Others |

| By Application | Fraud Detection Risk Management Customer Service Automation Compliance Monitoring Credit Scoring Forecasting & Reporting Portfolio Management Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Online Sales Distributors |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector AI Applications | 120 | Chief Technology Officers, AI Strategy Managers |

| Investment Firms AI Utilization | 90 | Portfolio Managers, Risk Analysts |

| Insurance Companies AI Integration | 70 | Underwriting Managers, Claims Processing Heads |

| Fintech Startups AI Solutions | 50 | Founders, Product Development Leads |

| Regulatory Bodies AI Oversight | 40 | Regulatory Affairs Managers, Compliance Officers |

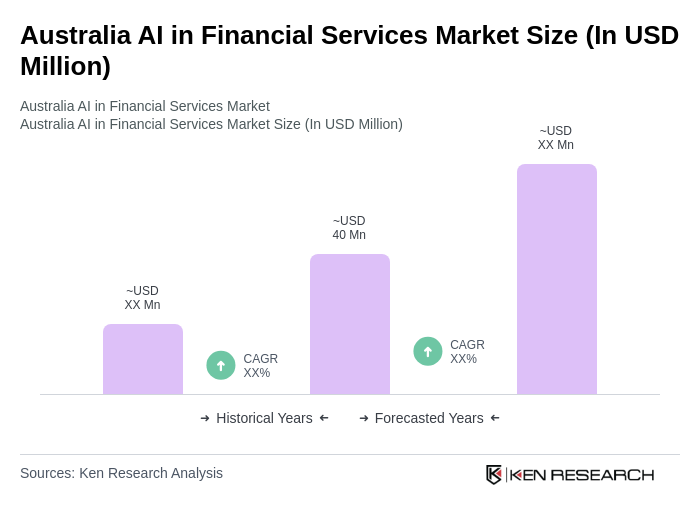

The Australia AI in Financial Services Market is valued at approximately USD 40 million, driven by the adoption of AI technologies by financial institutions to enhance operational efficiency, customer experience, and risk mitigation.