Region:Asia

Author(s):Shubham

Product Code:KRAB5020

Pages:97

Published On:October 2025

By Type:The market is segmented into Predictive Analytics, Natural Language Processing, Machine Learning, Robotic Process Automation, Generative AI, and Others. Among these, Predictive Analytics leads due to its critical role in enhancing decision-making, risk assessment, and fraud detection in financial institutions. The surge in demand for data-driven insights and robust risk management solutions is fueling the adoption of predictive analytics tools across banks and insurance companies .

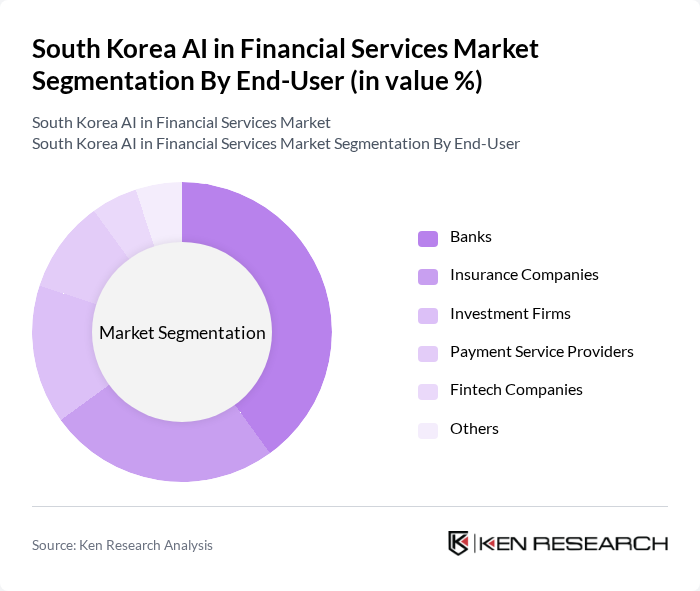

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Payment Service Providers, Fintech Companies, and Others. Banks are the leading end-user, leveraging AI for customer service automation, credit scoring, fraud detection, and operational efficiency. The competitive drive among banks to deliver personalized digital experiences and streamline operations has significantly accelerated AI adoption in this segment .

The South Korea AI in Financial Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung SDS, LG CNS, SK Telecom, KakaoBank, NH Investment & Securities, Shinhan Financial Group, KB Financial Group, Hana Financial Group, Mirae Asset Securities, Woori Bank, Samsung Life Insurance, Hanwha Life Insurance, Daishin Securities, Toss (Viva Republica), and DGB Financial Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South Korean AI in financial services market appears promising, driven by technological advancements and increasing consumer expectations. As institutions continue to adopt AI solutions, the focus will shift towards enhancing customer experiences and operational efficiencies. Additionally, the integration of AI with emerging technologies, such as blockchain, is expected to create new avenues for innovation. Financial institutions will likely prioritize investments in AI research and development to stay competitive and meet regulatory requirements, ensuring sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Natural Language Processing Machine Learning Robotic Process Automation Generative AI Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Service Providers Fintech Companies Others |

| By Application | Risk Management Fraud Detection Credit Scoring Forecasting & Reporting Customer Service and Chatbots Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Implementation Services Maintenance Services |

| By Pricing Model | Subscription-Based Pay-Per-Use Licensing |

| By Region | Seoul Busan Incheon Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector AI Implementation | 100 | Chief Technology Officers, IT Managers |

| Insurance Industry AI Applications | 60 | Product Managers, Risk Analysts |

| Investment Firms AI Utilization | 50 | Portfolio Managers, Data Scientists |

| Fintech Startups AI Strategies | 40 | Founders, Business Development Managers |

| Regulatory Bodies on AI in Finance | 40 | Policy Makers, Compliance Officers |

The South Korea AI in Financial Services Market is valued at approximately USD 25 million, driven by the adoption of AI technologies across banking, insurance, and investment sectors, enhancing operational efficiency and customer experience.