Region:Asia

Author(s):Dev

Product Code:KRAC2050

Pages:83

Published On:October 2025

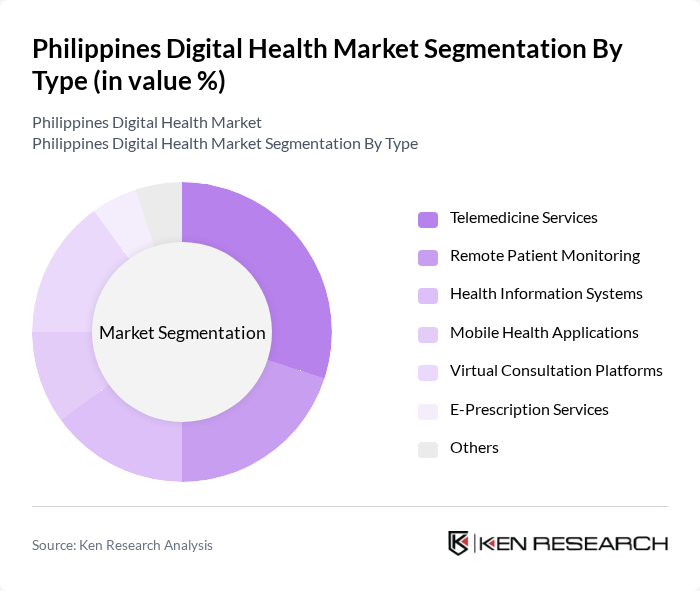

By Type:The digital health market can be segmented into various types, including Telemedicine Services, Remote Patient Monitoring, Health Information Systems, Mobile Health Applications, Virtual Consultation Platforms, E-Prescription Services, and Others. Each of these sub-segments plays a crucial role in enhancing healthcare delivery and patient engagement .

The Telemedicine Services segment is currently dominating the market due to the increasing acceptance of virtual consultations among patients and healthcare providers. The COVID-19 pandemic has significantly accelerated the adoption of telemedicine, as it allows patients to receive care from the safety of their homes. Additionally, the convenience and accessibility of telemedicine platforms have led to a surge in usage, making it a preferred choice for many individuals seeking healthcare services. The demand for remote monitoring and digital therapeutics is also rising, especially for chronic disease management .

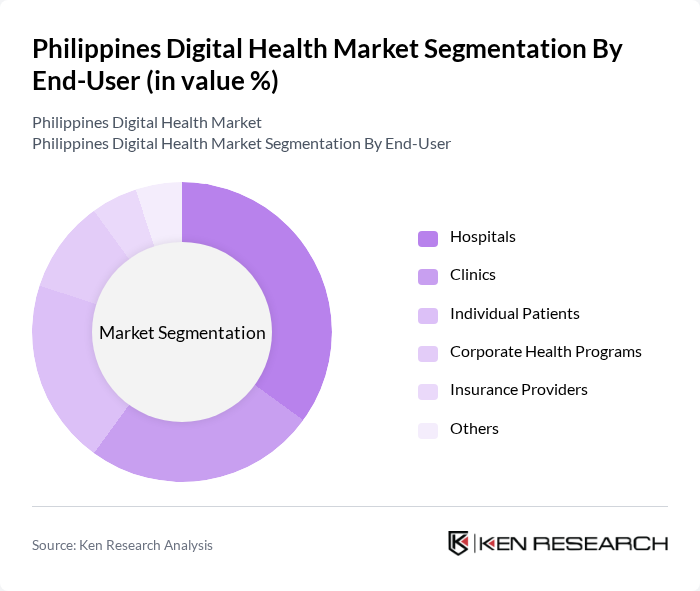

By End-User:The market can also be segmented by end-users, which include Hospitals, Clinics, Individual Patients, Corporate Health Programs, Insurance Providers, and Others. Each end-user category has unique needs and preferences that influence the adoption of digital health solutions .

Hospitals are the leading end-user segment in the digital health market, primarily due to their need for efficient patient management systems and the integration of advanced technologies to enhance service delivery. The increasing pressure on hospitals to improve patient outcomes and reduce operational costs has driven the adoption of digital health solutions, making them a key player in this market. Clinics and individual patients are also significant contributors, with growing interest in telemedicine and mobile health applications .

The Philippines Digital Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as MyHealth Clinic, KonsultaMD, Medgate Philippines, HealthNow, AIDE, Docquity, Lifetrack Medical Systems, PhilHealth, Medifi, eConsult, MediCard, Qure.ai, WellMed, CareSpan, Zennya Health contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines digital health market is poised for significant transformation, driven by technological advancements and increasing consumer demand for accessible healthcare solutions. As the government continues to invest in digital infrastructure and regulatory frameworks, the market is expected to see enhanced collaboration between health tech startups and traditional healthcare providers. This synergy will likely lead to innovative solutions that address local health challenges, ultimately improving patient outcomes and expanding the reach of digital health services across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Telemedicine Services Remote Patient Monitoring Health Information Systems Mobile Health Applications Virtual Consultation Platforms E-Prescription Services Others |

| By End-User | Hospitals Clinics Individual Patients Corporate Health Programs Insurance Providers Others |

| By Application | Chronic Disease Management Mental Health Services Preventive Healthcare Emergency Care Follow-Up Care Others |

| By Distribution Channel | Direct-to-Consumer B2B Partnerships Online Platforms Mobile Applications Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Bundled Services Freemium Models Others |

| By User Demographics | Age Groups Income Levels Geographic Distribution Health Status Others |

| By Technology Integration | Cloud-Based Solutions On-Premise Solutions Mobile Technologies AI and Machine Learning Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Service Providers | 80 | CEOs, Product Managers, Technology Officers |

| Healthcare Institutions Implementing Digital Solutions | 60 | Hospital Administrators, IT Managers, Clinical Directors |

| Patients Using Digital Health Apps | 100 | End-users, Patient Advocates, Health Coaches |

| Regulatory Bodies and Health Policy Makers | 40 | Policy Analysts, Health Economists, Regulatory Officers |

| Investors in Digital Health Startups | 50 | Venture Capitalists, Angel Investors, Financial Analysts |

The Philippines Digital Health Market is valued at approximately USD 2.8 billion, driven by the increasing adoption of telemedicine, smartphone penetration, and demand for remote healthcare services, particularly accelerated by the COVID-19 pandemic.