Region:Middle East

Author(s):Geetanshi

Product Code:KRAE0730

Pages:85

Published On:December 2025

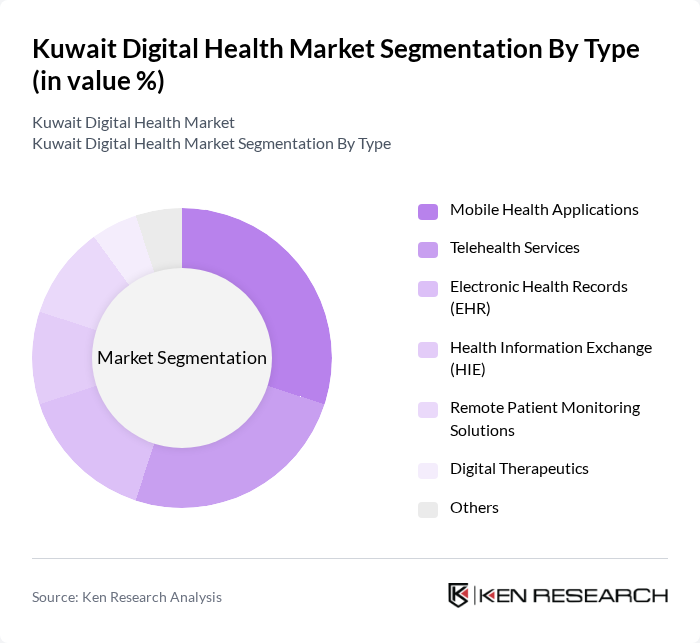

By Type:The digital health market in Kuwait is segmented into various types, including mobile health applications, telehealth services, electronic health records (EHR), health information exchange (HIE), remote patient monitoring solutions, digital therapeutics, and others. Among these, mobile health applications and telehealth services are particularly dominant due to the increasing smartphone penetration and the growing demand for remote healthcare solutions. The convenience and accessibility offered by these technologies are driving their adoption across various demographics.

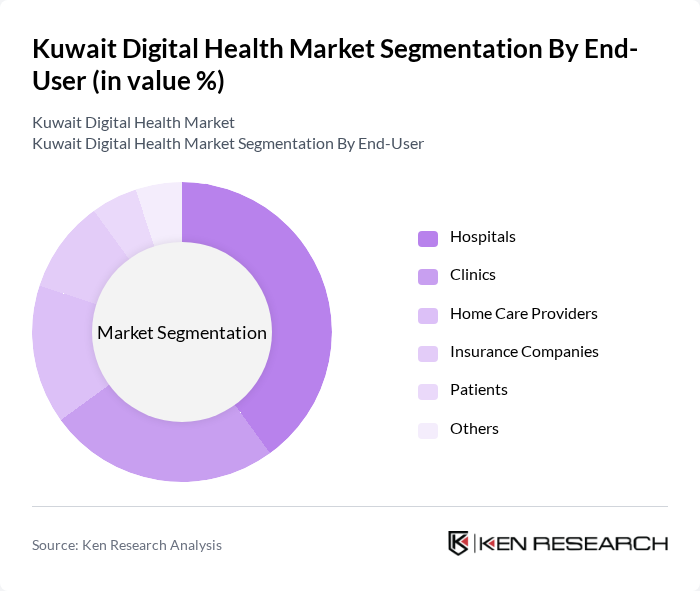

By End-User:The end-user segmentation of the digital health market includes hospitals, clinics, home care providers, insurance companies, patients, and others. Hospitals and clinics are the primary users of digital health solutions, driven by the need for efficient patient management and improved healthcare delivery. The increasing focus on patient-centered care and the integration of technology in healthcare practices are propelling the adoption of digital health solutions in these settings.

The Kuwait Digital Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Health Assurance Company, Gulf Insurance Group, Al-Diwan Health Services, MedGulf, DabaDoc, Health 360, KIMSHEALTH, eHealth Kuwait, Aster DM Healthcare, Al Seer Group, Medcare Hospital, American Hospital Kuwait, Al Razi Hospital, Kuwait Medical Center, and Al Salam International Hospital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait digital health market appears promising, driven by technological advancements and increasing consumer demand for accessible healthcare solutions. As the government continues to invest in digital health initiatives, the integration of artificial intelligence and machine learning into healthcare services is expected to enhance patient outcomes. Furthermore, the growing trend towards preventive healthcare will likely encourage the development of innovative health management applications, fostering a more proactive approach to health and wellness among the population.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Health Applications Telehealth Services Electronic Health Records (EHR) Health Information Exchange (HIE) Remote Patient Monitoring Solutions Digital Therapeutics Others |

| By End-User | Hospitals Clinics Home Care Providers Insurance Companies Patients Others |

| By Demographics | Age Groups (Children, Adults, Seniors) Gender Socioeconomic Status Others |

| By Service Type | Consultation Services Diagnostic Services Treatment Services Follow-up Services Others |

| By Technology Used | Cloud-based Solutions AI and Machine Learning Internet of Things (IoT) Blockchain Technology Others |

| By Geographic Distribution | Urban Areas Rural Areas Others |

| By Policy Support | Government Initiatives Subsidies for Digital Health Solutions Tax Incentives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Services | 100 | Healthcare Providers, Telehealth Coordinators |

| Electronic Health Records (EHR) Adoption | 80 | IT Managers, Health Information Officers |

| Mobile Health Applications | 70 | App Developers, User Experience Designers |

| Patient Engagement Tools | 60 | Patient Advocates, Healthcare Marketers |

| Health Data Analytics | 90 | Data Analysts, Health Economists |

The Kuwait Digital Health Market is valued at approximately USD 105 million, reflecting a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital fitness platforms, telemedicine, and patient engagement solutions within the healthcare system.