Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1612

Pages:93

Published On:October 2025

By Type:The segmentation by type includes various subsegments such as Telehealth and Telemedicine Services, Health Information Technology (EHR, HIE, e-Prescription), Wearable Health Devices and Remote Monitoring, Mobile Health (mHealth) Applications, Digital Therapeutics and Virtual Care Platforms, AI-Driven Diagnostics and Decision Support, and Others (Blockchain, Robotics in Healthcare). Among these, Telehealth and Telemedicine Services are leading the market due to the increasing demand for remote healthcare solutions, especially post-pandemic.

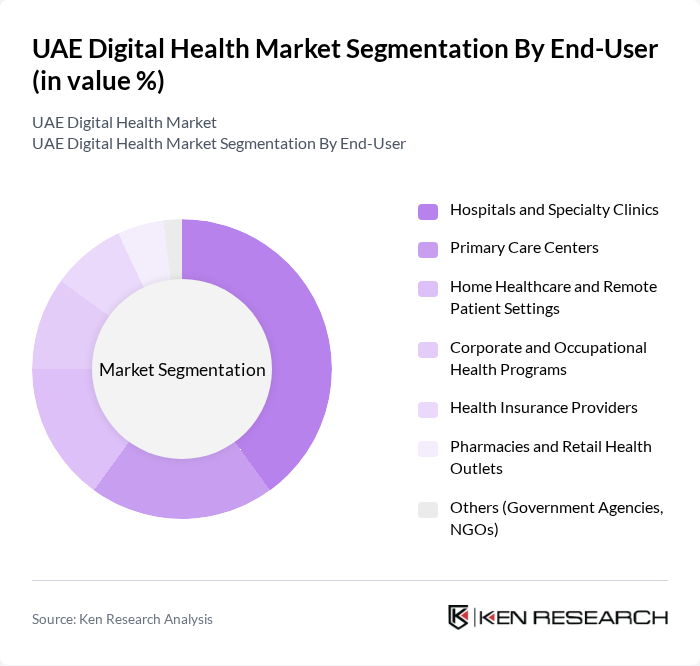

By End-User:The end-user segmentation includes Hospitals and Specialty Clinics, Primary Care Centers, Home Healthcare and Remote Patient Settings, Corporate and Occupational Health Programs, Health Insurance Providers, Pharmacies and Retail Health Outlets, and Others (Government Agencies, NGOs). Hospitals and Specialty Clinics dominate this segment as they are increasingly adopting digital health solutions to enhance patient care and streamline operations.

The UAE Digital Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daman National Health Insurance Company, Healthigo, Okadoc, Altibbi, Abu Dhabi Health Services Company (SEHA), Dubai Health Authority (DHA), Philips Healthcare, Siemens Healthineers, Cerner Corporation, GE Healthcare, Medcare Hospitals & Medical Centres, Aster DM Healthcare, Cleveland Clinic Abu Dhabi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE digital health market appears promising, driven by ongoing technological advancements and increasing consumer acceptance of telehealth services. As the government continues to support digital health initiatives, the integration of AI and machine learning will enhance patient care and operational efficiency. Furthermore, the growing emphasis on preventive healthcare will likely lead to increased investments in mobile health applications and remote monitoring solutions, fostering a more connected healthcare ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Telehealth and Telemedicine Services Health Information Technology (EHR, HIE, e-Prescription) Wearable Health Devices and Remote Monitoring Mobile Health (mHealth) Applications Digital Therapeutics and Virtual Care Platforms AI-Driven Diagnostics and Decision Support Others (Blockchain, Robotics in Healthcare) |

| By End-User | Hospitals and Specialty Clinics Primary Care Centers Home Healthcare and Remote Patient Settings Corporate and Occupational Health Programs Health Insurance Providers Pharmacies and Retail Health Outlets Others (Government Agencies, NGOs) |

| By Application | Chronic Disease Management (Diabetes, Hypertension) Mental and Behavioral Health Services Preventive and Wellness Care Emergency and Acute Care Rehabilitation and Post-Acute Care Maternal and Child Health Others |

| By Distribution Channel | Direct Sales (B2B, B2G) Online Platforms and App Stores Partnerships with Healthcare Providers Retail Pharmacies and Health Stores Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| By Technology | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions Mobile and IoT Technologies Artificial Intelligence and Machine Learning Others |

| By Investment Source | Private Investments Government Funding Venture Capital and Private Equity Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Adoption | 120 | Healthcare Providers, IT Managers |

| Wearable Health Technology | 110 | Product Managers, Health Tech Innovators |

| Patient Engagement Platforms | 90 | Patient Experience Officers, Digital Health Strategists |

| Health Data Analytics | 80 | Data Scientists, Healthcare Analysts |

| Mobile Health Applications | 100 | App Developers, UX/UI Designers |

The UAE Digital Health Market is valued at approximately USD 620 million, reflecting significant growth driven by the adoption of telehealth services, advancements in health information technology, and government initiatives aimed at enhancing healthcare accessibility and efficiency.