Region:Middle East

Author(s):Rebecca

Product Code:KRAC4617

Pages:96

Published On:October 2025

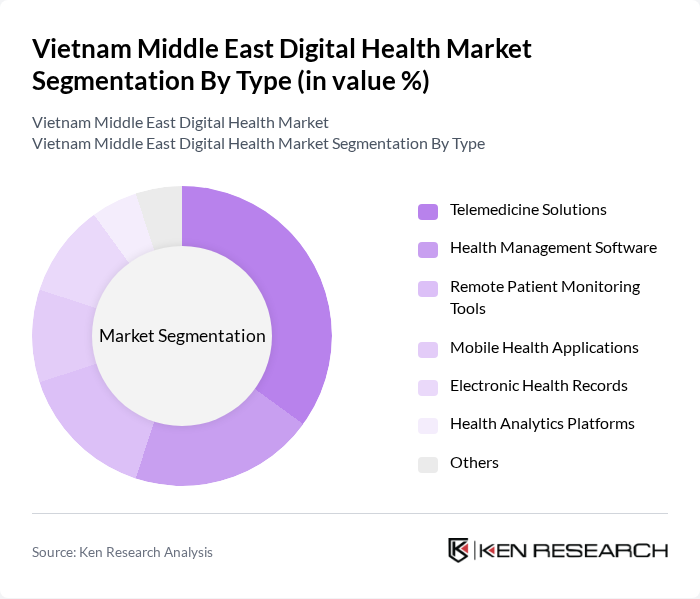

By Type:The digital health market can be segmented into various types, including telemedicine solutions, health management software, remote patient monitoring tools, mobile health applications, electronic health records, health analytics platforms, and others. Among these, telemedicine solutions are gaining significant traction due to their ability to provide remote consultations and healthcare services, especially in rural areas where access to healthcare is limited. The increasing smartphone penetration and high-speed internet connectivity, coupled with the growing prevalence of chronic diseases such as diabetes, hypertension, and dementia, further bolster the adoption of these solutions. Cloud-based platforms have emerged as the fastest-growing segment, offering cost-effective, scalable solutions that eliminate expensive hardware requirements.

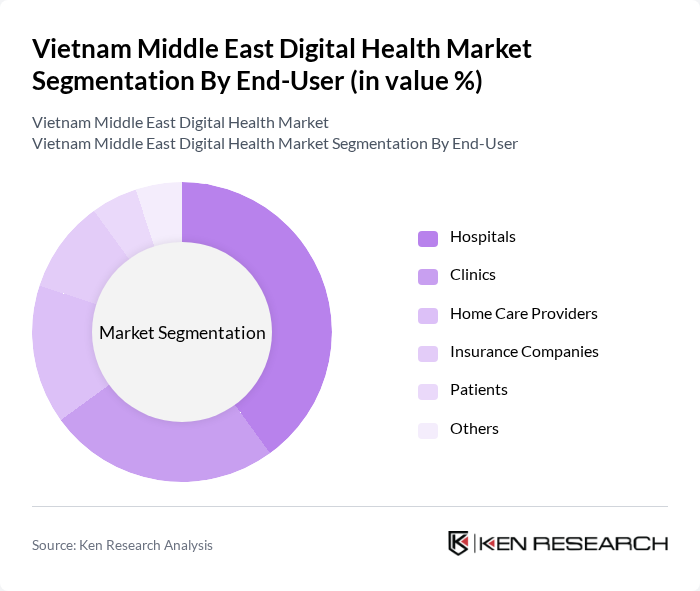

By End-User:The end-user segmentation includes hospitals, clinics, home care providers, insurance companies, patients, and others. Hospitals are the leading end-users of digital health solutions, driven by their need for efficient patient management systems and improved healthcare delivery. The increasing focus on patient-centered care and the integration of technology in hospital operations are key factors contributing to the dominance of hospitals in this segment. Homecare settings and patients themselves are increasingly adopting digital health solutions, particularly remote patient monitoring devices and mobile health applications, as healthcare shifts toward preventive and personalized medicine. Insurance companies are also integrating digital health tools into wellness programs, incentivizing device adoption through premium discounts.

The Vietnam Middle East Digital Health Market is characterized by a dynamic mix of regional and international players. Leading participants such as Viettel Group (Viettel Telehealth), Vingroup (Vinmec Telehealth), FPT Corporation, Hoan My Medical Corporation (Hoan My Telehealth), Med247, eDoctor, Doctor Anywhere Vietnam, Jio Health Vietnam, Hello Bacsi (Hello Health Group), AiHealth, Docosan, CMC Corporation, TMA Solutions, Bkav Corporation, MobiFone contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam Middle East digital health market appears promising, driven by technological advancements and increasing consumer acceptance. As internet connectivity improves and telemedicine becomes more mainstream, healthcare providers are likely to invest in innovative solutions. Additionally, the integration of artificial intelligence and machine learning into healthcare services will enhance patient care and operational efficiency. The focus on personalized health solutions will further cater to the diverse needs of the population, ensuring a more tailored healthcare experience.

| Segment | Sub-Segments |

|---|---|

| By Type | Telemedicine Solutions Health Management Software Remote Patient Monitoring Tools Mobile Health Applications Electronic Health Records Health Analytics Platforms Others |

| By End-User | Hospitals Clinics Home Care Providers Insurance Companies Patients Others |

| By Application | Chronic Disease Management Mental Health Services Preventive Healthcare Emergency Care Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Healthcare Providers Others |

| By Region | Northern Vietnam Southern Vietnam Central Vietnam Others |

| By Customer Segment | Individual Consumers Corporate Clients Government Institutions Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Adoption in Urban Areas | 120 | Healthcare Providers, Patients |

| Mobile Health App Usage | 100 | App Developers, End Users |

| Remote Patient Monitoring Systems | 80 | Healthcare Administrators, IT Managers |

| Digital Health Policy Impact | 70 | Policy Makers, Health Economists |

| Patient Satisfaction with Digital Health Services | 120 | Patients, Caregivers |

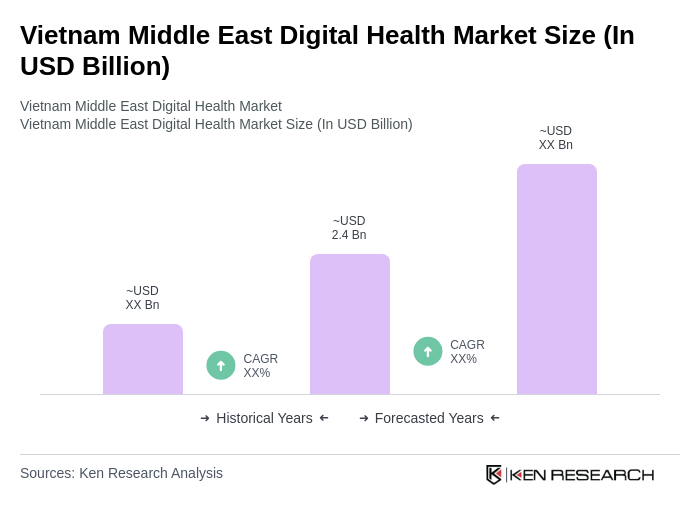

The Vietnam Middle East Digital Health Market is valued at approximately USD 2.4 billion, driven by the increasing adoption of telemedicine, rising healthcare costs, and the need for efficient healthcare delivery systems, particularly accelerated by the COVID-19 pandemic.