Region:Africa

Author(s):Geetanshi

Product Code:KRAA4778

Pages:94

Published On:September 2025

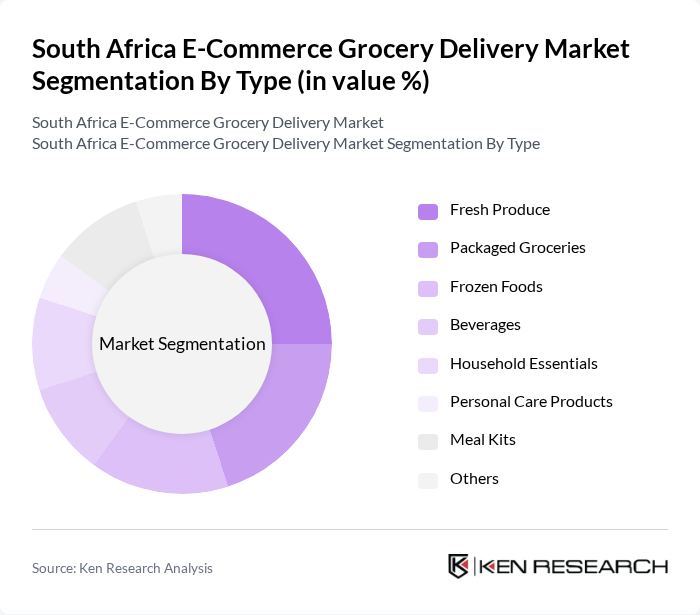

By Type:The market is segmented into various types of grocery products, including Fresh Produce, Packaged Groceries, Frozen Foods, Beverages, Household Essentials, Personal Care Products, Meal Kits, and Others. Each of these segments caters to different consumer needs and preferences, with specific trends influencing their growth.

TheFresh Producesegment is currently dominating the market due to the increasing consumer preference for healthy and organic food options. As more consumers become health-conscious, the demand for fresh fruits and vegetables delivered directly to their homes has surged. This trend is further supported by the convenience of online shopping, allowing consumers to easily access a variety of fresh produce without the need to visit physical stores. ThePackaged Groceriessegment also shows significant growth, driven by busy lifestyles and the need for quick meal solutions .

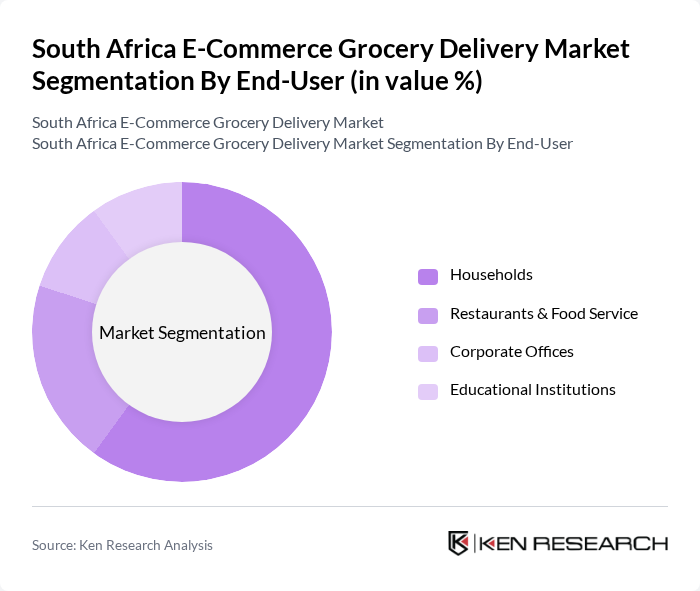

By End-User:The market is segmented by end-users, including Households, Restaurants & Food Service, Corporate Offices, and Educational Institutions. Each segment has unique requirements and purchasing behaviors that influence the overall market dynamics.

TheHouseholdssegment is the largest contributor to the market, accounting for a significant portion of the overall demand. This is largely due to the convenience and time-saving benefits that grocery delivery services offer to busy families and individuals. TheRestaurants & Food Servicesegment is also growing, as more establishments seek reliable suppliers for fresh ingredients and packaged goods to meet their operational needs. TheCorporate OfficesandEducational Institutionssegments are smaller but are gradually increasing their reliance on grocery delivery services for catering and staff meals .

The South Africa E-Commerce Grocery Delivery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pick n Pay, Checkers, Woolworths, SPAR, Takealot, Mr D Food, Uber Eats, Food Lover's Market, Dis-Chem, Makro, Game, Checkers Sixty60, Yuppiechef, OneCart, Zulzi contribute to innovation, geographic expansion, and service delivery in this space.

The South African e-commerce grocery delivery market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As more consumers prioritize convenience, the integration of AI and automation in logistics is expected to enhance operational efficiency. Additionally, the focus on sustainability will likely shape product offerings, with consumers increasingly favoring eco-friendly options. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Produce Packaged Groceries Frozen Foods Beverages Household Essentials Personal Care Products Meal Kits Others |

| By End-User | Households Restaurants & Food Service Corporate Offices Educational Institutions |

| By Sales Channel | Online Marketplaces Direct-to-Consumer Websites Mobile Applications Social Media Platforms |

| By Distribution Mode | Home Delivery Click and Collect (Pickup Points) Quick Commerce (Q-Commerce) Subscription Services |

| By Price Range | Budget Mid-Range Premium |

| By Customer Demographics | Age Group Income Level Urban vs Rural |

| By Payment Method | Credit/Debit Cards Mobile Payments Cash on Delivery Digital Wallets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Grocery Delivery Preferences | 120 | Online Shoppers, Grocery Delivery Users |

| Logistics and Supply Chain Insights | 60 | Logistics Managers, Supply Chain Analysts |

| Retailer Perspectives on E-commerce | 50 | Retail Executives, E-commerce Managers |

| Market Trends and Consumer Behavior | 80 | Market Researchers, Consumer Insights Analysts |

| Technology Adoption in Grocery Delivery | 40 | IT Managers, E-commerce Technology Specialists |

The South Africa E-Commerce Grocery Delivery Market is valued at approximately USD 5 billion, reflecting significant growth driven by increased online shopping adoption and changing consumer preferences towards convenience, particularly accelerated during the pandemic.