Region:Asia

Author(s):Rebecca

Product Code:KRAD1556

Pages:83

Published On:November 2025

By Type:The market is segmented into various types of fulfillment services, including Third-Party Logistics (3PL), Marketplace Fulfillment, In-House Fulfillment, Dropshipping, and Others. Among these, Third-Party Logistics (3PL) is the leading segment due to its ability to provide comprehensive logistics solutions, allowing businesses to focus on their core operations while outsourcing their fulfillment needs. The rise of integrated logistics platforms and demand for faster delivery options further strengthen the 3PL segment .

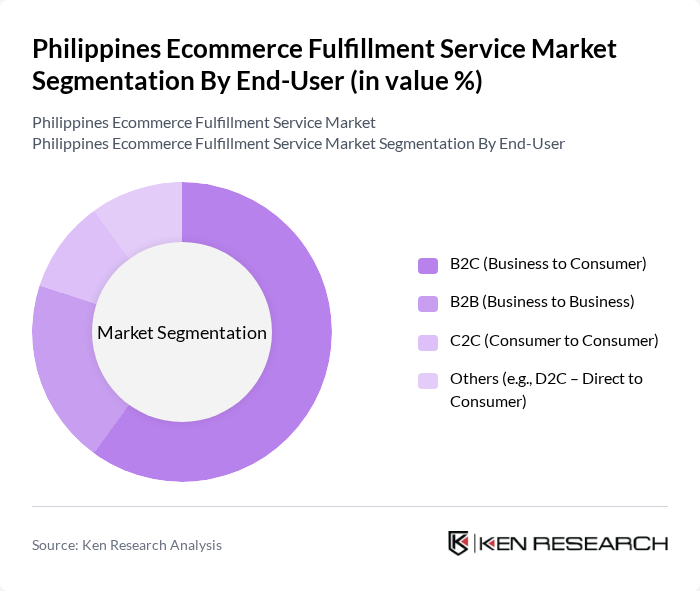

By End-User:The end-user segmentation includes B2C (Business to Consumer), B2B (Business to Business), C2C (Consumer to Consumer), and Others. The B2C segment dominates the market, driven by the increasing number of online shoppers and the growing preference for home delivery services, which has been further amplified by the pandemic. B2C accounts for the majority of market share, while B2B and C2C segments are expanding due to digital procurement and social commerce platforms .

The Philippines Ecommerce Fulfillment Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lazada Philippines, Shopee Philippines, J&T Express Philippines, Ninja Van Philippines, LBC Express, GrabExpress, Xend, 2GO Group, Deliveree Philippines, Entrego, GoGo Xpress, Air21, Fastrack, ZALORA Philippines, QuadX contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ecommerce fulfillment service market in the Philippines appears promising, driven by technological advancements and changing consumer preferences. As more businesses adopt omnichannel strategies, the demand for integrated fulfillment solutions will increase. Additionally, sustainability will become a key focus, with companies seeking eco-friendly practices. The government’s continued investment in infrastructure will also play a crucial role in enhancing logistics capabilities, ultimately supporting the growth of the ecommerce sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Third-Party Logistics (3PL) Marketplace Fulfillment (e.g., Fulfillment by Lazada, Shopee Xpress) In-House Fulfillment Dropshipping Others (e.g., Hybrid Fulfillment Models) |

| By End-User | B2C (Business to Consumer) B2B (Business to Business) C2C (Consumer to Consumer) Others (e.g., D2C – Direct to Consumer) |

| By Delivery Method | Standard Delivery Express Delivery Same-Day Delivery Scheduled Delivery Others (e.g., Click & Collect, Locker Pickup) |

| By Product Category | Electronics & Appliances Fashion & Apparel Home & Living (Furniture, Home Goods) Health, Beauty & Personal Care Groceries & FMCG Others (Toys, DIY, Media, etc.) |

| By Payment Method | Credit/Debit Cards Cash on Delivery E-Wallets Bank Transfers Others (e.g., Buy Now Pay Later) |

| By Geographic Coverage | Metro Manila Luzon (excluding Metro Manila) Visayas Mindanao Others (e.g., Island Provinces) |

| By Customer Segment | Millennials Gen Z Baby Boomers Micro, Small & Medium Enterprises (MSMEs) Others (e.g., Large Enterprises, Rural Consumers) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General E-commerce Fulfillment | 100 | E-commerce Business Owners, Operations Managers |

| Last-Mile Delivery Services | 70 | Logistics Coordinators, Delivery Service Managers |

| Warehousing Solutions | 60 | Warehouse Managers, Supply Chain Analysts |

| Cross-Border E-commerce Logistics | 50 | International Trade Managers, Compliance Officers |

| Consumer Experience in Fulfillment | 80 | End Consumers, Customer Experience Managers |

The Philippines Ecommerce Fulfillment Service Market is valued at approximately USD 15 billion, driven by the rapid growth of online shopping, digital payment solutions, and improved internet connectivity, particularly accelerated by the pandemic.