Region:Asia

Author(s):Shubham

Product Code:KRAD3657

Pages:89

Published On:November 2025

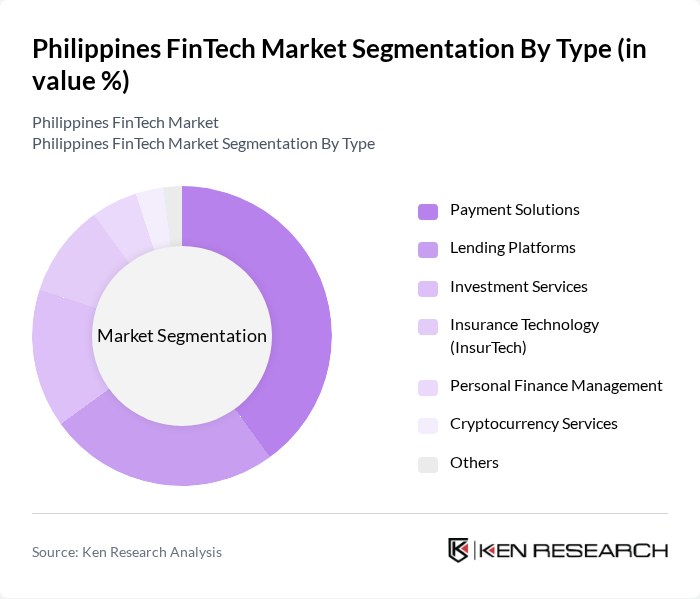

By Type:The FinTech market in the Philippines can be segmented into various types, including Payment Solutions, Lending Platforms, Investment Services, Insurance Technology (InsurTech), Personal Finance Management, Cryptocurrency Services, and Others. Among these, Payment Solutions is the leading segment, driven by the rapid adoption of mobile wallets and digital payment platforms, which cater to the increasing demand for convenient and secure transaction methods.

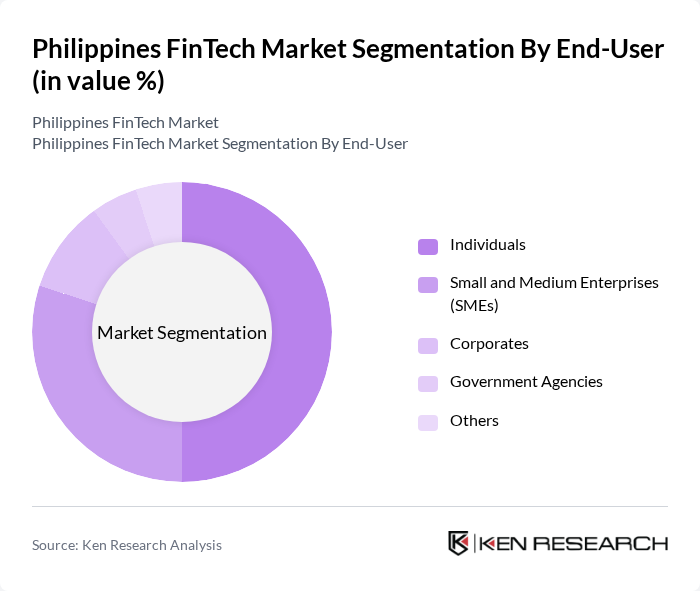

By End-User:The FinTech market can also be segmented by end-user categories, including Individuals, Small and Medium Enterprises (SMEs), Corporates, Government Agencies, and Others. The Individuals segment is currently the most significant, as the growing number of tech-savvy consumers increasingly seek digital financial solutions for personal banking, payments, and investments.

The Philippines FinTech market is characterized by a dynamic mix of regional and international players. Leading participants such as GCash, PayMaya, UnionBank, Coins.ph, Grab Financial Group, CIMB Bank Philippines, RCBC, EastWest Bank, Asia United Bank (AUB), Payoneer, LenddoEFL, Kiva Philippines, Mynt, Finastra, FINTQ contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines FinTech market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The increasing integration of artificial intelligence in financial services is expected to enhance customer experiences and operational efficiencies. Additionally, the shift towards open banking will foster innovation and collaboration among financial institutions and FinTech firms. As the government continues to support digital financial initiatives, the market is likely to witness accelerated growth, paving the way for new entrants and innovative solutions in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Solutions Lending Platforms Investment Services Insurance Technology (InsurTech) Personal Finance Management Cryptocurrency Services Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Government Agencies Others |

| By Region | Luzon Visayas Mindanao |

| By Technology | Mobile Applications Web Platforms API Integrations Blockchain Technology Others |

| By Application | Retail Banking Investment Management Payment Processing Wealth Management Others |

| By Investment Source | Venture Capital Private Equity Government Grants Crowdfunding Others |

| By Policy Support | Tax Incentives Regulatory Sandboxes Subsidies for Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Payment Adoption | 100 | Consumers aged 18-45, Tech-savvy Individuals |

| SME FinTech Utilization | 60 | Business Owners, Financial Managers |

| Peer-to-Peer Lending Insights | 50 | Borrowers, Lenders, Financial Advisors |

| Insurance Technology Feedback | 40 | Insurance Policyholders, Agents |

| Investment Platforms Engagement | 50 | Investors, Financial Planners |

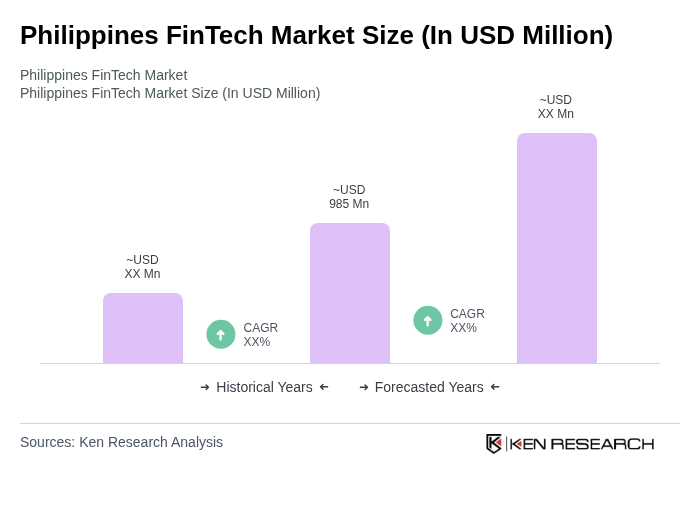

The Philippines FinTech market is valued at approximately USD 985 million, driven by the increasing adoption of digital payment solutions, e-commerce growth, and a rising unbanked population seeking financial services.