Region:Asia

Author(s):Dev

Product Code:KRAC4809

Pages:88

Published On:October 2025

By Type:The market is segmented into a range of services tailored to the operational and compliance needs of healthcare facilities. The primary segments include Hard Services (such as maintenance, HVAC, electrical, and plumbing), Soft Services (including cleaning, janitorial, security, and catering), Waste Management Services (covering biomedical, hazardous, and general waste), Energy & Environmental Management (focused on sustainability and resource optimization), IT & Digital Facility Management (leveraging digital platforms and automation), Landscaping & Grounds Maintenance, and Others (such as laundry and patient transport) .

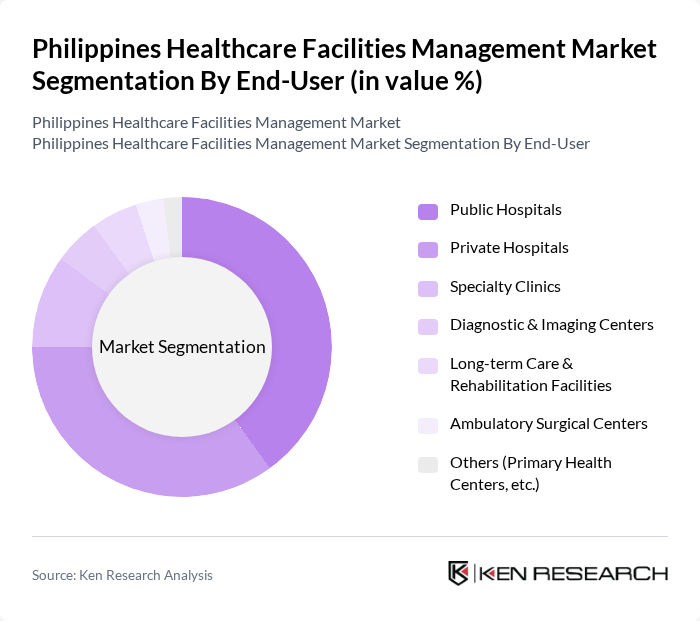

By End-User:The end-user segmentation covers a broad spectrum of healthcare facilities utilizing management services. Key segments are Public Hospitals, Private Hospitals, Specialty Clinics, Diagnostic & Imaging Centers, Long-term Care & Rehabilitation Facilities, Ambulatory Surgical Centers, and Others (such as primary health centers and community clinics) .

The Philippines Healthcare Facilities Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ayala Healthcare Holdings, Inc., Metro Pacific Investments Corporation, Healthway Medical, St. Luke's Medical Center, The Medical City, Makati Medical Center, Asian Hospital and Medical Center, Cardinal Santos Medical Center, Chong Hua Hospital, De Los Santos Medical Center, Philippine General Hospital, University of Santo Tomas Hospital, Research Institute for Tropical Medicine, Southern Philippines Medical Center, Mount Grace Hospitals, Inc., Philcare Manpower Services, Inc., ISS Facility Services Philippines, Inc., CBRE Philippines, Colliers International Philippines, Sodexo Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The future of healthcare facilities management in the Philippines appears promising, driven by ongoing government initiatives and technological advancements. As the demand for quality healthcare services continues to rise, facilities management will increasingly focus on integrating smart technologies and sustainable practices. Additionally, public-private partnerships are expected to play a crucial role in enhancing infrastructure and service delivery, ensuring that healthcare facilities can meet the evolving needs of the population effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services (Maintenance, HVAC, Electrical, Plumbing) Soft Services (Cleaning, Janitorial, Security, Catering) Waste Management Services (Biomedical, Hazardous, General) Energy & Environmental Management IT & Digital Facility Management Landscaping & Grounds Maintenance Others (Laundry, Patient Transport, etc.) |

| By End-User | Public Hospitals Private Hospitals Specialty Clinics Diagnostic & Imaging Centers Long-term Care & Rehabilitation Facilities Ambulatory Surgical Centers Others (Primary Health Centers, etc.) |

| By Service Model | Outsourced Facility Management In-house Facility Management Hybrid Facility Management |

| By Region | Metro Manila Luzon (excluding Metro Manila) Visayas Mindanao |

| By Compliance Standards | DOH Accreditation ISO 41001 (Facility Management Standard) Local Health & Safety Regulations International Health Regulations |

| By Technology Adoption | Manual/Traditional Methods Automated Systems (CMMS, BMS) Smart Technologies (IoT, AI, Predictive Analytics) |

| By Investment Source | Private Sector Investments Government Funding Multilateral/International Aid Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Facility Management | 60 | Facility Managers, Hospital Administrators |

| Outpatient Clinic Operations | 40 | Clinic Managers, Healthcare Coordinators |

| Long-term Care Facility Management | 40 | Care Facility Directors, Operations Managers |

| Healthcare Technology Integration | 40 | IT Managers, Healthcare Technology Specialists |

| Regulatory Compliance in Healthcare Facilities | 40 | Compliance Officers, Quality Assurance Managers |

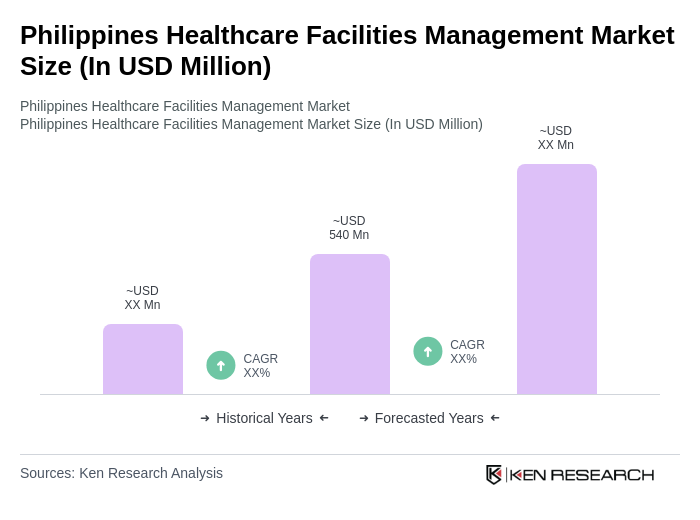

The Philippines Healthcare Facilities Management Market is valued at approximately USD 540 million, driven by increasing healthcare service demand, investments in hospital infrastructure, and a focus on patient safety and operational efficiency.