Region:Asia

Author(s):Shubham

Product Code:KRAB1226

Pages:98

Published On:October 2025

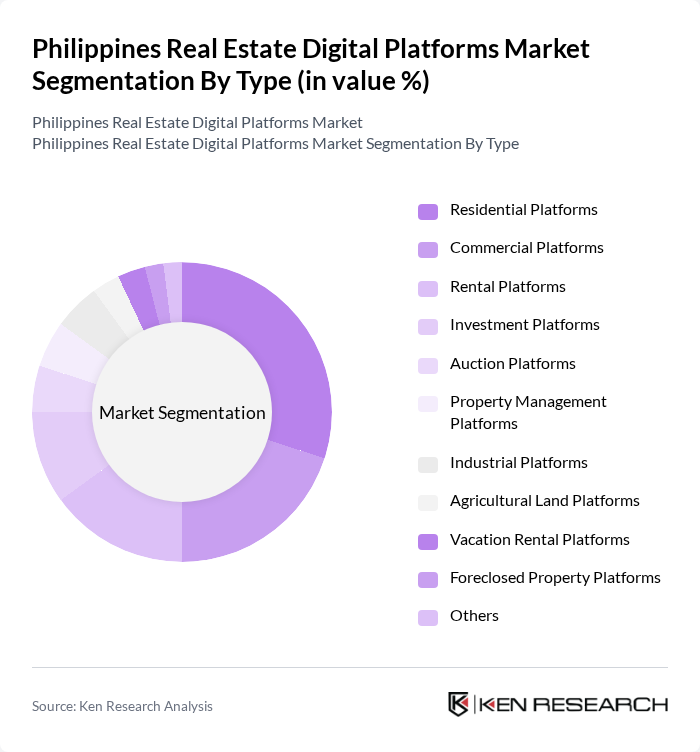

By Type:The market is segmented into Residential Platforms, Commercial Platforms, Rental Platforms, Investment Platforms, Auction Platforms, Property Management Platforms, Industrial Platforms, Agricultural Land Platforms, Vacation Rental Platforms, Foreclosed Property Platforms, and Others. Each segment caters to specific consumer needs and preferences, with Residential Platforms leading due to high demand from first-time home buyers and OFW investors, while Commercial and Rental Platforms serve growing business and urban renter populations. Investment and Auction Platforms are increasingly popular among institutional investors and high-net-worth individuals seeking diversified property portfolios. Property Management and Industrial Platforms support operational efficiency for developers and logistics firms, while Agricultural Land and Vacation Rental Platforms address niche markets for rural and leisure properties .

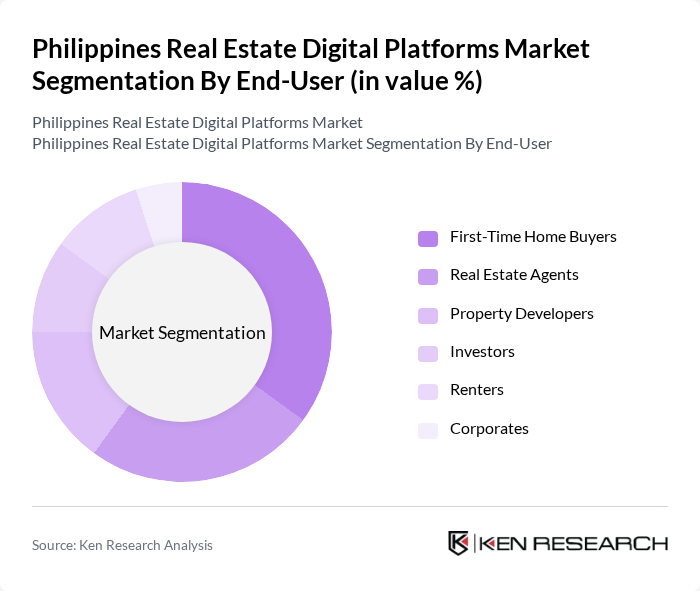

By End-User:The end-user segmentation includes First-Time Home Buyers, Real Estate Agents, Property Developers, Investors, Renters, and Corporates. First-Time Home Buyers represent the largest segment, driven by accessible mortgage products, government-backed housing programs, and rising household incomes. Real Estate Agents and Property Developers utilize digital platforms for enhanced marketing reach and operational efficiency. Investors and Renters increasingly rely on online tools for property discovery and transaction management, while Corporates use platforms for portfolio optimization and workspace solutions .

The Philippines Real Estate Digital Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lamudi Philippines, Property24 Philippines, Carousell Philippines, ZipMatch, MyProperty.ph, Dot Property Philippines, Hoppler, Pinnacle Real Estate Consulting Services, Point Blue, TheFlats, MyTown, Woke Coliving, The Communal, CoLiving Philippines, Robinsons Land Corporation, Ayala Land, Megaworld Corporation, DMCI Homes, Century Properties, Vista Land, SM Development Corporation, Rockwell Land, Filinvest Land contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Philippines real estate digital platforms market appears promising, driven by technological advancements and changing consumer preferences. As urbanization continues, platforms are likely to enhance their offerings with features like virtual tours and AI-driven property recommendations. Additionally, the integration of digital payment solutions will facilitate smoother transactions, making real estate more accessible. The focus on sustainability and eco-friendly developments will also shape the market, as consumers increasingly prioritize environmentally responsible options in their property choices.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Platforms Commercial Platforms Rental Platforms Investment Platforms Auction Platforms Property Management Platforms Industrial Platforms Agricultural Land Platforms Vacation Rental Platforms Foreclosed Property Platforms Others |

| By End-User | First-Time Home Buyers Real Estate Agents Property Developers Investors Renters Corporates |

| By Application | Property Listing Virtual Tours Market Analysis Tools Customer Relationship Management Online Auctions Digital Payment Integration |

| By Sales Channel | Online Platforms Real Estate Agents Direct Sales Auctions Affiliate Marketing Partnerships with Real Estate Agencies |

| By Distribution Mode | Mobile Applications Web Platforms Social Media Channels |

| By Pricing Strategy | Subscription-Based Commission-Based Freemium Models Listing Fees |

| By Customer Segment | First-Time Home Buyers Luxury Property Buyers Commercial Investors Real Estate Investors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Platforms | 100 | Real Estate Agents, Home Buyers |

| Commercial Property Listings | 60 | Commercial Brokers, Property Managers |

| Real Estate Investment Platforms | 40 | Investors, Financial Advisors |

| Property Management Software Users | 50 | Property Managers, Landlords |

| Real Estate Marketing Services | 60 | Marketing Managers, Digital Strategists |

The Philippines Real Estate Digital Platforms Market is valued at approximately USD 90 billion, driven by digital technology adoption, urbanization, and a growing middle class seeking convenient property solutions.