Region:Asia

Author(s):Geetanshi

Product Code:KRAD4864

Pages:90

Published On:December 2025

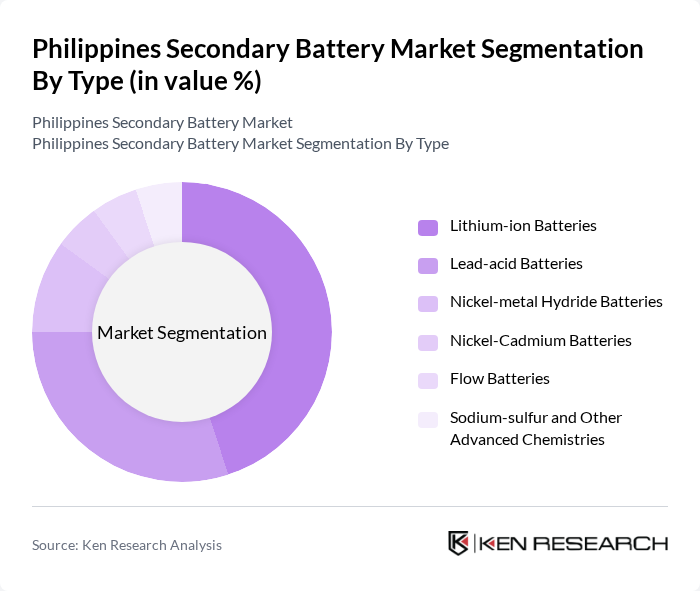

By Type:The market is segmented into various types of batteries, including Lithium-ion Batteries, Lead-acid Batteries, Nickel-metal Hydride Batteries, Nickel-Cadmium Batteries, Flow Batteries, and Sodium-sulfur and Other Advanced Chemistries. Among these, Lithium-ion Batteries are the most dominant in value terms due to their high energy density, longer lifespan, and decreasing costs, making them the preferred choice for electric vehicles, portable electronics, and stationary energy storage systems.

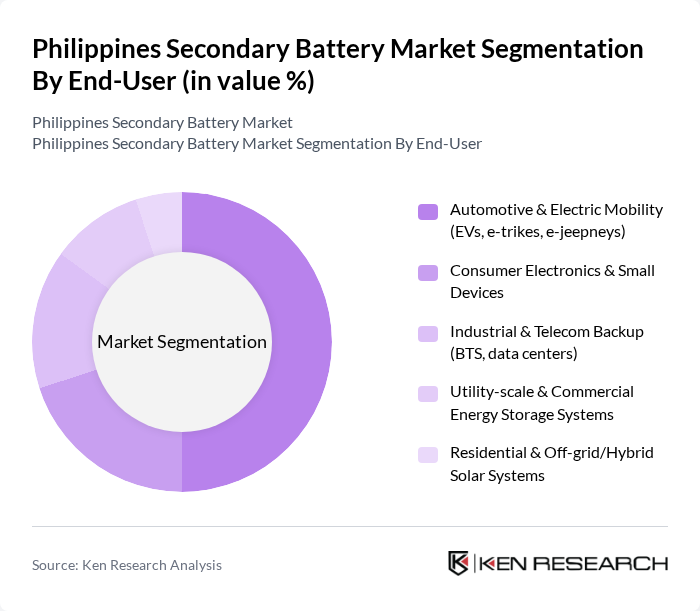

By End-User:The end-user segmentation includes Automotive & Electric Mobility (EVs, e-trikes, e-jeepneys), Consumer Electronics & Small Devices, Industrial & Telecom Backup (BTS, data centers), Utility-scale & Commercial Energy Storage Systems, and Residential & Off-grid/Hybrid Solar Systems. The Automotive & Electric Mobility segment is leading, supported by the national EV roadmap under EVIDA, ambitious deployment targets for electric cars, motorcycles, and buses, and incentives that accelerate battery demand for e-trikes, e-jeepneys, and other fleet applications. Industrial, telecom, and utility-scale storage demand is also expanding in response to grid reliability needs and rising integration of solar and wind capacity, further boosting secondary battery uptake.

The Philippines Secondary Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Motolite (Oriental & Motolite Marketing Corporation), First Gen Corporation, Aboitiz Power Corporation, ACEN Corporation (Ayala Group), San Miguel Global Power Holdings Corp., SMC Infrastructure – Battery Energy Storage Project (BESS) Portfolio, Meralco PowerGen Corporation (MGen) and Manila Electric Company (Meralco), Energy Development Corporation, Solar Philippines Power Project Holdings, Inc., Shell Pilipinas Corporation (including renewable and storage initiatives), TotalEnergies Philippines (solar and C&I storage projects), Narada Power Source Co., Ltd. (Philippines projects), Fluence Energy, Inc. (Philippines BESS deployments), Sungrow Power Supply Co., Ltd. (energy storage solutions in the Philippines), Huawei Digital Power (energy storage and telecom backup solutions) contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines secondary battery market is poised for significant growth, driven by increasing investments in renewable energy and electric vehicle infrastructure. As the government implements supportive policies and incentives, the market is expected to see advancements in battery technology and recycling initiatives. Furthermore, the integration of smart grid solutions will enhance energy management, creating a favorable environment for secondary battery adoption. Overall, the future looks promising as the market aligns with global sustainability trends and technological innovations.

| Segment | Sub-Segments |

|---|---|

| By Type | Lithium-ion Batteries Lead-acid Batteries Nickel-metal Hydride Batteries Nickel-Cadmium Batteries Flow Batteries Sodium-sulfur and Other Advanced Chemistries |

| By End-User | Automotive & Electric Mobility (EVs, e-trikes, e-jeepneys) Consumer Electronics & Small Devices Industrial & Telecom Backup (BTS, data centers) Utility-scale & Commercial Energy Storage Systems Residential & Off-grid/Hybrid Solar Systems |

| By Application | Electric Vehicles & Mobility Renewable Energy Integration & Grid-scale Storage Telecom & Data Center Backup Power Industrial Motive Power (forklifts, material handling) Residential Backup & Portable Electronics |

| By Distribution Channel | OEM Supply (to EV, solar, and equipment manufacturers) Direct Institutional & Utility Tenders Authorized Dealers & Distributors Retail Outlets & Service Centers Online & Marketplace Channels |

| By Geography | Luzon (including NCR) Visayas Mindanao Remote Islands & Off-grid Areas |

| By Technology | Conventional Lead-acid & VRLA Technology Lithium Iron Phosphate (LFP) and Other Li-ion Chemistries Advanced Lead-carbon & AGM Technologies Solid-state and Next-generation Battery Technologies |

| By Policy Support | Renewable Portfolio Standards & Green Energy Option Program EV Incentives under the Electric Vehicle Industry Development Act (EVIDA) Tax Incentives & Fiscal Support via BOI/PEZA Research, Demonstration Projects & Development Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Battery Market | 150 | Automotive Manufacturers, Service Center Managers |

| Consumer Electronics Battery Usage | 120 | Product Managers, Retail Buyers |

| Industrial Battery Applications | 90 | Operations Managers, Facility Engineers |

| Renewable Energy Storage Solutions | 80 | Energy Consultants, Project Developers |

| Battery Recycling Initiatives | 60 | Sustainability Managers, Environmental Compliance Officers |

The Philippines Secondary Battery Market is valued at approximately USD 1.3 billion, driven by the rising demand for electric vehicles, renewable energy storage, and consumer electronics, particularly lithium-ion batteries.