Region:Europe

Author(s):Geetanshi

Product Code:KRAA6750

Pages:98

Published On:September 2025

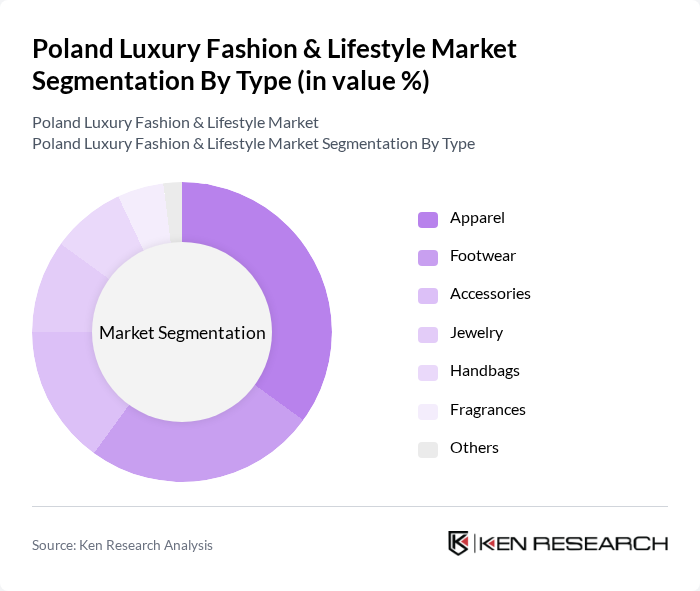

By Type:The luxury fashion and lifestyle market can be segmented into various types, including apparel, footwear, accessories, jewelry, handbags, fragrances, and others. Among these, apparel and footwear are the most significant segments, driven by changing fashion trends and consumer preferences for high-quality, branded products. The demand for accessories and jewelry is also growing, as consumers seek to complement their outfits with luxury items.

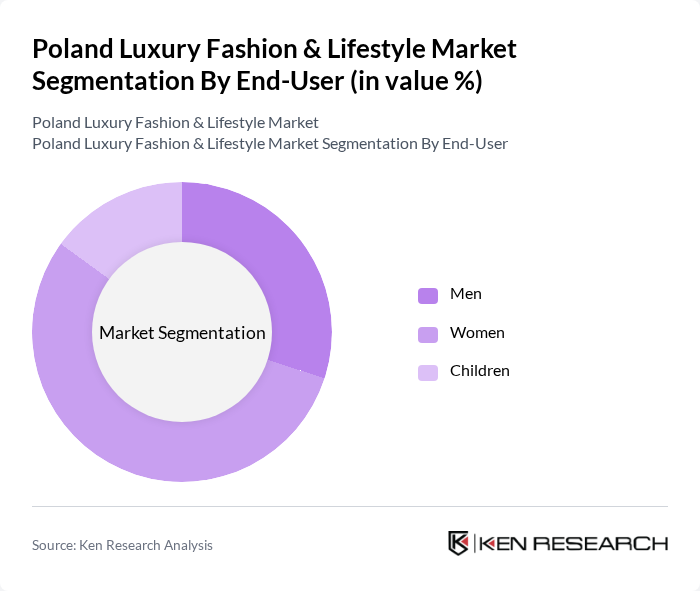

By End-User:The market can also be segmented by end-user demographics, including men, women, and children. Women represent the largest segment, driven by their higher spending on fashion and lifestyle products. Men’s fashion is also gaining traction, with increasing interest in luxury brands, while the children’s segment is growing due to parents' willingness to invest in high-quality, branded items for their children.

The Poland Luxury Fashion & Lifestyle Market is characterized by a dynamic mix of regional and international players. Leading participants such as LPP S.A., Reserved, Gino Rossi S.A., Monnari Trade S.A., W.Kruk S.A., Vistula Group S.A., 4F, Kazar, Ochnik, Bytom S.A., Tatuum, Mohito, Sinsay, Cropp, House contribute to innovation, geographic expansion, and service delivery in this space.

The Poland luxury fashion and lifestyle market is poised for significant transformation in the coming years, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, brands that prioritize eco-friendly practices will likely gain a competitive edge. Additionally, the integration of augmented reality and artificial intelligence in retail experiences will enhance personalization, making luxury shopping more engaging. These trends indicate a dynamic market landscape that will continue to evolve, presenting both challenges and opportunities for industry players.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Accessories Jewelry Handbags Fragrances Others |

| By End-User | Men Women Children |

| By Distribution Channel | Online Retail Department Stores Specialty Stores Direct Sales |

| By Price Range | Premium Super Premium Luxury |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| By Occasion | Casual Wear Formal Wear Sportswear |

| By Brand Loyalty | Brand Loyal Customers Brand Switchers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchasers | 150 | Affluent Consumers, Fashion Enthusiasts |

| High-End Accessory Buyers | 100 | Luxury Brand Loyalists, Trendsetters |

| Lifestyle Product Consumers | 80 | Home Decor Aficionados, Wellness Seekers |

| Online Luxury Shoppers | 120 | eCommerce Users, Digital Natives |

| Fashion Influencers and Bloggers | 50 | Content Creators, Social Media Influencers |

The Poland Luxury Fashion & Lifestyle Market is valued at approximately USD 5 billion, reflecting a significant growth trend driven by increasing disposable incomes and a rising middle class with a growing appetite for luxury goods.