Region:Asia

Author(s):Geetanshi

Product Code:KRAA6300

Pages:82

Published On:September 2025

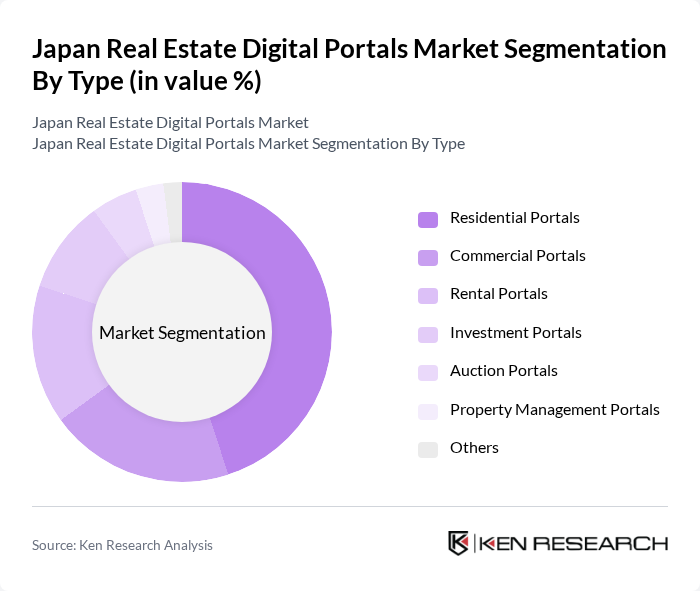

By Type:The market is segmented into various types, including Residential Portals, Commercial Portals, Rental Portals, Investment Portals, Auction Portals, Property Management Portals, and Others. Among these, Residential Portals dominate the market due to the high demand for housing and the increasing trend of online property searches by consumers. The convenience of browsing listings and accessing detailed property information has made residential portals the preferred choice for homebuyers and renters alike.

By End-User:The end-user segmentation includes Individual Buyers, Real Estate Agents, Property Developers, and Investors. Individual Buyers represent the largest segment, driven by the growing trend of homeownership and the increasing reliance on digital platforms for property searches. The ease of access to information and the ability to compare properties online have made this segment a significant contributor to the market's growth.

The Japan Real Estate Digital Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as REINS, SUUMO, HOME'S, At Home, Yahoo! Real Estate, Rakuten Real Estate, Mitsui Fudosan Realty, Tokyu Livable, Century 21 Japan, Daiwa House Industry, Nomura Real Estate, Sumitomo Realty & Development, Tokyu Corporation, Urban Research, Japan Property Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of Japan's real estate digital portals market appears promising, driven by technological advancements and changing consumer preferences. As the demand for online property transactions continues to rise, portals are likely to enhance their offerings with features like virtual tours and AI-driven insights. Additionally, the increasing focus on sustainability will push platforms to incorporate eco-friendly property listings, aligning with consumer values. This evolution will create a dynamic environment for innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Portals Commercial Portals Rental Portals Investment Portals Auction Portals Property Management Portals Others |

| By End-User | Individual Buyers Real Estate Agents Property Developers Investors |

| By Sales Channel | Direct Sales Online Marketplaces Affiliate Marketing Others |

| By Subscription Model | Free Listings Paid Listings Subscription-Based Services |

| By Geographic Focus | Urban Areas Suburban Areas Rural Areas |

| By User Demographics | Millennials Gen X Baby Boomers |

| By Market Positioning | Luxury Market Mid-Range Market Budget Market |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 150 | First-time Homebuyers, Investors |

| Commercial Real Estate Agents | 100 | Commercial Brokers, Property Managers |

| Digital Platform Users | 120 | Active Users, Casual Browsers |

| Real Estate Developers | 80 | Project Managers, Business Development Heads |

| Market Analysts | 60 | Real Estate Analysts, Economic Researchers |

The Japan Real Estate Digital Portals Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital technologies in real estate transactions and a rising demand for online property listings and virtual tours.