Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1089

Pages:94

Published On:November 2025

By Type:The market is segmented into various types, including Automated Storage and Retrieval Systems (ASRS), Mobile Robots (AGVs, AMRs), Warehouse Management Systems (WMS), Conveyor & Sortation Systems, Smart Shelving and Racks, and Others. Among these, Warehouse Management Systems (WMS) is the leading sub-segment, driven by the increasing need for efficient inventory management and real-time data analytics. The adoption of WMS solutions is crucial for businesses aiming to streamline operations and enhance customer satisfaction. The market also sees strong growth in robotics and automation equipment, reflecting the sector's focus on operational efficiency and scalability .

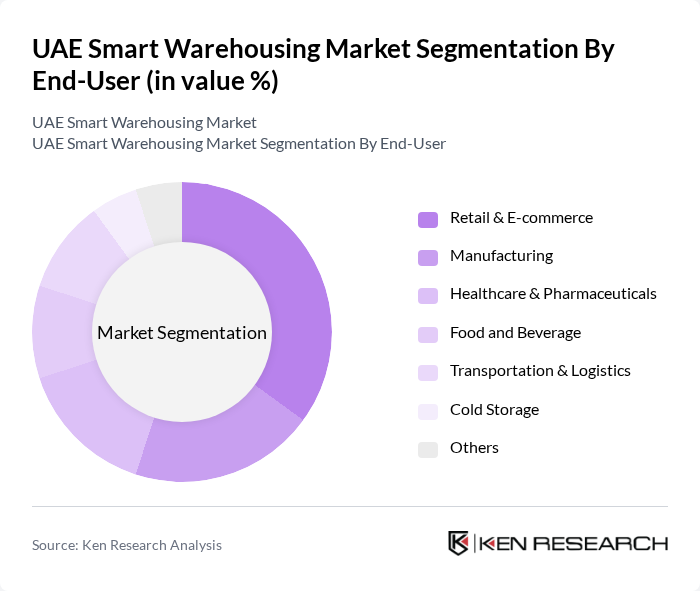

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Food and Beverage, Transportation & Logistics, Cold Storage, and Others. The Retail & E-commerce sector is the dominant end-user, driven by the exponential growth of online shopping and the need for efficient order fulfillment processes. This sector's demand for smart warehousing solutions is fueled by the necessity to manage high volumes of inventory and ensure timely deliveries. Manufacturing and logistics sectors also show robust adoption of smart warehousing technologies, reflecting the broader push for supply chain optimization and automation .

The UAE Smart Warehousing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aramex, Agility Logistics, DB Schenker, Kuehne + Nagel, DHL Supply Chain, CEVA Logistics, Al-Futtaim Logistics, Gulf Agency Company (GAC), Emirates Logistics LLC, RSA Logistics, Honeywell International Inc., Siemens AG, Zebra Technologies Corporation, Huawei Technologies Co., Ltd., Manhattan Associates Inc. contribute to innovation, geographic expansion, and service delivery in this space. These companies are actively investing in advanced automation, AI-driven warehouse management, and digital transformation initiatives to enhance operational efficiency and customer experience .

The future of the UAE smart warehousing market appears promising, driven by technological advancements and increasing demand for efficiency. As companies continue to embrace automation and data analytics, the integration of IoT and AI technologies will enhance operational capabilities. Furthermore, the government's commitment to improving logistics infrastructure will facilitate the growth of smart warehousing solutions, positioning the UAE as a leader in innovative logistics practices in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Storage and Retrieval Systems (ASRS) Mobile Robots (AGVs, AMRs) Warehouse Management Systems (WMS) Conveyor & Sortation Systems Smart Shelving and Racks Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Food and Beverage Transportation & Logistics Cold Storage Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Technology | RFID Technology IoT Solutions AI and Machine Learning Drones and Robotics Cloud-Based Solutions Others |

| By Application | Inventory Management Order Fulfillment Shipping and Receiving Asset Tracking Warehouse Maintenance Others |

| By Investment Source | Private Investments Government Funding Venture Capital Others |

| By Policy Support | Government Grants Tax Incentives Subsidies for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Solutions | 100 | Warehouse Managers, Supply Chain Executives |

| Automotive Parts Distribution | 80 | Logistics Coordinators, Operations Managers |

| Pharmaceutical Storage and Distribution | 70 | Compliance Officers, Warehouse Supervisors |

| Food and Beverage Supply Chain | 90 | Quality Assurance Managers, Distribution Managers |

| Technology Integration in Warehousing | 75 | IT Managers, Automation Specialists |

The UAE Smart Warehousing Market is valued at approximately USD 590 million, reflecting significant growth driven by automation technologies, efficient supply chain solutions, and the rise of e-commerce, which demands advanced warehousing capabilities.