Region:Middle East

Author(s):Rebecca

Product Code:KRAC8596

Pages:95

Published On:November 2025

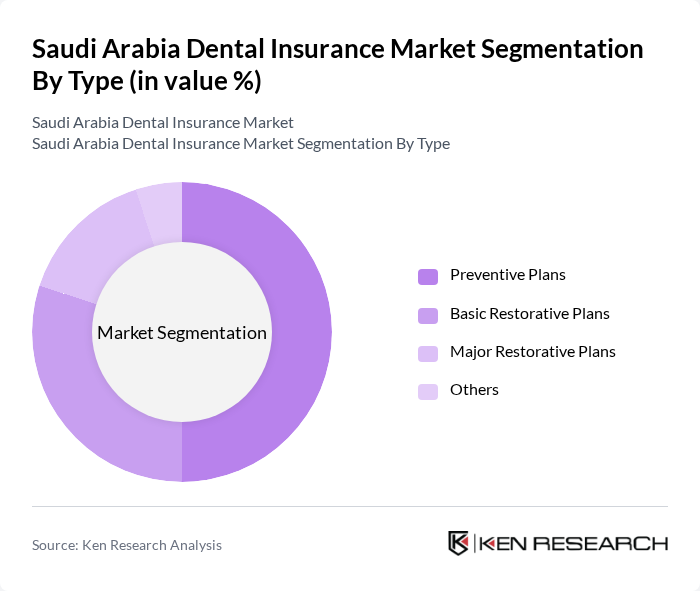

By Type:

The segmentation by type includes Preventive Plans, Basic Restorative Plans, Major Restorative Plans, and Others. Among these, Preventive Plans dominate the market due to the increasing emphasis on preventive care and early diagnosis of dental issues. Consumers are becoming more aware of the importance of regular dental check-ups and cleanings, leading to a higher uptake of preventive insurance plans. Basic Restorative Plans also see significant demand as they cover essential treatments like fillings and extractions, appealing to a broad demographic. Major Restorative Plans, while necessary, are less frequently utilized, as they cater to more severe dental issues that may not affect the majority of the population. Overall, the trend towards preventive care is shaping consumer preferences in the dental insurance market.

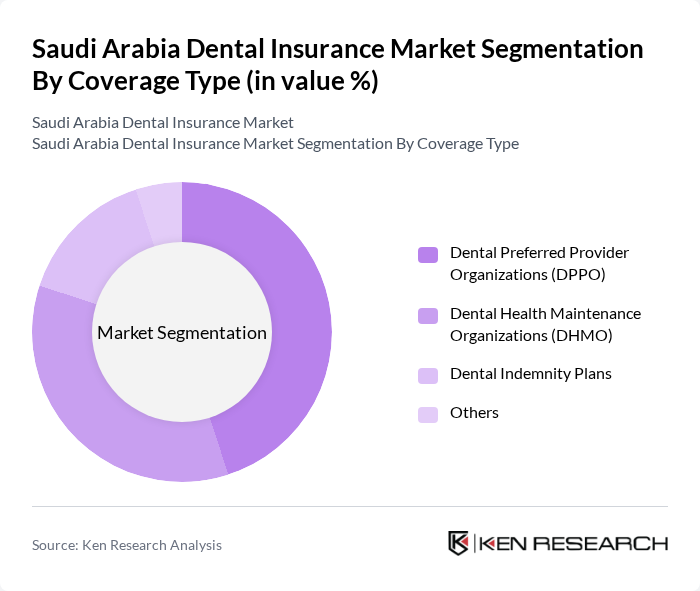

By Coverage Type:

This segmentation includes Dental Preferred Provider Organizations (DPPO), Dental Health Maintenance Organizations (DHMO), Dental Indemnity Plans, and Others. The DPPO segment leads the market, as it offers flexibility in choosing dental providers while maintaining cost-effectiveness. Consumers appreciate the ability to select from a network of dentists, which enhances their overall satisfaction. DHMO plans are also popular due to their lower premiums and comprehensive coverage, appealing to families and individuals seeking affordable options. Dental Indemnity Plans, while providing greater freedom, are less favored due to higher out-of-pocket costs. The trend towards more structured and affordable plans is driving the growth of DPPO and DHMO segments.

The Saudi Arabia Dental Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tawuniya (The Company for Cooperative Insurance), Bupa Arabia for Cooperative Insurance, Medgulf (Mediterranean & Gulf Cooperative Insurance and Reinsurance Company), Al Rajhi Takaful (Al Rajhi Company for Cooperative Insurance), Gulf Insurance Group (GIG Saudi), United Cooperative Assurance Company, Alinma Tokio Marine Company, Al-Etihad Cooperative Insurance Company, Al-Jazira Takaful Taawuni Company, Al-Sagr Cooperative Insurance Company, Malath Cooperative Insurance Company, Walaa Cooperative Insurance Company, Arabian Shield Cooperative Insurance Company, AXA Cooperative Insurance Company, SABB Takaful contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia dental insurance market appears promising, driven by increasing consumer awareness and government support for healthcare initiatives. As disposable incomes rise, more individuals are likely to invest in dental insurance, particularly in urban areas. Additionally, the integration of technology in dental services, such as tele-dentistry, is expected to enhance service delivery and accessibility, further boosting market growth. The focus on preventive care will also shape the offerings of insurance providers, aligning with consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Preventive Plans Basic Restorative Plans Major Restorative Plans Others |

| By Coverage Type | Dental Preferred Provider Organizations (DPPO) Dental Health Maintenance Organizations (DHMO) Dental Indemnity Plans Others |

| By Distribution Channel | Direct Sales Brokers Online Platforms Insurance Agents Others |

| By Demographics | Senior Citizens Adults Minors Others |

| By Geographic Region | Northern and Central Region Western Region Eastern Region Southern Region Others |

| By End User | Individuals Corporates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Insurance Providers | 50 | Product Managers, Underwriters |

| Dental Practitioners | 60 | Dentists, Clinic Managers |

| Consumers with Dental Insurance | 100 | Policyholders, Patients |

| Healthcare Policy Makers | 40 | Regulatory Officials, Health Economists |

| Insurance Brokers | 50 | Insurance Agents, Financial Advisors |

The Saudi Arabia Dental Insurance Market is valued at approximately USD 2.3 billion, reflecting significant growth driven by increased awareness of dental health, rising disposable incomes, and the expansion of dental care services across the country.