Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0095

Pages:98

Published On:August 2025

By Type:The foodservice market in Qatar is segmented into various types, including Full-Service Restaurants (FSR), Quick Service Restaurants (QSR), Cafés and Coffee Shops, Catering Services, Food Trucks, Cloud Kitchens / Ghost Kitchens, Bars and Pubs, and Others (e.g., Bakeries, Juice Bars). Among these, Quick Service Restaurants (QSR) have emerged as the dominant segment, accounting for over 40% of the market share. This dominance is driven by the increasing demand for fast, convenient dining options among busy consumers, the popularity of international fast-food chains, and the rapid growth of online food delivery platforms. Cloud kitchens are also witnessing the fastest growth rate, propelled by the expansion of delivery services and changing consumer habits.

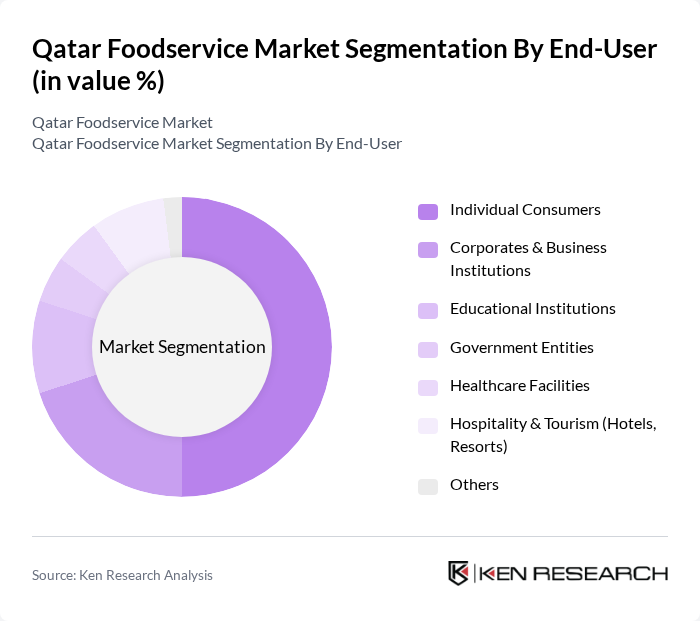

By End-User:The end-user segmentation of the foodservice market in Qatar includes Individual Consumers, Corporates & Business Institutions, Educational Institutions, Government Entities, Healthcare Facilities, Hospitality & Tourism (Hotels, Resorts), and Others. Individual Consumers represent the largest segment, accounting for half of the market share, driven by the growing trend of dining out, the increasing number of expatriates seeking diverse culinary experiences, and the rise in disposable income. Corporate and institutional demand is also significant, supported by the expansion of business districts and the hospitality sector.

The Qatar Foodservice Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Food Company (Qatar Foods Industries), Al Meera Consumer Goods Company, Gourmet Gulf, Qatar Food Company (QAFCO), M.H. Alshaya Co., Americana Group (KFC, Pizza Hut, Hardee's Qatar), Azadea Group (Paul, Eataly, The Butcher Shop & Grill Qatar), Talabat Qatar, Carriage Qatar, McDonald's Qatar (Al Mana Restaurants & Food Co.), Starbucks Qatar (Alshaya Group), The Cheesecake Factory Qatar (Alshaya Group), Shake Shack Qatar (Alshaya Group), Nando's Qatar (Oryx Group for Food Services), Chili's Qatar (Saleh Al Hamad Al Mana Co.), PF Chang's Qatar (Alshaya Group), Texas Roadhouse Qatar (Alshaya Group), Applebee's Qatar (Saleh Al Hamad Al Mana Co.), Turkey Central Restaurant, Al Shami Home Restaurant contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar foodservice market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As health-conscious dining becomes more prevalent, establishments are likely to adapt their menus to include nutritious options. Additionally, the integration of technology in ordering and payment systems will enhance customer experiences, making dining more convenient. The focus on sustainability will also shape future developments, with businesses increasingly adopting eco-friendly practices to meet consumer demand for responsible dining.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Restaurants (FSR) Quick Service Restaurants (QSR) Cafés and Coffee Shops Catering Services Food Trucks Cloud Kitchens / Ghost Kitchens Bars and Pubs Others (e.g., Bakeries, Juice Bars) |

| By End-User | Individual Consumers Corporates & Business Institutions Educational Institutions Government Entities Healthcare Facilities Hospitality & Tourism (Hotels, Resorts) Others |

| By Service Style | Dine-In Takeaway Delivery Drive-Thru Others (e.g., Curbside Pickup) |

| By Cuisine Type | Middle Eastern/Arabian Asian (Indian, Chinese, Japanese, etc.) Western (American, European, etc.) Fast Food Others (e.g., Fusion, African) |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Location | Urban Areas Suburban Areas Rural Areas Tourist Areas Commercial Districts Others |

| By Distribution Channel | Direct Sales (On-Premise) Online Platforms (Own App/Website) Third-Party Delivery Services (e.g., Talabat, Carriage, Deliveroo) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Full-Service Restaurants | 60 | Owners, Managers, Head Chefs |

| Quick-Service Restaurants | 50 | Franchise Owners, Operations Managers |

| Catering Services | 40 | Catering Managers, Event Coordinators |

| Food Trucks and Street Vendors | 40 | Food Truck Owners, Street Vendor Operators |

| Consumer Dining Preferences | 100 | General Public, Frequent Diners |

The Qatar Foodservice Market is valued at approximately USD 2 billion, reflecting a significant growth driven by increasing consumer spending, a growing expatriate population, and a rising trend towards dining out.