Region:Middle East

Author(s):Shubham

Product Code:KRAD6748

Pages:93

Published On:December 2025

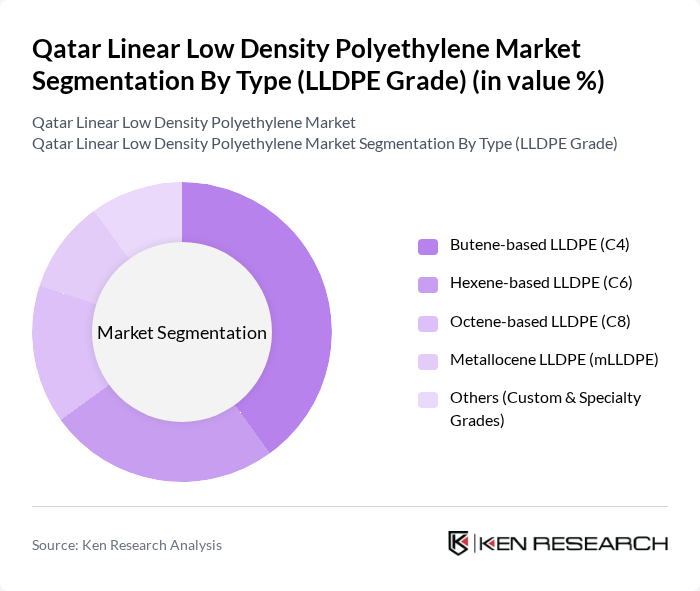

By Type (LLDPE Grade):The LLDPE market is segmented into various grades, including Butene-based LLDPE (C4), Hexene-based LLDPE (C6), Octene-based LLDPE (C8), Metallocene LLDPE (mLLDPE), and Others (Custom & Specialty Grades). Among these, Butene-based LLDPE (C4) is the most widely used due to its excellent balance of strength and flexibility, making it ideal for packaging applications. The growing demand for high-performance materials in the packaging sector is driving the preference for this grade, while Metallocene LLDPE is gaining traction for its superior properties in niche applications.

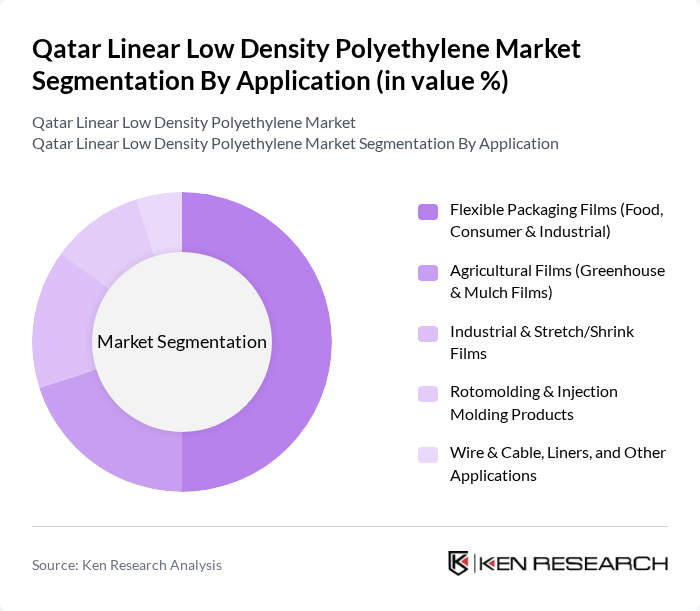

By Application:The applications of LLDPE are diverse, including Flexible Packaging Films (Food, Consumer & Industrial), Agricultural Films (Greenhouse & Mulch Films), Industrial & Stretch/Shrink Films, Rotomolding & Injection Molding Products, and Wire & Cable, Liners, and Other Applications. Flexible packaging films dominate the market due to their versatility and increasing demand in the food and beverage sector, driven by consumer preferences for convenience and sustainability. Agricultural films are also significant, as they support the growing agricultural sector in Qatar.

The Qatar Linear Low Density Polyethylene Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Petrochemical Company Q.P.J.S.C. (QAPCO), Qatar Chemical Company Ltd. (Q-Chem), Mesaieed Petrochemical Holding Company Q.P.S.C. (MPHC), QatarEnergy (formerly Qatar Petroleum), Qatar Industrial Manufacturing Company Q.P.S.C. (QIMC), Qatar Plastic Products Company W.L.L. (QPPC), Doha Plastic Company W.L.L., Al Jazeera Factory for Plastic Products, Qatar Polymer Industrial Company W.L.L., Al Ahrar Plastic Industries, United Plastic Products Company (UPPC), Al Sidra Plastic Factory, Al Jabr Plastic Factory, Qatar German Gasket Factory (Polymer-based Sealing Materials), Gulf Organisation for Research & Development (GORD) – Green Materials & Standards Stakeholder contribute to innovation, geographic expansion, and service delivery in this space.

The future of the LLDPE market in Qatar appears promising, driven by increasing demand across various sectors, including packaging and construction. As the government continues to invest in infrastructure and sustainability initiatives, manufacturers are likely to innovate and adapt to changing consumer preferences. The focus on lightweight materials in automotive applications will further enhance LLDPE's relevance. Overall, the market is expected to evolve with a strong emphasis on sustainability and technological advancements, positioning it for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type (LLDPE Grade) | Butene-based LLDPE (C4) Hexene-based LLDPE (C6) Octene-based LLDPE (C8) Metallocene LLDPE (mLLDPE) Others (Custom & Specialty Grades) |

| By Application | Flexible Packaging Films (Food, Consumer & Industrial) Agricultural Films (Greenhouse & Mulch Films) Industrial & Stretch/Shrink Films Rotomolding & Injection Molding Products Wire & Cable, Liners, and Other Applications |

| By End-Use Industry | Packaging (Food, Beverage & Consumer Goods) Construction & Infrastructure Agriculture & Horticulture Industrial & Chemical Others (Automotive, Healthcare, etc.) |

| By Distribution Channel | Direct Sales to Converters & End-users Petrochemical Traders & Distributors Online Procurement Platforms Local Resin Stockists & Agents Others |

| By Geography (Within Qatar) | Doha & Industrial Areas (Mesaieed, Ras Laffan) Al Rayyan Al Wakrah Umm Salal & Al Khor Others |

| By Product Form | Pellets / Granules Powder Compounds & Masterbatches Others |

| By Processing Technology | Blown Film Extrusion Cast Film Extrusion Injection Molding Rotational Molding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Stakeholders | 100 | Procurement Managers, Product Development Heads |

| Automotive Sector Representatives | 80 | Supply Chain Managers, Quality Assurance Officers |

| Construction Material Suppliers | 70 | Sales Directors, Operations Managers |

| Consumer Goods Manufacturers | 90 | Marketing Managers, Production Supervisors |

| Regulatory Bodies and Associations | 50 | Policy Makers, Industry Analysts |

The Qatar Linear Low Density Polyethylene (LLDPE) Market is valued at approximately USD 1.1 billion, reflecting a robust growth trajectory driven by increasing demand in sectors such as flexible packaging and construction.