Region:Middle East

Author(s):Dev

Product Code:KRAC3470

Pages:90

Published On:October 2025

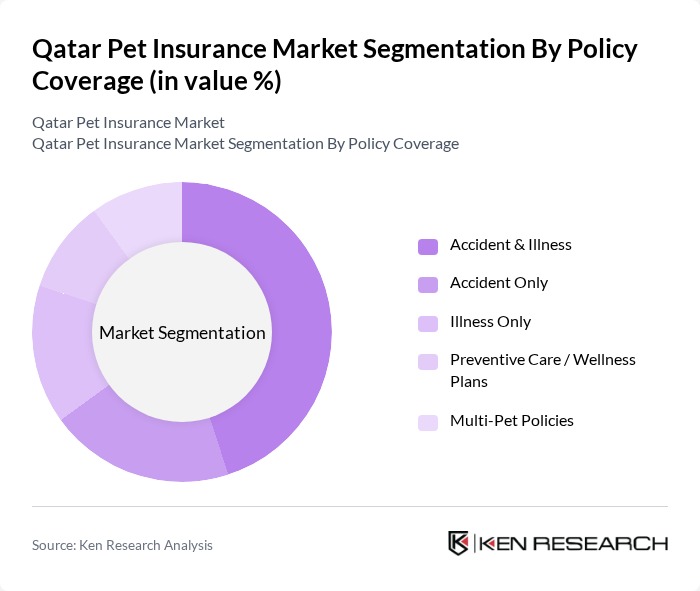

By Policy Coverage:The policy coverage segment includes various types of insurance plans that cater to different needs of pet owners. The subsegments are Accident & Illness, Accident Only, Illness Only, Preventive Care / Wellness Plans, and Multi-Pet Policies. Among these, Accident & Illness policies dominate the market due to their comprehensive nature, providing coverage for a wide range of veterinary expenses. This trend is driven by pet owners' desire for financial protection against unexpected health issues and accidents. The market is also witnessing increasing demand for preventive care and wellness plans, reflecting a shift toward proactive pet health management and regular veterinary check-ups .

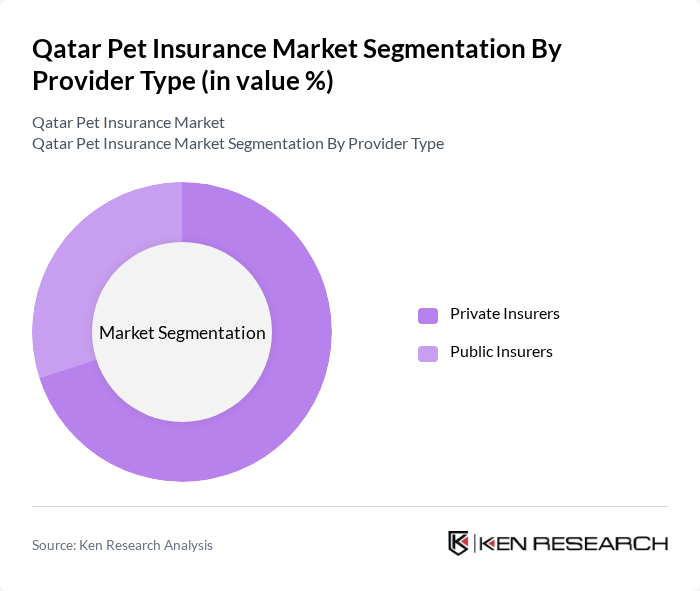

By Provider Type:This segmentation includes Private Insurers and Public Insurers. Private Insurers dominate the market, primarily due to their ability to offer tailored policies and superior customer service. The competitive landscape among private companies fosters innovation and better policy options, attracting more pet owners to seek insurance coverage for their pets. The rise of digital insurance platforms and partnerships with veterinary clinics further strengthens the position of private insurers in the market .

The Qatar Pet Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Insurance Company (QIC), Doha Insurance Group, Al Khaleej Takaful Insurance, Qatar General Insurance & Reinsurance Company, Qatar Islamic Insurance Company, Damaan Islamic Insurance Company (Beema), Al-Ahli Takaful Company, Qatar National Insurance Company (QNIC), Gulf Insurance Group (GIG Qatar), AXA Gulf, Allianz Qatar, MetLife Qatar, AIG Qatar, Zurich Insurance Qatar, RSA Insurance Qatar, Dubai Pet Insurance (DPi), PetAssure Middle East contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Qatar pet insurance market appears promising, driven by increasing pet ownership and a growing emphasis on pet health. As more pet owners recognize the financial benefits of insurance, the market is likely to see innovative products tailored to diverse needs. Additionally, advancements in technology, such as telemedicine for pets, will enhance service delivery, making insurance more accessible and appealing to consumers, thereby fostering market growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Policy Coverage | Accident & Illness Accident Only Illness Only Preventive Care / Wellness Plans Multi-Pet Policies |

| By Provider Type | Private Insurers Public Insurers |

| By Sales Channel | Direct Sales Online Platforms Insurance Brokers Bancassurance |

| By Animal Type | Dogs Cats Exotic Pets |

| By End-User | Individual Pet Owners Veterinary Clinics Pet Retailers Pet Breeders |

| By Policy Term | Annual Policies Monthly Policies Lifetime Policies |

| By Coverage Level | Basic Coverage Standard Coverage Premium Coverage |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Owners in Urban Areas | 95 | Dog and Cat Owners, Pet Enthusiasts |

| Veterinary Clinics | 42 | Veterinarians, Clinic Managers |

| Insurance Providers | 28 | Insurance Agents, Underwriters |

| Pet Retailers | 35 | Store Owners, Pet Product Managers |

| Pet Adoption Organizations | 25 | Adoption Coordinators, Animal Welfare Advocates |

The Qatar Pet Insurance Market is valued at approximately USD 20 million, driven by increasing pet ownership, awareness of pet health, and the trend of pet humanization among owners. This growth reflects a rising demand for comprehensive pet insurance policies.