Region:Middle East

Author(s):Rebecca

Product Code:KRAC9685

Pages:88

Published On:November 2025

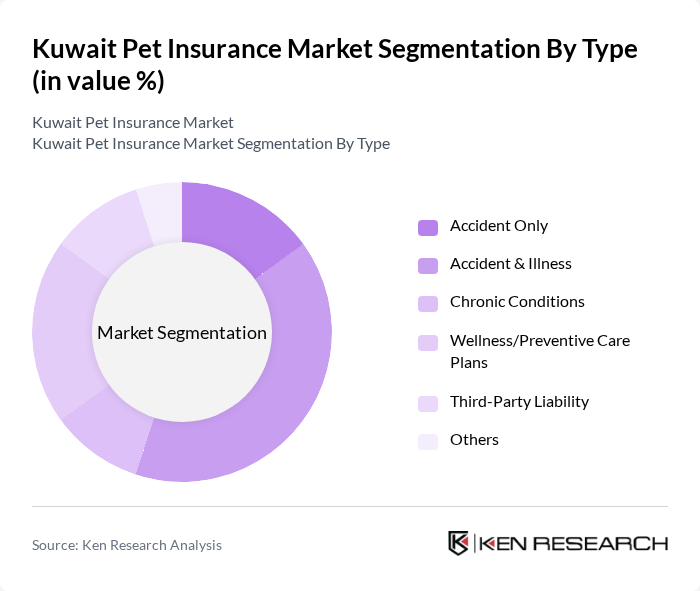

By Type:The market is segmented into various types of insurance plans that cater to different needs of pet owners. The subsegments include Accident Only, Accident & Illness, Chronic Conditions, Wellness/Preventive Care Plans, Third-Party Liability, and Others. Among these, Accident & Illness plans hold the largest share and are gaining further traction due to their comprehensive coverage, appealing to pet owners who seek financial protection against unexpected veterinary costs .

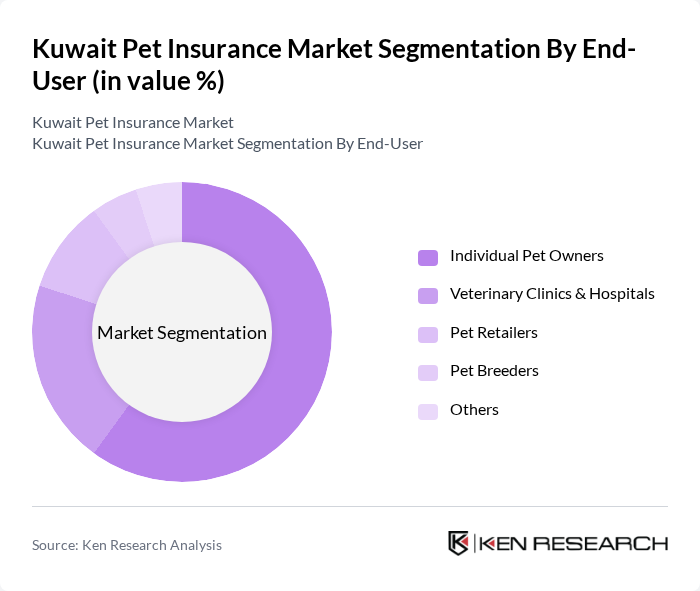

By End-User:The end-user segmentation includes Individual Pet Owners, Veterinary Clinics & Hospitals, Pet Retailers, Pet Breeders, and Others. Individual Pet Owners dominate the market as they are the primary purchasers of pet insurance, driven by the increasing trend of pet ownership and the desire for financial security in veterinary care .

The Kuwait Pet Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Insurance Group (GIG) – Kuwait, Warba Insurance Company, Al Ahleia Insurance Company, Kuwait Insurance Company, Al Fajer Insurance Company, AXA Gulf (now GIG Gulf), Qatar Insurance Company (QIC), Orient Insurance, Oman Insurance Company, RSA Insurance Group, Tokio Marine & Nichido Fire Insurance Co., Al Ain Ahlia Insurance Company, Tawuniya, PetSecure, Al Dar Insurance contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Kuwait pet insurance market appears promising, driven by increasing pet ownership and a growing emphasis on pet health. As awareness of pet insurance benefits rises, more pet owners are likely to seek coverage. Additionally, technological advancements in digital insurance solutions will facilitate easier access to policies. The market is expected to evolve with innovative products tailored to diverse consumer needs, enhancing overall market growth and sustainability in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Accident Only Accident & Illness Chronic Conditions Wellness/Preventive Care Plans Third-Party Liability Others |

| By End-User | Individual Pet Owners Veterinary Clinics & Hospitals Pet Retailers Pet Breeders Others |

| By Pet Type | Dogs Cats Exotic Pets Other Animals |

| By Coverage Type | Basic Coverage Enhanced Coverage Premium Coverage Others |

| By Distribution Channel | Online Platforms Insurance Agents & Brokers Veterinary Partnerships Direct Sales Bancassurance Others |

| By Policy Duration | Annual Policies Multi-Year Policies Others |

| By Customer Segment | First-Time Pet Owners Experienced Pet Owners High-Income Households Middle-Income Households Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Owners | 120 | Dog and cat owners, varying age groups |

| Veterinarians | 40 | Practicing veterinarians, clinic owners |

| Insurance Providers | 20 | Executives and product managers from pet insurance companies |

| Pet Retailers | 40 | Owners and managers of pet supply stores |

| Pet Care Professionals | 25 | Pet groomers, trainers, and pet sitters |

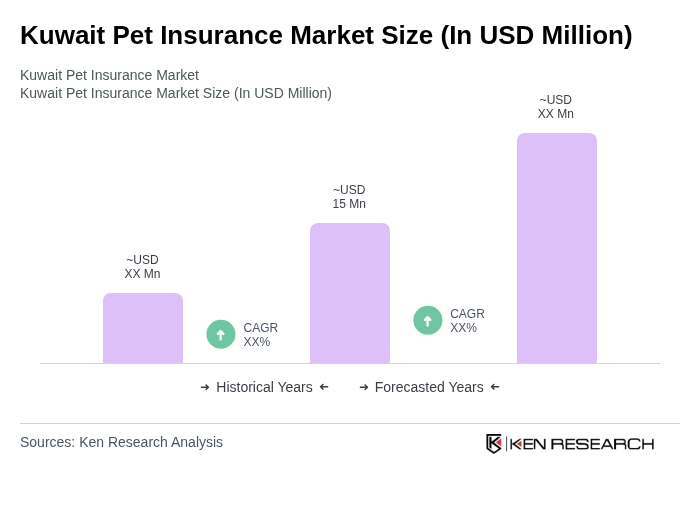

The Kuwait Pet Insurance Market is valued at approximately USD 15 million, reflecting a significant growth trend driven by increasing pet ownership and rising awareness of pet health among Kuwaiti citizens.