Region:Middle East

Author(s):Shubham

Product Code:KRAA1141

Pages:95

Published On:August 2025

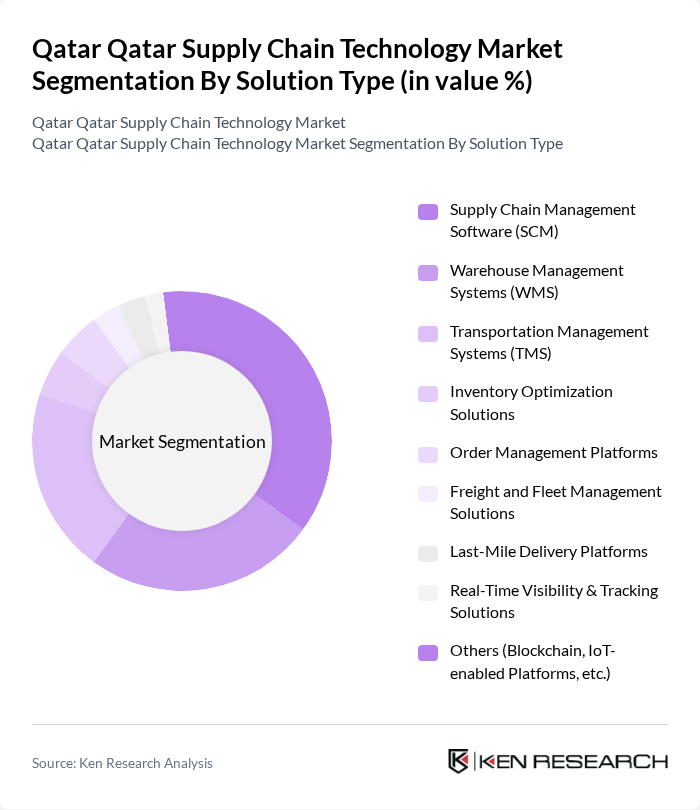

By Solution Type:The solution type segmentation encompasses a range of technologies that enhance supply chain operations. The dominant sub-segment is Supply Chain Management Software (SCM), widely adopted for its ability to streamline processes, improve end-to-end visibility, and enable data-driven decision-making. Other notable sub-segments include Warehouse Management Systems (WMS), which optimize storage and inventory flows, and Transportation Management Systems (TMS), crucial for route optimization and real-time shipment tracking. Additional solutions such as inventory optimization, order management, freight and fleet management, last-mile delivery, and real-time visibility platforms are increasingly integrated, reflecting the market's shift toward automation and digitalization .

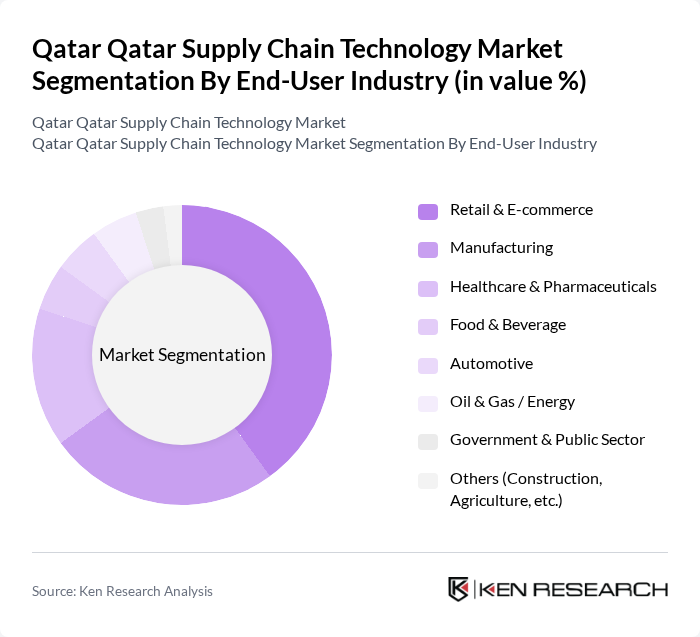

By End-User Industry:The end-user industry segmentation highlights the sectors utilizing supply chain technologies. Retail and e-commerce is the leading segment, driven by the surge in online shopping and the need for agile logistics. Manufacturing follows, leveraging supply chain solutions for production efficiency and inventory management. Healthcare and pharmaceuticals increasingly adopt digital supply chain tools for traceability and regulatory compliance. Other sectors such as food and beverage, automotive, oil and gas/energy, government, and construction are also investing in supply chain technologies to improve operational resilience and meet sector-specific requirements .

The Qatar Supply Chain Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Blue Yonder (formerly JDA Software), Manhattan Associates, Infor, Kinaxis, Descartes Systems Group, FourKites, Project44, Maersk Group (Maersk Logistics & Services), DHL Supply Chain (Deutsche Post DHL Group), FedEx Logistics, Qatar Post (Qatar Postal Services Company), GWC (Gulf Warehousing Company), Milaha (Qatar Navigation Q.P.S.C.), and Agility Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Qatar supply chain technology market appears promising, driven by ongoing advancements in automation and digitalization. As businesses increasingly adopt IoT and AI technologies, operational efficiencies are expected to improve significantly. Furthermore, the government's commitment to infrastructure development will likely enhance logistics capabilities, fostering a more robust supply chain ecosystem. These trends indicate a shift towards more integrated and technology-driven supply chain solutions, positioning Qatar as a regional leader in supply chain innovation.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Supply Chain Management Software (SCM) Warehouse Management Systems (WMS) Transportation Management Systems (TMS) Inventory Optimization Solutions Order Management Platforms Freight and Fleet Management Solutions Last-Mile Delivery Platforms Real-Time Visibility & Tracking Solutions Others (Blockchain, IoT-enabled Platforms, etc.) |

| By End-User Industry | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Food & Beverage Automotive Oil & Gas / Energy Government & Public Sector Others (Construction, Agriculture, etc.) |

| By Component | Software Hardware (RFID, Sensors, IoT Devices) Services (Consulting, Integration, Managed Services) |

| By Deployment Mode | On-Premise Cloud-Based |

| By Distribution Mode | B2B B2C |

| By Price Range | Entry-Level Solutions Mid-Tier Solutions Enterprise/Advanced Solutions |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Adoption |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Supply Chain Technology | 60 | Supply Chain Managers, IT Directors |

| Retail Logistics Solutions | 50 | Logistics Coordinators, Operations Managers |

| Manufacturing Process Optimization | 40 | Production Managers, Quality Assurance Leads |

| Transportation Management Systems | 45 | Fleet Managers, Supply Chain Analysts |

| Warehouse Automation Technologies | 40 | Warehouse Managers, Technology Implementation Specialists |

The Qatar Supply Chain Technology Market is valued at approximately USD 1.4 billion, reflecting a robust growth trajectory driven by increasing demand for efficient logistics solutions and digital transformation initiatives in the region.