Region:Europe

Author(s):Geetanshi

Product Code:KRAA0147

Pages:90

Published On:August 2025

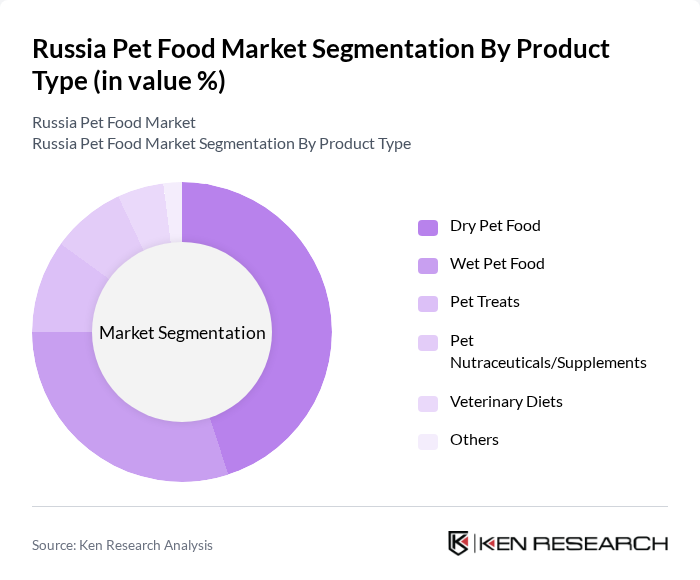

By Product Type:The product type segmentation includes various categories such as Dry Pet Food, Wet Pet Food, Pet Treats, Pet Nutraceuticals/Supplements, Veterinary Diets, and Others. Among these, Dry Pet Food is the leading subsegment, driven by its convenience, longer shelf life, and cost-effectiveness. Wet Pet Food follows closely, appealing to pet owners seeking palatability and hydration for their pets. The growing trend towards health-conscious pet ownership has also boosted the demand for Pet Nutraceuticals and Veterinary Diets. Dry pet food holds the largest share, reflecting consumer preference for easy storage and feeding, while wet food and treats are gaining traction due to increasing pet humanization and demand for variety .

By Animal Type:The animal type segmentation includes Dogs, Cats, Birds, Small Mammals, and Others. Dogs represent the largest segment, driven by their popularity as pets and the increasing willingness of owners to invest in high-quality food. Cats follow closely, with a growing trend towards premium and specialized diets. The demand for pet food for Birds and Small Mammals is also rising, although these segments remain smaller compared to Dogs and Cats. The dominance of dog and cat food is supported by the high pet population and the trend towards pet humanization, with owners seeking tailored nutrition and functional benefits .

The Russia Pet Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mars Petcare (Pedigree, Whiskas, Chappi, Kitekat), Nestlé Purina PetCare (Purina ONE, Friskies, Felix), Royal Canin (Royal Canin Russia), Monge & C. S.p.A., Aller Petfood, Landor, Grandorf, Mealfeel, Pet-Product LLC, Veles, Farmina Pet Foods, Unicharm (Aixia, Gin no Spoon), Hill's Pet Nutrition, ProBalance, TiTBiT contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pet food market in Russia appears promising, driven by increasing pet ownership and a growing focus on pet health and nutrition. Innovations in product offerings, such as organic and specialized diets, are expected to gain traction. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products. As consumer preferences evolve, companies that adapt to these trends will likely capture significant market share and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Dry Pet Food Wet Pet Food Pet Treats Pet Nutraceuticals/Supplements Veterinary Diets Others |

| By Animal Type | Dogs Cats Birds Small Mammals Others |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Convenience Stores Online Channel Others |

| By Price Range | Economy Mid-Range Premium Super Premium Others |

| By Packaging Type | Bags Cans Pouches Others |

| By Region | Central Russia Northern Russia Southern Russia Eastern Russia Others |

| By Consumer Demographics | Age Group Income Level Urban vs Rural Pet Ownership Duration Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Food Retailers | 100 | Store Managers, Category Buyers |

| Pet Owners | 150 | Dog and Cat Owners, Pet Enthusiasts |

| Veterinary Clinics | 80 | Veterinarians, Clinic Managers |

| Pet Food Manufacturers | 60 | Product Development Managers, Marketing Directors |

| Pet Supply Distributors | 50 | Distribution Managers, Sales Representatives |

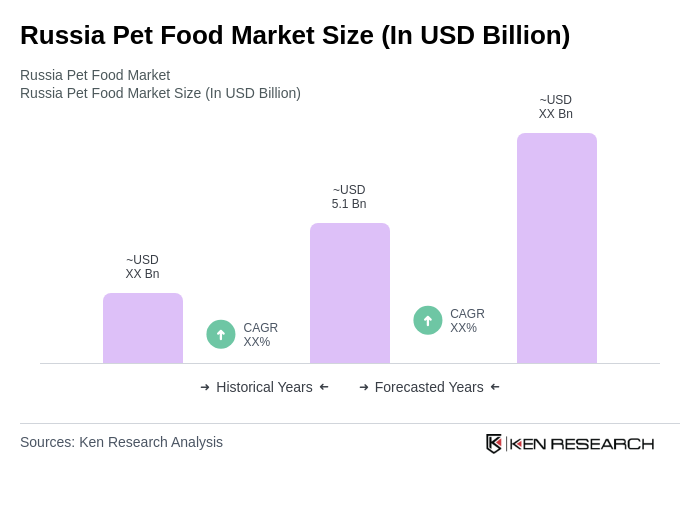

The Russia Pet Food Market is valued at approximately USD 5.1 billion, reflecting a significant growth trend driven by increasing pet ownership, rising disposable incomes, and a shift towards premium pet food products.