Region:Middle East

Author(s):Shubham

Product Code:KRAD3665

Pages:88

Published On:November 2025

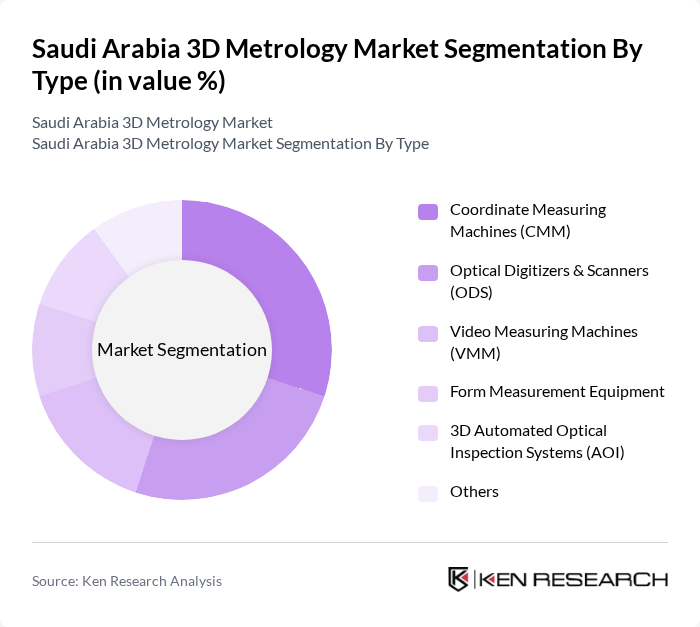

By Type:The market is segmented into various types, including Coordinate Measuring Machines (CMM), Optical Digitizers & Scanners (ODS), Video Measuring Machines (VMM), Form Measurement Equipment, 3D Automated Optical Inspection Systems (AOI), and Others. Each of these sub-segments plays a crucial role in the overall market dynamics, catering to different measurement needs across industries. Coordinate Measuring Machines (CMM) are widely adopted for their high precision in automotive and aerospace manufacturing. Optical Digitizers & Scanners (ODS) are increasingly used for rapid prototyping and reverse engineering, while Video Measuring Machines (VMM) and AOI systems support electronics and component inspection. Form Measurement Equipment addresses specialized needs in quality assurance for complex geometries .

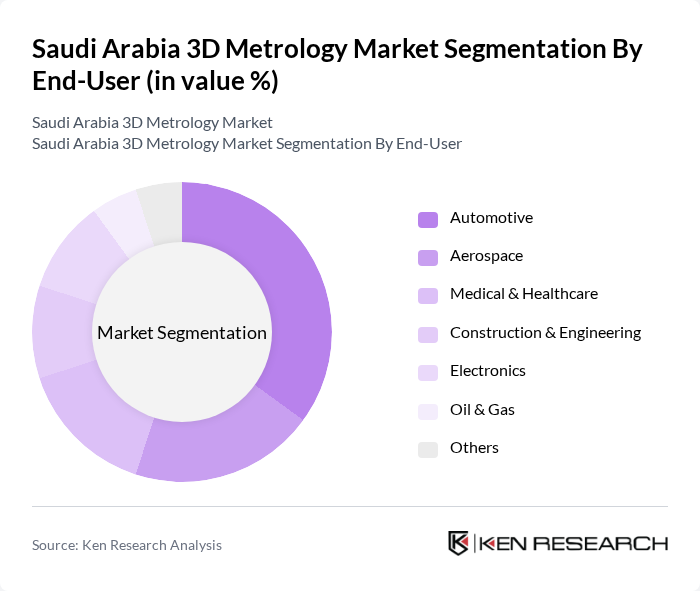

By End-User:The end-user segmentation includes Automotive, Aerospace, Medical & Healthcare, Construction & Engineering, Electronics, Oil & Gas, and Others. Each sector has unique requirements for precision measurement, driving the demand for specific metrology solutions tailored to their operational needs. Automotive and aerospace sectors lead adoption due to stringent quality standards and the need for high-accuracy component verification. The oil & gas sector increasingly utilizes 3D metrology for pipeline inspection and facility maintenance, while the medical and electronics industries leverage these technologies for device validation and micro-component analysis .

The Saudi Arabia 3D Metrology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hexagon AB, Carl Zeiss AG, Mitutoyo Corporation, Nikon Metrology NV, FARO Technologies Inc., Renishaw plc, Keyence Corporation, Creaform Inc., 3D Systems Corporation, GOM GmbH (a ZEISS company), AMETEK, Inc., KUKA AG, Siemens AG, Trimble Inc., TESA Technology SA, Perceptron Inc., WENZEL Group GmbH & Co. KG, InnovMetric Software Inc., Metrologic Group, Saudi Metrology and Calibration Company (Saudi local) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the 3D metrology market in Saudi Arabia appears promising, driven by technological advancements and increasing industrial demands. As industries continue to embrace automation and smart manufacturing, the integration of 3D metrology solutions will become crucial for maintaining quality standards. Furthermore, the government's commitment to enhancing infrastructure and regulatory frameworks will likely foster a conducive environment for market growth, encouraging investments in advanced metrology technologies and training programs for the workforce.

| Segment | Sub-Segments |

|---|---|

| By Type | Coordinate Measuring Machines (CMM) Optical Digitizers & Scanners (ODS) Video Measuring Machines (VMM) Form Measurement Equipment D Automated Optical Inspection Systems (AOI) Others |

| By End-User | Automotive Aerospace Medical & Healthcare Construction & Engineering Electronics Oil & Gas Others |

| By Application | Quality Control & Inspection Research and Development Production & Manufacturing Calibration Services Reverse Engineering Others |

| By Technology | D Laser Scanning (including LiDAR) Structured Light Scanning Photogrammetry Contact Measurement Non-Contact Measurement AI-based 3D Reconstruction Others |

| By Industry Vertical | Manufacturing Oil & Gas Healthcare Defense Construction Electronics Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Manufacturing | 100 | Quality Control Managers, Production Engineers |

| Automotive Industry | 80 | Manufacturing Supervisors, R&D Engineers |

| Electronics Manufacturing | 70 | Process Engineers, Quality Assurance Specialists |

| Construction Sector | 60 | Project Managers, Site Engineers |

| Calibration Services | 90 | Calibration Technicians, Lab Managers |

The Saudi Arabia 3D Metrology Market is valued at approximately USD 125 million, driven by the increasing demand for precision measurement across various industries, including automotive, aerospace, oil & gas, and healthcare.