Region:Middle East

Author(s):Shubham

Product Code:KRAE0014

Pages:91

Published On:December 2025

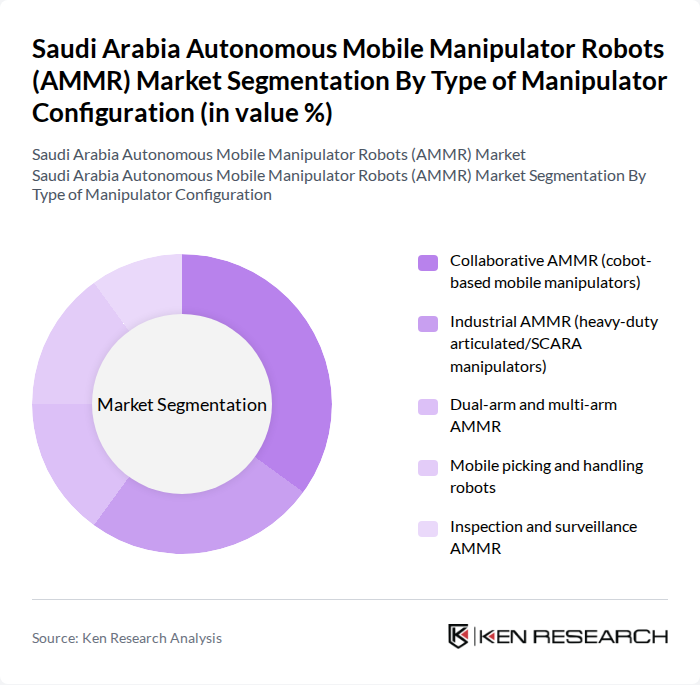

By Type of Manipulator Configuration:

The market for Autonomous Mobile Manipulator Robots is segmented into five key types: Collaborative AMMR (cobot-based mobile manipulators), Industrial AMMR (heavy-duty articulated/SCARA manipulators), Dual-arm and multi-arm AMMR, Mobile picking and handling robots, and Inspection and surveillance AMMR. Among these, Collaborative AMMR is leading the market due to its versatility and ease of integration into existing workflows. The growing trend towards collaborative robots in various industries, including manufacturing and healthcare, is driving demand for this segment. The focus on enhancing productivity while ensuring safety in human-robot interactions is also contributing to its dominance.

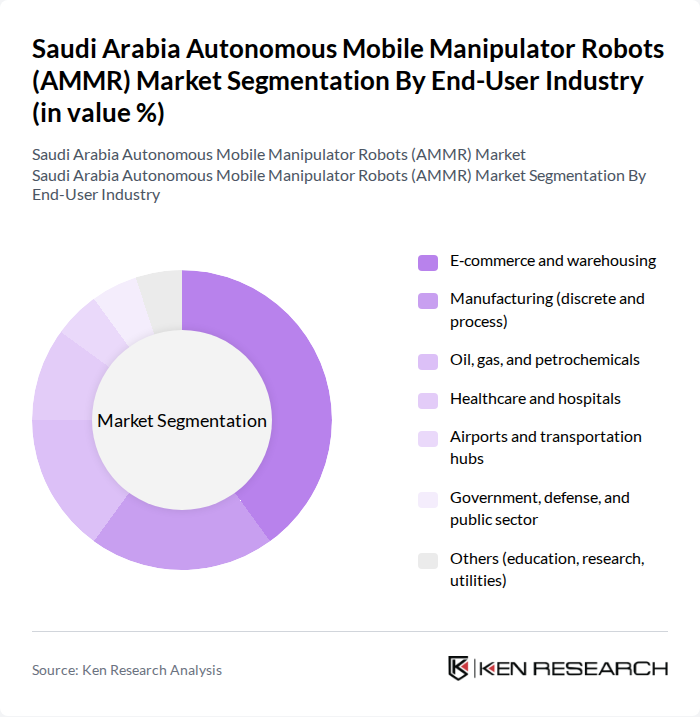

By End-User Industry:

The Autonomous Mobile Manipulator Robots market is segmented by end-user industries, including E-commerce and warehousing, Manufacturing (discrete and process), Oil, gas, and petrochemicals, Healthcare and hospitals, Airports and transportation hubs, Government, defense, and public sector, and Others (education, research, utilities). The E-commerce and warehousing sector is currently the leading segment, driven by the rapid growth of online shopping and the need for efficient logistics solutions. The increasing demand for automation in warehousing operations to enhance order fulfillment speed and accuracy is propelling this segment's growth.

The Saudi Arabia Autonomous Mobile Manipulator Robots (AMMR) Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Omron Corporation (including Omron Adept mobile platforms), Universal Robots A/S, Boston Dynamics, Inc., Mobile Industrial Robots A/S (MiR), Fetch Robotics, Inc. (a Zebra Technologies company), Robotnik Automation S.L., PAL Robotics S.L., Neura Robotics GmbH, OTTO Motors by Rockwell Automation, Hikrobot (Hangzhou Hikrobot Technology Co., Ltd.), Saudi Arabian Oil Company (Saudi Aramco) – digital & robotics initiatives contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AMMR market in Saudi Arabia appears promising, driven by ongoing technological advancements and increasing integration of AI. As industries continue to embrace automation, the demand for AMMRs is expected to rise, particularly in healthcare and logistics. Furthermore, the government's commitment to fostering innovation through funding and partnerships will likely accelerate the development of customized solutions, enhancing the overall market landscape and positioning Saudi Arabia as a regional leader in robotics.

| Segment | Sub-Segments |

|---|---|

| By Type of Manipulator Configuration | Collaborative AMMR (cobot-based mobile manipulators) Industrial AMMR (heavy-duty articulated/SCARA manipulators) Dual-arm and multi-arm AMMR Mobile picking and handling robots Inspection and surveillance AMMR |

| By End-User Industry | E?commerce and warehousing Manufacturing (discrete and process) Oil, gas, and petrochemicals Healthcare and hospitals Airports and transportation hubs Government, defense, and public sector Others (education, research, utilities) |

| By Application | Palletizing, depalletizing, and kitting Picking, put?away, and order fulfillment Intralogistics and line-side material replenishment Inspection, monitoring, and maintenance tasks Collaborative assembly and machine tending Sterile and clinical logistics (meds, samples, linen) Others |

| By Payload Capacity | Up to 50 kg payload –250 kg payload –1,000 kg payload Above 1,000 kg payload |

| By Navigation & Sensing Technology | LiDAR?based SLAM navigation Vision?guided and 3D perception AMMR QR / RFID / magnetic?guided AMMR Multi?sensor fusion and AI?enabled navigation Others |

| By Deployment Model | Capex purchase Robotics?as?a?Service (RaaS) Lease / rental models |

| By Region | Central Region (Riyadh and surrounding areas) Eastern Region (Dammam, Dhahran, Jubail, Ras Al?Khair) Western Region (Jeddah, Makkah, Madinah, NEOM, Red Sea) Southern Region Northern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics and Warehousing | 100 | Warehouse Managers, Operations Directors |

| Healthcare Robotics Applications | 80 | Healthcare Administrators, Robotics Engineers |

| Manufacturing Automation | 90 | Production Managers, Automation Specialists |

| Agricultural Robotics | 70 | Agronomists, Farm Operations Managers |

| Research and Development in Robotics | 60 | R&D Managers, University Researchers |

The Saudi Arabia Autonomous Mobile Manipulator Robots (AMMR) Market is valued at approximately USD 2.1 billion, reflecting significant growth driven by advancements in robotics technology and increasing automation demand across various sectors.