Region:Middle East

Author(s):Shubham

Product Code:KRAB1203

Pages:97

Published On:October 2025

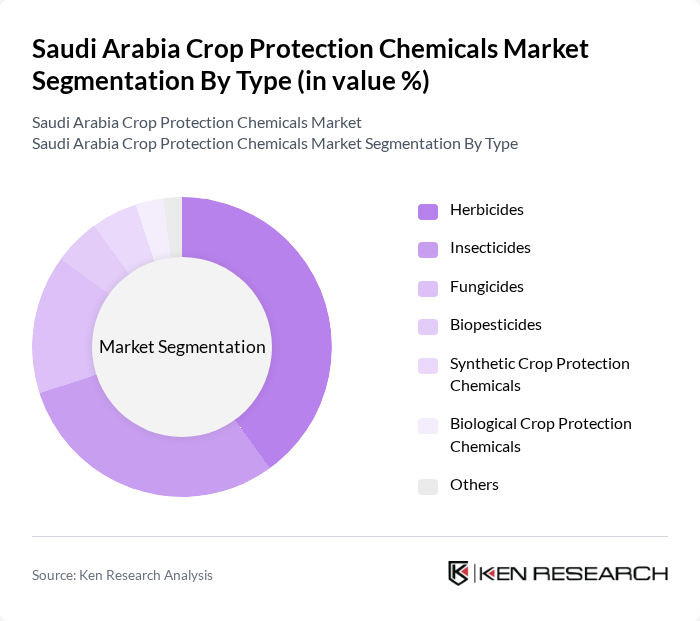

By Type:The market is segmented into various types of crop protection chemicals, including herbicides, insecticides, fungicides, biopesticides, synthetic crop protection chemicals, biological crop protection chemicals, and others. Herbicides and insecticides remain the most widely used due to their effectiveness in controlling weeds and pests, which are significant threats to crop yield. The adoption of integrated pest management (IPM) and the increasing use of biopesticides are gaining traction as farmers seek sustainable and environmentally responsible solutions .

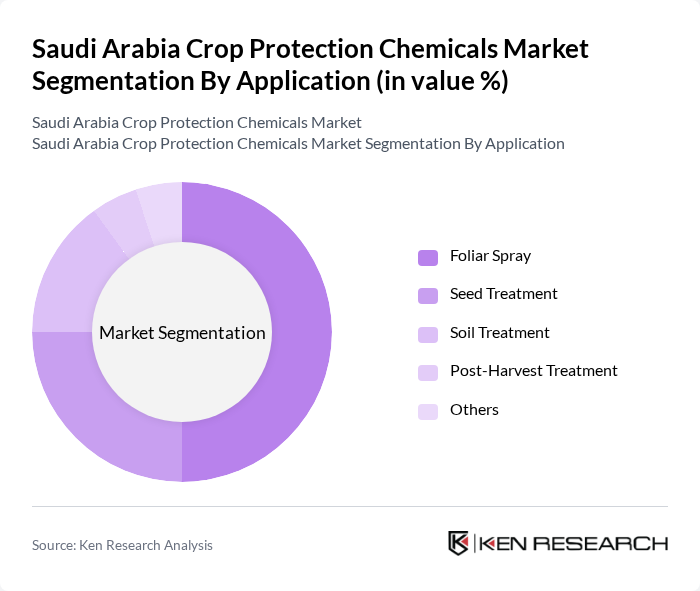

By Application:The application of crop protection chemicals is categorized into foliar spray, seed treatment, soil treatment, post-harvest treatment, and others. Foliar spray is the dominant application method due to its effectiveness in delivering chemicals directly to plant leaves, ensuring better absorption and control of pests and diseases. The increasing adoption of seed treatment is also notable, as it helps protect seeds from soil-borne diseases and pests, enhancing germination rates and early crop vigor .

The Saudi Arabia Crop Protection Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Syngenta AG, Bayer AG, Corteva Agriscience, FMC Corporation, ADAMA Agricultural Solutions Ltd., Nufarm Limited, UPL Limited, Sumitomo Chemical Co., Ltd., Delta Saudi Chemical Industries Company, Saudi United Fertilizer Company (Al-Asmida), Saudi Agricultural and Livestock Investment Company (SALIC), Al-Jubail Fertilizer Company (AlBayroni), Saudi Basic Industries Corporation (SABIC) – Agri-Nutrients, Al Rowad Chemicals Company contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia crop protection chemicals market is poised for significant transformation as sustainability becomes a central focus. In future, the integration of biopesticides and organic farming practices is expected to reshape the landscape, driven by consumer demand for environmentally friendly products. Additionally, advancements in technology, such as drone-assisted crop monitoring, will enhance pest management efficiency. These trends indicate a shift towards more sustainable agricultural practices, presenting both challenges and opportunities for market players in adapting to evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Herbicides Insecticides Fungicides Biopesticides Synthetic Crop Protection Chemicals Biological Crop Protection Chemicals Others |

| By Application | Foliar Spray Seed Treatment Soil Treatment Post-Harvest Treatment Others |

| By Crop Type | Cereals & Grains Fruits & Vegetables Oilseeds & Pulses Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors Others |

| By Region | Central Region Eastern Region Western Region Southern Region Northern Region Others |

| By Product Formulation | Liquid Granular Powder Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Protection | 100 | Agronomists, Crop Managers |

| Fruit and Vegetable Protection | 80 | Farm Owners, Agricultural Consultants |

| Herbicide Usage in Row Crops | 60 | Field Technicians, Product Managers |

| Pesticide Application Practices | 70 | Retailers, Distribution Managers |

| Market Trends in Organic Crop Protection | 50 | Sustainability Officers, Research Scientists |

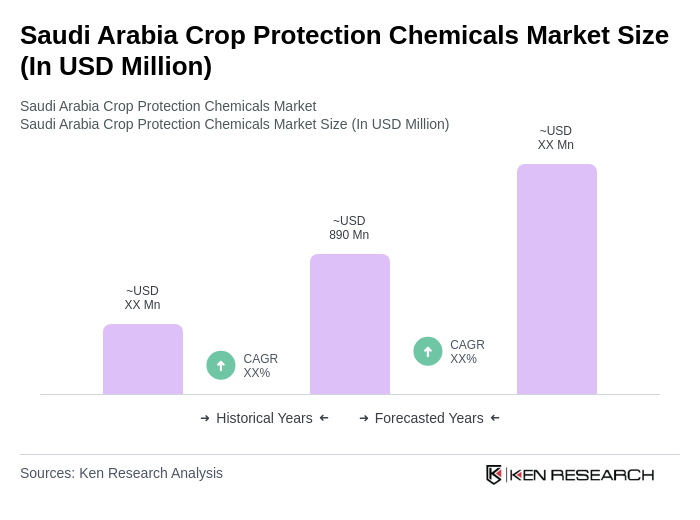

The Saudi Arabia Crop Protection Chemicals Market is valued at approximately USD 890 million, reflecting a significant growth driven by increasing food security demands, advancements in agricultural practices, and government support for sustainable farming initiatives.